There are significant problems with tying currency to the gold supply:

It doesn’t guarantee financial or economic stability.

It’s costly and environmentally damaging to mine.

The supply of gold is not fixed.

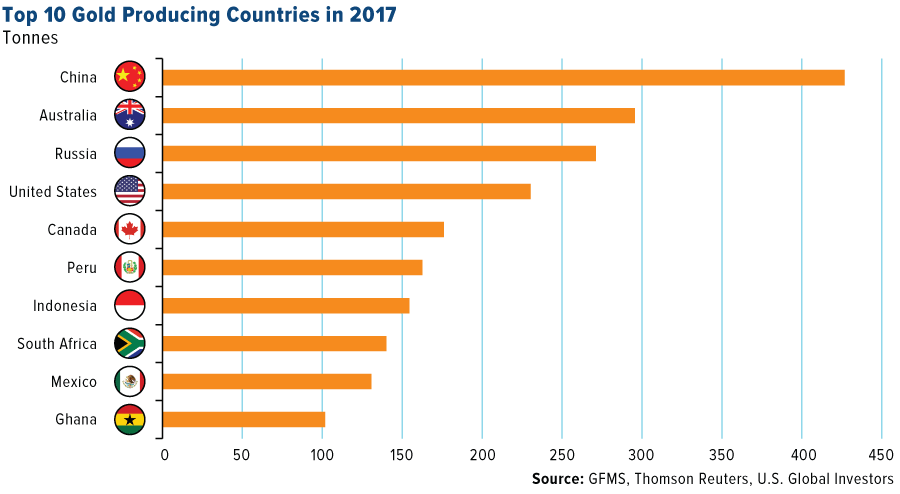

“The U.S. mines a lot of gold, but we’re not the biggest producer,” Wheelock said. “The bigger suppliers of gold would have more control over our monetary policy, and there’s no reason to have it because we can get the advantages of the gold standard and avoid the disadvantages without being on a gold standard.”

Yes, but FIAT currency like the US dollar allows uncontrolled spending by the Federal government and endless devaluation of US consumer purchasing power. Why is that NOT a problem?

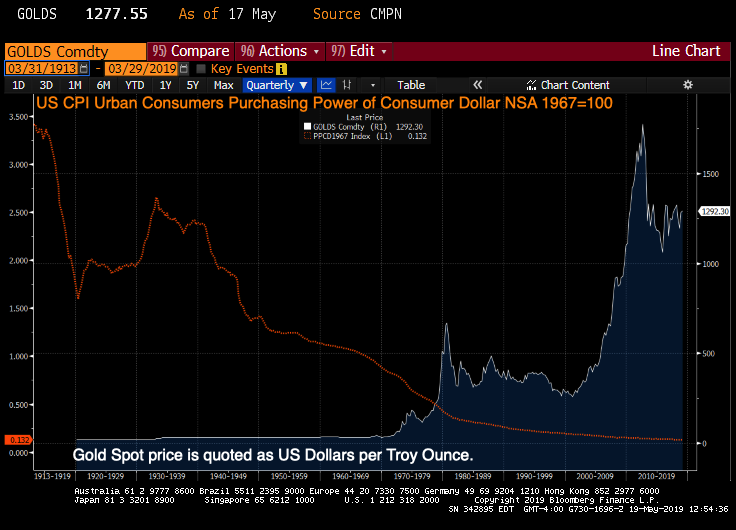

Since the creation of The Federal Reserve System in 1913, the purchasing power of the US dollar for consumers has been demolished while gold is increasing as consumer purchasing protection (on average).

The supply of gold is not fixed? No kidding. As of 2017, China, Australia and Russia produced more gold than the US.

Environmental concerns? Yes, but will China, Australia and Russia stop production of gold for environmental reasons? I think not.

True, gold prices can be quite volatile. But on the other hand, government spending cannot be contained. Hence the belief in MMT (modern monetary theory). Where government spending, debt and deficits don’t matter. Until they do!

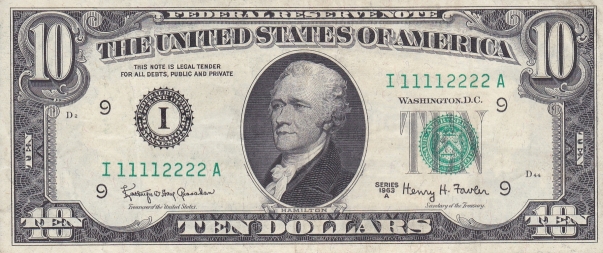

I would like the ability to exchange a $10 bill for $10 of gold, even with volatility. And gold volatility is at its lowest level since 2006.

Fiat currency? That’s the way The Fed and Congress like it!

The 1928 $10 bill was replaced with .. no gold!

- Source, Confounded Interest