Fed Chairman Jerome Powell states that the markets are doing great, things are moving along nicely and the economy is growing at a healthy pace, this is great news and clearly the stock market reflects this very much "real" reality.

As can be seen from the charts above, the S&P 500 seems to agree with the Fed Chairman's very much true assessment of the current state of the US and global economies, with the S&P 500 continuing to make and trade at all time highs.

Of course, this is going to continue on forever, as currently nothing, absolutely nothing is on the near, medium, or even long term horizon that could possibly derail this very much real, not artificially inflated stock market rally.

That is until you take your rose colored glasses off and actually take a look at what is going on in the world around you.

Extensively, I have followed the ongoing trade wars between the United States and China and although some short term resolution may "possibly" be in order, this dire situation is far from over and even the initial compromises appear to be riddled with problems, problems that are not going to be silenced and are likely to flare back to the forefront as we head into the 2020 elections.

However, I believe this threat takes a back seat in comparison to the ongoing affliction that is affecting the vital overnight repo markets, an affliction that is keeping the Federal Reserve up late at night, despite their seemingly calm demeanor when they jawbone to the general public.

(Source, Bloomberg)

Does this look normal to you?

This historic expansion of the Federal Reserve balance sheet is occurring at the fastest rate ever, even faster than the months following the 2008 crisis and the massive Quantitative Easing programs that followed when the Fed began to intervene, placing a bandage on the gaping wounds that were done to the economy, wounds that were never allowed to properly heal because the sickness was only ever masked over, not cured.

The Fed is becoming the market in the overnight repo markets, as financial institutions once again become weary of each other, sparking similar concerns to the days following the 2008 collapse.

Contagion is a very real risk and the Fed knows this, that is exactly why they are taking such drastic measuring, revving up the printing presses to maximum capacity.

President Trump is also engaging in similar double speak as the Federal Reserve, on the one hand, praising how great things appear to be on the surface, which as shown above, they appear to be at face value, while at the same time calling for lower interest rates and encouraging the Fed to openingly enact a new, proper Quanitative Easing program.

Taking to twitter, President Trump stated the following, once again targeting the Fed;

“It would be sooo great if the Fed would further lower interest rates and quantitative ease. The Dollar is very strong against other currencies and there is almost no inflation. This is the time to do it. Exports would zoom!”

Of course, he knows that his chances of re-election depend greatly on two things, whether or not the economy "remains" strong at face value and also whether or not he is impeached.

The latter of these risks for President Trump is currently unfolding in real time and at the time of writing, a vote by the House on whether or not to proceed with impeachment is set to soon take place.

This scenario creates extreme uncertainty and anxiety for many within the United States and around the world, as this move could have major ramifications that would be felt for years to come.

Republicans believe that the Democratic party is simply trying to undo the 2016 elections and they are not going to forget anytime soon this slight against them.

Unfortunately for President Trump, it is very likely that the Democratic party controlled House is going to vote yes on impeachment.

However, fortunately for him, the Senate, which is controlled by Republicans is incredibly unlikely to move forward with impeachment.

This leaves the choice up to voters in 2020, which in my opinion leans heavily towards a Trump re-election if the Fed can continue to keep the repo markets together and stem the current bleeding that is occurring.

Whether or not they can is yet to be seen.

Yet, gold and silver bullion continue to have a heavy lid placed upon them, even opening sharply lower in today's trading session, despite all of the risks mentioned above and despite the fact that common sense would dictate that they should be moving higher.

Risks abound and uncertainty reigns supreme, but worry not...

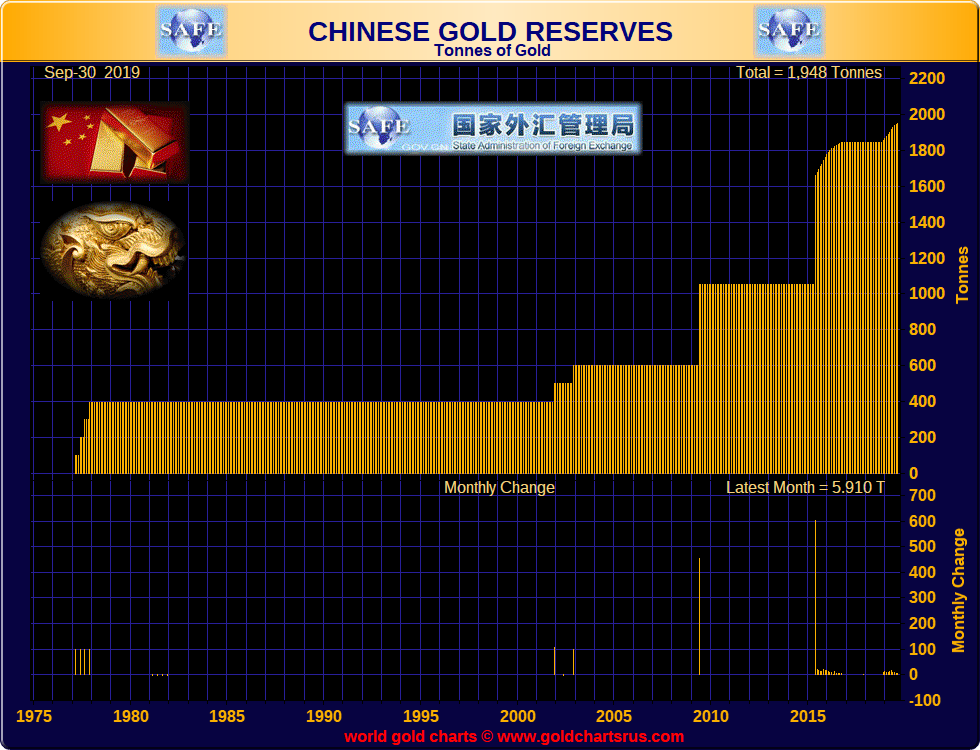

Chinese central bank gold reserves – No buying in October

Chinese central bank gold reserves – No buying in October