- Source, David Morgan

Wednesday, March 30, 2022

David Morgan: The Run To Gold is On?

Monday, March 28, 2022

Oil Volatility The New Normal? Despite Much Higher Oil Prices OPEC Doesn't Meet Production Quota

The world could see a record breaking oil supply shock.

- Source, Wall St for Main St

Sunday, March 27, 2022

Michael Pento: Revenge of the Real Economy

Regardless of what the Fed does, the economy sinks.

"The economy is already rapidly deteriorating," says portfolio manager Michael Pento. "This is the revenge of the real economy," he says.

- Source, Liberty and Finance

Friday, March 25, 2022

Doug Casey: These crises will reshape the world; Gold will be reinstituted as money

- Source, Kitco News

Wednesday, March 9, 2022

Palisade Gold Radio: Gold to $4000 in 2024? Silver to $100?

Meanwhile, the Russian invasion into Ukraine is going to disrupt global energy and food markets, leading to persistent and likely higher inflation this year.

A historical parallel could be the 1973 to 1975 period which included a bear market and stagflationary recession. The Gold surged and peaked near the end of the bear market and recession while Silver and general commodity prices peaked well before Gold.

Gold is on the cusp of making one of its most significant breakouts. It has upside targets of $3,000 and $4,000 which could be hit in 2024. Silver will likely break $50 but it is less certain if it can hit $100 in this scenario.

- Source, Palisade Radio

Tuesday, March 8, 2022

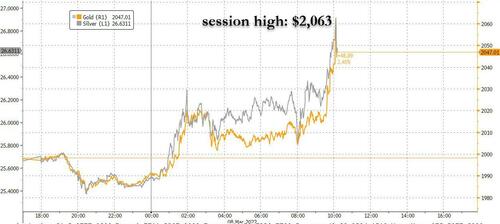

Gold Soars To $2063, Just One Cent Away From New All Time High

With digital gold acting more like digital lead in recent weeks, as bitcoin and the broader crypto sector trade as high-beta tech stocks perhaps helping tech funds satisfy margin calls, the real gold has no such qualms and after flatlining for much of the past 18 months, has broken out solidly to the upside, and just today spike more than 3%, rising to session high of $2,063.53

Why $2,063.53? Because $2,063.54 was the closing high on August 6, 2020 when gold hit an all time high in the aftermath of the Fed's money debasement frenzy when the Fed's balance sheet exploded by hundreds of billions weekly.

But while technical selling may have emerged at this key resistance level, we expect it to be taken out shortly, with even Goldman raising its gold forecast overnight, writing that in light of the Russia-Ukraine war, the bank is raising its gold price target over different time horizons. Targets raised for:

3-month horizon to USD2,300 vs. $1950 previous.

6-month horizon to USD2,500, from $2050 previous.

12-month horizon to USD2,500 vs. $2150 previous.”

Why? Because "An increase in demand from consumers, investors, central banks due to the rising geopolitical uncertainty."

Why $2,063.53? Because $2,063.54 was the closing high on August 6, 2020 when gold hit an all time high in the aftermath of the Fed's money debasement frenzy when the Fed's balance sheet exploded by hundreds of billions weekly.

But while technical selling may have emerged at this key resistance level, we expect it to be taken out shortly, with even Goldman raising its gold forecast overnight, writing that in light of the Russia-Ukraine war, the bank is raising its gold price target over different time horizons. Targets raised for:

3-month horizon to USD2,300 vs. $1950 previous.

6-month horizon to USD2,500, from $2050 previous.

12-month horizon to USD2,500 vs. $2150 previous.”

Why? Because "An increase in demand from consumers, investors, central banks due to the rising geopolitical uncertainty."

- Source, Zero Hedge

Monday, March 7, 2022

Ron Paul: Are Sanctions Acts of War?

They also place heavy economic costs on the civilians of nations imposing the sanctions.

To add insult to injury, the track record of sanctions forcing political change is disgracefully bad as well.

- Source, Ron Paul

Thursday, March 3, 2022

David Morgan: Stocks, Silver, and Bitcoin

Bitcoin price jumps above $42,320, altcoins rally along side. But, will crypto soon be banned? Silvers day is coming.

Obviously, no one has a crystal ball. And hence, no one really knows when.

Everybody involved in the silver market is asking: when? Patience is key.

- Source, David Morgan

Subscribe to:

Posts (Atom)