- Source, Reluctant Preppers

Wednesday, April 29, 2020

Alasdair Macleod: Destruction of Fiat Currencies, Coming Soon

Monday, April 27, 2020

Rick Ackerman: We Have a Deflationary Abyss to Cross

Gold is catching on now because of uncertainty and not inflation—yet.” In closing, Ackerman says, “I still believe we are going to have a deflationary abyss to cross before we get to the hyperinflation of the mind where people realize the government’s obligation either to default on Treasury debt or not is the crux of the hyperinflation argument.

Yes, at that point, I have to acknowledge the Fed can print money without limit, and they may have to.”

- Source, USA Watchdog

Sunday, April 26, 2020

Martin Armstrong: President Has Power to Reopen Country, Federal Reserve is Failing

Armstrong explains, “He doesn’t want to use it, but he actually has the power to open up the entire country. I wrote a piece on this, and it’s called the Commerce Clause (in the U.S. Constitution) which governs. They (the governors) have no legal authority to shut down the economy—period.

They cannot do that. The Commerce Clause prohibits interference with interstate commerce—period. Increasing the money supply, which is what the Fed is doing right now, is not going to save the day because the amount of money lost on a leverage basis is 20 to 30 times that.

It’s like throwing a bucket of water into the wind, it’s going to come right back in their face. They can’t stimulate enough. It’s impossible to overcome this.

The only way to overcome this is to open up the economy. We have to get the productive capacity back up, which is what wealth is and you are destroying that. 70% of employment is with small business.”

- Source, USA Watchdog

Saturday, April 25, 2020

Gold Miners Soar Higher as Oil Crashes Below Rock Bottom

For the first time ever, on Monday, April 20th, the benchmark price for US oil crashed below $0 a barrel, a reality that almost no one even thought was a possibility up until a few short days ago.

However, the carnage in the oil markets didn't stop there, as a further 30% cut in consumer demand caused prices to continue cascading lower, hitting negative $40 per barrel at one point in the trading session, later settling at negative $37.63 per barrel.

This of course is the lowest price that oil has ever traded at, in all of its history on the markets, symbolizing just how dire of an economic situation we now find ourselves in. A true black swan event.

Large sectors of the economy are all but virtually shut down, meaning that demand for oil has fallen off a cliff, leading to a huge surplus of oil reserves, that continue to pile up in warehouses, as consumers simply have no need for the tremendous amount of oil being produced on a daily basis.

Fortunately, in recent days these lows were not maintained and the price of WTI Crude, along with other key benchmarks have staged a rally, however, they still remain at historically low levels, of which are not profitable for many producers.

The Canadian oil markets, which already trade at a disadvantage due to a number of significant factors against it, are especially hard hit by this crash lower in prices and are unlikely to see a recovery anytime soon, even if normality returns in the short to medium term.

Sadly, if this crisis continues on in its current state, or god forbid, things deteriorate even further, then you can rest assured that this will not be the last time that we witness negative oil prices, which would devastate the oil industry even more than it already has been, especially if as some health experts are stating, that this crisis is very likely to have a second wave come the fall of 2020.

Gold Miners Benefit

It is not all doom and gloom however for the entirety of the commodities sector, as gold producers are uniquely positioned to benefit in these dire times, especially if they are capable of continuing production throughout this crisis.

Miners such as Barrick Gold Corp and Newmont Goldcorp are two of the largest gold bullion miners in the world and as can be seen from the chart below are weathering this crisis much better than most.

However, the carnage in the oil markets didn't stop there, as a further 30% cut in consumer demand caused prices to continue cascading lower, hitting negative $40 per barrel at one point in the trading session, later settling at negative $37.63 per barrel.

This of course is the lowest price that oil has ever traded at, in all of its history on the markets, symbolizing just how dire of an economic situation we now find ourselves in. A true black swan event.

Large sectors of the economy are all but virtually shut down, meaning that demand for oil has fallen off a cliff, leading to a huge surplus of oil reserves, that continue to pile up in warehouses, as consumers simply have no need for the tremendous amount of oil being produced on a daily basis.

(Chart source, oilprice.com)

Fortunately, in recent days these lows were not maintained and the price of WTI Crude, along with other key benchmarks have staged a rally, however, they still remain at historically low levels, of which are not profitable for many producers.

The Canadian oil markets, which already trade at a disadvantage due to a number of significant factors against it, are especially hard hit by this crash lower in prices and are unlikely to see a recovery anytime soon, even if normality returns in the short to medium term.

Sadly, if this crisis continues on in its current state, or god forbid, things deteriorate even further, then you can rest assured that this will not be the last time that we witness negative oil prices, which would devastate the oil industry even more than it already has been, especially if as some health experts are stating, that this crisis is very likely to have a second wave come the fall of 2020.

Gold Miners Benefit

It is not all doom and gloom however for the entirety of the commodities sector, as gold producers are uniquely positioned to benefit in these dire times, especially if they are capable of continuing production throughout this crisis.

Miners such as Barrick Gold Corp and Newmont Goldcorp are two of the largest gold bullion miners in the world and as can be seen from the chart below are weathering this crisis much better than most.

(Chart sources, globeandmail.com)

It is a fact that the price of oil is one of the largest cost inputs for precious metal miners and miners in general, with the price of oil having a direct impact on the total cost that it takes to get commodities out of the ground.

This means that miners are now able to get materials out of the ground at a much lower price than they would of previous been able to do so, just a few short months ago when the price of oil was higher.

For most miners, this point is moot as demand for many commodities is suffering alongside oil, however, gold bullion is not one of these commodities. In fact the demand for physical gold bullion is through the roof.

The reasoning for this is of course the vital role that gold bullion has played for over 10,000 years in the our financial history, acting as a safe haven asset in times of need, strife and economic crisis. Of which our current time period most definitely qualifies as.

(Chart source, goldprice.org)

This is why you are seeing the paper chart prices for both gold and silver bullion remain at healthy levels, even while everything else seemingly turns to mud.

However, when looking at the physical precious metals markets, you see a much different picture being painted, as premiums continue to remain at elevated levels, disconnecting themselves from the largely fraudulent and easily manipulated paper price.

These premiums are due to the incredible demand that physical metals are currently and have been experiencing since this crisis kicked off in earnest and of which I believe is a trend that is only going gain traction the longer COVID-19 remains a threat to society.

Because of this, gold bullion miners, most notably the titans of the industry such as Barrick and Newmont, who have the capital to continue operations throughout this crisis are going to uniquely benefit and thus continue to increase in price as they reap the dual benefit of increased demand and lower mining costs.

Opportunity still exist, even in these dire times.

Stay safe and keep stacking.

- Source, Nathan McDonald via the Sprott Money Blog

Friday, April 24, 2020

Golden Rule Radio: Oil Goes Negative, First Time In History

Thursday, April 23, 2020

Governments Are Broke And Can Only Print, Gold & Silver Will Do Much More Than Just Maintain Purchasing Power

Egon says the current situation in the world is the catalyst, but not the cause, which kicks off the global hyperinflationary depression, and the current situation in the world is the worst catalyst, Egon says.

How does Egon see the hyperinflation playing out? How does Egon see the disconnect between the paper markets and the real markets, especially in gold and in oil? What are we to make of the crude oil futures markets going bonkers with prices even trading negative?

Does Egon see gold as something that can appreciate with capital gains, or are gold & silver strictly held for wealth preservation and insurance purposes?

Is real estate good for wealth preservation, and is real estate even a good investment at all?

For the answers to those questions and a whole lot more, tune-in to the interview in its entirety.

- Source, Silver Doctors

Wednesday, April 22, 2020

Perth Mint: Gold Supply Decimated, What Will a Recovery Look Like?

Rich says we are currently in the opening phases of normalizing.

“There already is more commercial freight being allowed, I think commercial flights are now allowed to carry freight,” he said.

- Source, Kitco News

Monday, April 20, 2020

Losing Faith In Fiat: COVID Crisis Has Dragged Forward The Moment When "The Money Is No Good"

Money manager and economist Michael Pento says the Federal Reserve has only massive money printing left to try to save the economy from the current and ongoing debt implosion. There is going to be lots of fresh cash needed.

Pento runs down a list of just few of the things the Fed will need to spend money on and says,

“We all should know more than 22 million people have lost their jobs in the last four weeks alone. That’s 22 million people, and the unemployment rate, according to me, is heading up to 15% to 17%. That, my friends, is a depression. We also have the Philly Fed (Manufacturing Index rating) come out with a -56.6. That’s a minus 56.6. That’s the worst ever. Empire State Manufacturing -78.2, which is the worst rating ever. Retail sales plunged in March 8.7%. That is also the worst reading ever. That’s the worst plunge ever, and that’s just March. In my opinion, it will be something worse in April because all of the month will be completely shut down. That’s 90% to 95% of the economy.”

Now you know why the Fed freaked out and started printing money at the highest pace ever. Pento predicts the Fed, who took $4.5 trillion onto its balance sheet as a result of the “Great Recession,” will explode “The Federal Reserve’s balance sheet to $10 trillion by end of the year.”

Pento says forget the so-called “V shaped recovery” because “you cannot simply turn back on the economy like a light switch. There’s no electricity.” On top of that, Pento points out that,

“Millions of people who have been thrown out of work have taken on even more debt . . . . So, the economy is not bouncing back.”

So, it is clear the Fed is going to print trillions of dollars in fresh cash to pay for bailouts, unemployment checks and debt payments to avoid massive defaults in the U.S. economy. Pento asks, “What kind of faith will people have in the purchasing power of their fiat currencies?"

"...If the Fed can print trillions of dollars with no consequences... why bother working? Everybody can just stay home and cash a check...This is a recipe for hyper-inflation. It’s been tried many, many times in history, and it has never worked...

The gap between the real economy, asset prices and debt and the underlying economy has never been greater...

You have a massive increase of insolvent debt...Then you are going to ad inflation to that mix? Think about the carnage that is to come. That is the real crash... We will partially recover from this virus. . . . We are now sending money, helicopter money, directly to consumers, and that will cause inflation.”

Pento predicts a “tsunami of inflation” is coming in the not-too-distant future. Pento says,

“People are losing faith in fiat currencies. The price of gold in other currencies is already at all-time record highs. Even in dollar terms it’s $1,700 per ounce and on its way to record highs. What is the government going to do when you have insolvency and inflationary implosion of the bond market? The real crash is coming...

A government cannot issue more debt to bail out an insolvent condition—fact.

A government cannot print more money to placate a market that is afraid of inflation—fact.

That’s what they are going to be faced with: Yields spiking because of inflation and insolvency concerns, and then there is nothing a government can do. It’s not going to be just the United States, it’s going to be the case globally... That’s when the money is no good, and the bonds are no good.”

- Source, Zero Hedge

Fauci: No Recovery Possible If Virus Isn't Under Control

President Trump's top doctor on the White House coronavirus task force has pushed back against protesters demonstrating against stay-at-home orders, warning that the US economy won't recover until COVID-19 is "under control."

"This is something that is hurting from the standpoint of economics," Fauci acknowledged during an appearance on ABC's "Good Morning America," in comments which sharply contrast with those by President Trump, who has encouraged the protests, Bloomberg reports.

"Unless we get the virus under control, the real recovery economically is not going to happen," Fauci added. "So what you do if you jump the gun and go into a situation where you have a big spike, you’re going to set yourself back."

“Clearly this is something that this is hurting …. but unless we get the virus under control, the real recovery, economically, is not going to happen.”

Fauci added that while it can be "painful" to follow federal guidelines regarding a phased re-opening, it will "backfire" if done too soon.

Protests have erupted in Michigan, Minnesota, Texas and other states demanding that governors lift strict social distancing policies that have battered the U.S. economy. Some demonstrators have called for Fauci’s firing.

Trump has encouraged the protests, tweeting that protesters should “liberate” Michigan, Minnesota and Virginia. The president said Sunday he watched footage of the crowded protests, called them “orderly” and said people “were all six feet apart.” -Bloomberg

According to Trump, people on both sides - including state governors, have gone "too far."

"Some of the things that happened are maybe not so appropriate," he said.

"This is something that is hurting from the standpoint of economics," Fauci acknowledged during an appearance on ABC's "Good Morning America," in comments which sharply contrast with those by President Trump, who has encouraged the protests, Bloomberg reports.

"Unless we get the virus under control, the real recovery economically is not going to happen," Fauci added. "So what you do if you jump the gun and go into a situation where you have a big spike, you’re going to set yourself back."

“Clearly this is something that this is hurting …. but unless we get the virus under control, the real recovery, economically, is not going to happen.”

Fauci added that while it can be "painful" to follow federal guidelines regarding a phased re-opening, it will "backfire" if done too soon.

Protests have erupted in Michigan, Minnesota, Texas and other states demanding that governors lift strict social distancing policies that have battered the U.S. economy. Some demonstrators have called for Fauci’s firing.

Trump has encouraged the protests, tweeting that protesters should “liberate” Michigan, Minnesota and Virginia. The president said Sunday he watched footage of the crowded protests, called them “orderly” and said people “were all six feet apart.” -Bloomberg

According to Trump, people on both sides - including state governors, have gone "too far."

"Some of the things that happened are maybe not so appropriate," he said.

- Source, Zero Hedge

Saturday, April 18, 2020

JP Morgan is on the Verge of Collapse, Shares Plunge as They Warn of a Massive Recession

While they see a mortgage crisis at the same time as a global recession it's important to point out we've been in a recession since 2008. It never ended. It was simply papered over.

What we are seeing today is a global depression, the likes of which we've never seen in history and it will be historic. One can take that to the bank. Jamie Dimon recently recovered from surgery as JP Morgan watched shares dive fast.

Their cash to deposit ratio was never good but surely they will have some problems if people do what they should have done long ago. Done a run on the bank.

We cover this and the comments by BlackRock on the Federal Reserve basically running the stock market today as we enter the era of complete central planning.

- Source, World Alternative Media

Friday, April 17, 2020

Paul Craig Roberts: We Need a Debt Jubilee or the System Will Collapse

Either the system goes into collapse or you write the debts down and you start over. Again, either you paper it over again or you don’t succeed and everything blows up.”

What about the rising gold price during this new round of bailouts? Roberts says, “In the previous bailout, it did not affect the dollar. The question is this bailout, on top of the previous bailout, is it going to affect the dollar?

Are people going to say, good heavens, do we really want to hold dollars when they are creating so many? People are saying we don’t know how this is going to play out, but they can’t print gold, so let’s get into gold.

I don’t know how people are going to see this, but the enormous money creation, no doubt, worries some. If they are successful in reflating the stock prices, then the problems with the dollar is over--for now.

Again, bailing out debt with more debt is kicking the can down the road. How long can you kick it? We don’t know until we will find out you can’t kick it any further.”

- Source, USA Watchdog

Thursday, April 16, 2020

Economy on Life Support: The Federal Reserve is Now the Market

Rapidly increasing taxes? Massive, runaway inflation? Or an outright economic collapse, the likes of which the world has never seen before?

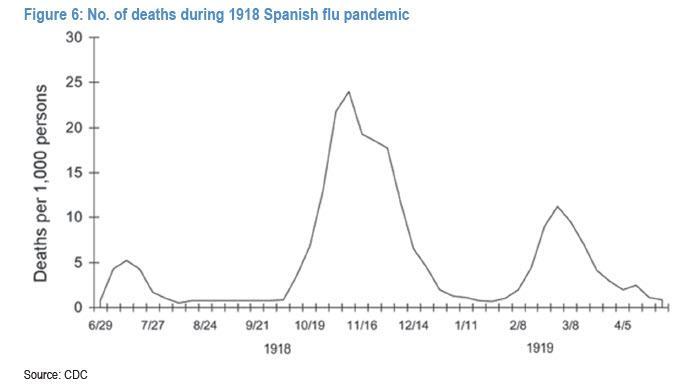

Dr. Robert Redfield, Director of the CDC made the following statements;

“I think we have to assume this is like other respiratory viruses, and there will be a seasonality to it.”

“The CDC is science-based, data-driven, so until we see it, we don’t know for certain [there will be a resurgence], But it is critical that we plan that this virus is likely to follow a seasonality pattern similar to flu, and we’re going to have another battle with it upfront and aggressively next winter.”

Choose your poison, because something is going to have to give, sooner or later...

The Federal Reserve, along with many other governments around the world, have essentially circumvented the free markets, choosing in the short term to keep the system and the entirety of their populations from entering into an outright collapse by simply printing staggering sums of fiat money, out of thin air.

Whether or not this is the right course of action, is not up to me to decide, however, to think that there will not be long term consequences to what government officials are currently engaging in, would be foolish to say the least.

Bailout after bailout program has been initiated, with many countries choosing to send their citizens large sums of money in the mail, or digitally, to help mitigate some of the economic damage caused by the COVID-19 shutdown.

Unfortunately, as common sense would dictate, this cannot and thus will not go on forever, as one cannot create true wealth by simply printing ever increasing amounts of money, without any production, or productivity to go along with it.

However, in the short term, government officials are proving just how far they can push the limits of an ever increasing supply of fiat money, without entering into an outright collapse.

(Chart source, usdebtclock.org)

This has caused national debts around the world to explode, with the most notable of these being the United States government, who has issued trillions of dollars since the outbreak of COVID-19 began just a short few months ago.

This blatant intervention in the markets has inverted reality, largely destroying the free markets in the process, as we have just recently seen with the latest jobless claim figures, which in any rational world, would of sent markets spiraling lower.

Yet, this is not rational times that we live in. Quite the opposite.

Over five million Americans filed jobless claims last week alone, bringing the total to over 22 million in just one month!

These are truly staggering numbers, that are going to have cascading and dire effects on the economy not only in the short term, but the long as well. The true economic fallout caused by the COVID-19 outbreak is going to be felt for years to come.

As one economist recently stated;

“The labor market is showing us what I think we all know, that the economy is falling off a cliff at an unprecedented rate,”

At the same time as this, the United States is reporting their largest ever one day increase in coronavirus related deaths, rising by at least 2,371 and bringing the total to 30,800, according to a recent tally done by Reuters.

(Chart source, worldometers.info)

Meanwhile, futures rebounded on this devastating news, doing exactly the opposite of what any rational minded person would believe they should do, indicating once again just how much of a bizzaro world we now live in.

This is because, as I stated earlier, Wall Street knows that the Federal Reserve "will do whatever it takes" to keep the markets afloat, they will print as much money as need be, no matter the economic cost down the road.

Even if that means completely eroding the value of the dollar in the long term.

The Federal Reserve is now the market and that is truly terrifying, as this has the potential to end in complete and utter disaster, as people lose complete faith in the system as a whole, forcing the Fed to take an ever increasing role in supporting the markets.

What people also need to remember is that we are just in the early days of this crisis, as many health experts are now indicating that the coronavirus is going to be a threat for many more months, if not into next year as a possible "second wave" brings the system to its knees once again.

If these statements come true, this means that the bailouts are far from over and thus the fiat money printing is going to have to continue, unless governments around the world suddenly change their tunes and open up their economies again, hoping for herd immunity to occur, while also hoping that they are not sacrificing a significant percentage of their populations in the process.

This means that the markets are going to become increasingly more and more of an illusion, the longer that Central Banks are forced to intervene and support the system as a whole. How long can this last? No one truly knows, as nothing the likes of this, on such a grand scale, has ever been attempted before.

However, one thing is for certain, tangible, real assets, such as physical gold and silver bullion are going to continue to increase in price and be in extreme demand the longer that this crisis continues.

I believe that $2000 USD per oz of gold is only going to be a pit stop, with future gains in the coming years to make that price look cheap in comparison.

Additionally, I believe silver bullion is going to follow a similar pattern, however, with even greater potential gains in store, as the gold to silver ratio eventual stabilizes and comes back down to a more historic average.

Until then, stay the course, stay safe and keep stacking.

- Source, Nathan McDonald via Sprott Money Blog

Monday, April 13, 2020

Why Russia’s Central Bank Really Stopped Buying Gold

“The Russian government is strapped for cash. It’s facing the pandemic that everybody else is facing, but it was slow to move on it so it’s got serious problems there. It still has sanctions, it doesn’t have a lot of foreign exchange coming in, it’s losing money on every barrel of oil that it sold in Russia,” Christian told Kitco News. It doesn’t have the money to buy gold.

- Source, Kitco News

Sunday, April 12, 2020

Golden Rule Radio: Gold Prices Nearing All Time Highs

With more massive government stimulus on the way, we'll explore the real consequences of these injections and how the U.S. Dollar index will react. We cover the prices of gold, silver, platinum, & palladium.

Friday, April 10, 2020

$20,000 Gold Price: Franco Nevada Chairman Makes the Case

“When I look at where we are today, the money creation will take time to [money] into people’s hands. I look at supply chain disruption, I think we’re looking at a two to five year period and I do believe that we will see, if not one to one [in the Dow/gold ratio], then very close to one to one,” Lassonde told Kitco News.

Thursday, April 9, 2020

The Great Fiat Money Experiment: Helicopter Money Goes Global

Gold and silver bullion have once again resumed their now inevitable trend higher, spiking throughout today's trading session as country after country unleashes wave after wave of fiat money creation.

Never before have we witnessed such a global phenomenon, in which so much fiat money was simply created out of thin air and injected into the system, whether it be through businesses being bailed out, or by directly placing it in consumers hands.

As COVID-19 continues to spread across the world, with countries such as the United States, Italy and the United Kingdom being hit particularly hard at the moment, Government officials have little to no choice in the matter, unless they wish to see the virus run out of control, killing possibly millions in the process.

As can be understood, the latter is simply not a scenario that they are willing to see unfold and who can blame them? Would you want to be remembered in the history books as the leader who sacrificed millions of your citizens lives?

Unfortunately, the harsh reality of the matter is that the decision to sacrifice the economy over peoples lives is not without consequences, as millions of people are simply falling through the cracks, suffering financial hardship due to forced closures and regulations that they have to abide by.

This is particularly true for small to medium sized businesses, many of whom are simply being eviscerated due to government actions taken in the hopes of stopping the spread of COVID-19.

Many of these businesses have been forced to shutter their doors, knowing that they are unlikely to ever reopen them again, as they watch their finances waste away, due to a lack of sufficient income.

There are many other economic consequences, with one in particular that I believe is going to have dire ramifications in the coming years, even though the general population seemingly is blissfully unaware of it.

Helicopter Money Goes Global

With each passing day, another government around the globe announces another stimulus, bailout, injection, whatever you want to call it program, in which billions to trillions of dollars are being added to the system, in an attempt to help keep the economy churning along as best as it can.

Many of these programs are akin to sticking your finger in a dam, however, the amount of fiat money simply being created out of thin air cannot be ignored and thus will not be ignored.

The Federal Reserve on Thursday took additional actions to provide up to $2.3 trillion in loans to support the economy. This funding will assist households and employers of all sizes and bolster the ability of state and local governments to deliver critical services during the coronavirus pandemic.

"Our country's highest priority must be to address this public health crisis, providing care for the ill and limiting the further spread of the virus," said Federal Reserve Board Chair Jerome H. Powell.

(Chart source, goldprice.org)

Never before have we witnessed such a global phenomenon, in which so much fiat money was simply created out of thin air and injected into the system, whether it be through businesses being bailed out, or by directly placing it in consumers hands.

As COVID-19 continues to spread across the world, with countries such as the United States, Italy and the United Kingdom being hit particularly hard at the moment, Government officials have little to no choice in the matter, unless they wish to see the virus run out of control, killing possibly millions in the process.

As can be understood, the latter is simply not a scenario that they are willing to see unfold and who can blame them? Would you want to be remembered in the history books as the leader who sacrificed millions of your citizens lives?

Unfortunately, the harsh reality of the matter is that the decision to sacrifice the economy over peoples lives is not without consequences, as millions of people are simply falling through the cracks, suffering financial hardship due to forced closures and regulations that they have to abide by.

This is particularly true for small to medium sized businesses, many of whom are simply being eviscerated due to government actions taken in the hopes of stopping the spread of COVID-19.

Many of these businesses have been forced to shutter their doors, knowing that they are unlikely to ever reopen them again, as they watch their finances waste away, due to a lack of sufficient income.

There are many other economic consequences, with one in particular that I believe is going to have dire ramifications in the coming years, even though the general population seemingly is blissfully unaware of it.

Helicopter Money Goes Global

With each passing day, another government around the globe announces another stimulus, bailout, injection, whatever you want to call it program, in which billions to trillions of dollars are being added to the system, in an attempt to help keep the economy churning along as best as it can.

Many of these programs are akin to sticking your finger in a dam, however, the amount of fiat money simply being created out of thin air cannot be ignored and thus will not be ignored.

(Image Source, Pixabay)

Take for example the bazooka fiat money shot, just fired by the Federal Reserve, who have stated that they are going to do whatever it takes to keep the economy moving, announcing that they will provide an additional $2.3 trillion in loans to support the economy.

As per the Fed's most recent press release;

"Our country's highest priority must be to address this public health crisis, providing care for the ill and limiting the further spread of the virus," said Federal Reserve Board Chair Jerome H. Powell.

"The Fed's role is to provide as much relief and stability as we can during this period of constrained economic activity, and our actions today will help ensure that the eventual recovery is as vigorous as possible."

(Chart source, Bloomberg)

This apparently was the straw that broke the camels back, finally causing the USD to drop lower, as investors finally came to their senses, realizing just how historic this fiat money printing experiment truly is.

Before this announcement, many other bailout programs had been issued by the Federal Reserve, however, the US Dollar Index continued to hold strong.

What makes this move truly shocking is the fact that similar scenarios are being repeated all across the world, such as in the United Kingdom, where the Bank of England has stated they will directly finance the UK government, a move that is akin to letting the genie out of the bottle and of which it may possibly never be put back in.

This is a massive move, and of which the Bank of England is the first Central Bank to do so, however, I suspect others may soon be forced to join their ranks, as they continue to promise ever increasing amounts of fiat money to their citizens, with no real means of doing so, other than simply creating the money out of thin air.

Meanwhile, the Canadian government has tipped over into socialism, choosing to engage in numerous bailout programs, that will directly support its citizens by sending them large sums of money, for many months, if they have found themselves out of work due to the COVID-19 crisis.

The Great Fiat Reckoning

As I've stated many time before, I do not envy the positions our government officials have been placed in and I can understand exactly why they are doing what they doing, even if I do not agree with each and every action.

However, what you, as an individual need to understand is the fact that the consequences of printing this much money, of debasing your currencies in such a voracious manner are very real and are only going to truly manifest themselves in the coming years.

Fiat currencies are being debased like never before and the printing presses are working in overdrive, injecting money into the system, hoping to keep our fragile economies afloat.

Will they be successful? This is yet unknown, as nothing like this has ever been attempted before.

Regardless, there is one thing that I am certain of. One thing that has stood the test of time, over and over again in these times of crisis, in these times of debasement. Precious metals.

Precious metals, most notably, physical gold and silver bullion are going to move higher.

They are going to continue to be sought after for the protection that only they can offer in a time of crisis, as they inevitably account and adjust to this drastic increase in the fiat money supply, the likes of which we have never before seen.

Keep stacking, keep safe.

- Source, Nathan McDonald via the Sprott Money Blog

Wednesday, April 8, 2020

Is The Coronavirus Causing The Great Depression 2.0?

And the peak of the coronavirus outbreak in the US still isn't projected to arrive for several more weeks. How bad will the economic fallout from covid-19 be? Truly epic.

As in possibly "Great Depression 2.0" magnitude. Yes, the clown show in charge of dealing with this mess will likely just make things worse. But the reasons for the dismal economic outlook go far beyond the damage being done right now by the coronavirus.

The global economy was dangerously unstable and unsustainable long before this pandemic started. Covid-19 is simply the trigger to bring the house of cards down. Peak Prosperity has been warning of such an economic breakdown for many years.

Through our Crash Course video series, we've laid out exactly what the biggest risks are and why we should have been (and still should be) so concerned.

We'll be surfacing those core deficiencies in upcoming videos, as we are now swiftly moving from the "warning" phase and rushing into the "managing" phase.

Being armed with the information to take appropriate action will become even more important in the days to come.

- Source, Peak Prosperity

Coronavirus Cases Pass 1.4 Million As Scientists Discover Reinfection Risk For Patients Much Higher Than Expected

Though the coronavirus outbreak figures reported out of Europe yesterday were probably more mixed than health officials would have liked, there was, apparently, enough to keep the resurgence of optimism that has fueled market gains in recent days alive. While China blithely prepares to unleash its second wave on itself and the world in what seems like an almost deliberate act, the Washington Post reported overnight that the main epidemiological model being followed by the federal government has just revised down the need for ventilators, beds and other equipment as the world seems to have convinced itself that a lull is underway.

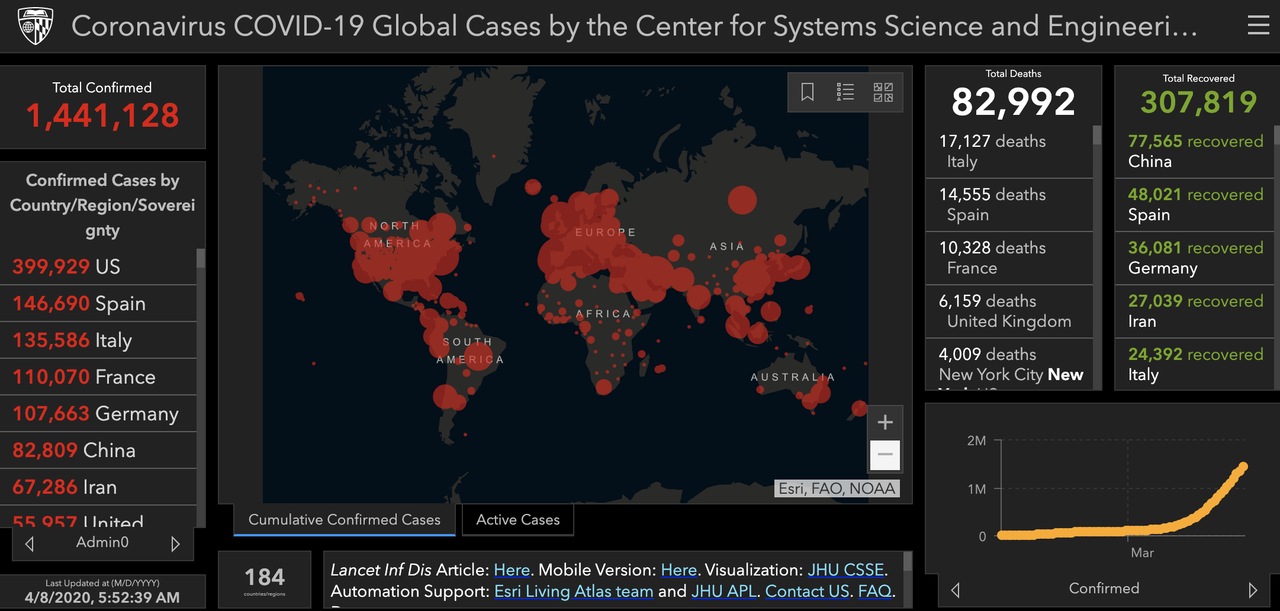

Across the US, chatter on social media about the need to get at least some of the shut-down economy back online has intensified in recent days, as political commentary as inspired heated discussions as opponents accuse Republicans and many regular Americans of callously placing the economy and their own self-interest above protecting society's most vulnerable. Meanwhile, the global case total has surpassed 1.4 million, with 83k+ deaths.

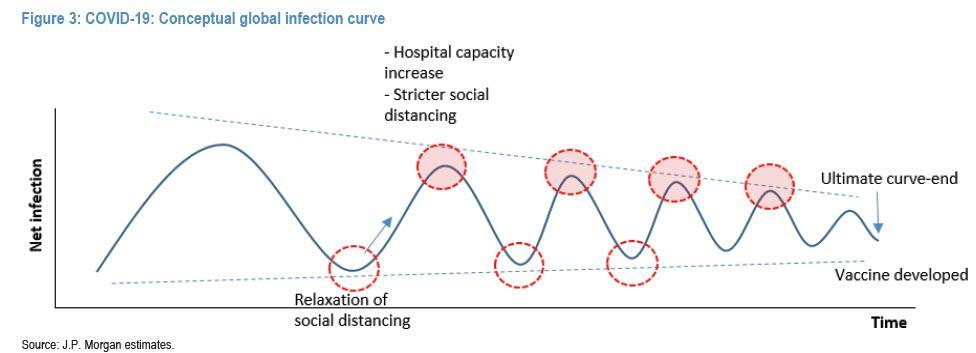

But as JPM projected, and as was the case during SARS and other prior pandemics, even if the novel coronavirus does begin to recede heading into the summer, remember: this is only part one.

At this point, it's not like anybody is going to snap their fingers and suddenly turn the clock back to Dec. 31, 2019. Many Americans - especially those at high risk - will likely cut down on leisure air travel, as pundits are already talking about the death of the "one-flight meeting".

But as we begin to weigh the pros and cons, and the Trump Administration reportedly weighs a plan to reactivate parts of the economy and allowing some people to get back to work if they can demonstrate that they're healthy, the SCMP late last night highlighted some new scientific evidence that is extremely disturbing.

As we explained above, by lifting restrictions on Wuhan, China is potentially unleashing hundreds, maybe even thousands, of asymptomatic carriers on the rest of the country. But scientists believe the 'herd immunity' that has supposedly been built up during the first wave should blunt the impact of ensuing waves somewhat. Well, unfortunately, it looks like that thesis needs to be reexamined.

Since the early days of the outbreak, we've seen reports about people being reinfected with the virus (though in some cases there were doubts about whether the virus ever really left). Well, now, a team of researchers at Fudan University in Shanghai has discovered that an alarmingly high number of recovered patients whom they've tested show low, or no, levels of the virus antibodies in their blood. That means a sizable chunk of those who are infected will be vulnerable to reinfection.

In other words, if these findings are confirmed, the hoped-for "herd immunity" that is supposed to help us get things back to normal in the time between now and however long it takes researchers to mass produce a vaccine simply isn't going to materialize: Instead of diluting the density and acting as blockers for spread, many will be reinfected, and go on to spread the virus to others, all over again. It's just the latest reason to worry that the second wave of the virus could be larger than the first.

Some countries are already seeing the first stirrings of a second wave: On Wednesday, Tokyo reported a record 144 new cases on Wednesday as PM Shinzo Abe's lockdown (which is legally toothless but has inspired most businesses to close nonetheless) took effect.

As the virus continues its woefully underreported spread across Africa - or so public health experts fear - Ethiopia announced on Wednesday that it's joining a growing list of African nations - already including Botswana, Congo, Ivory Coast, Senegal, South Africa and others - by declaring a state of emergency over the virus. The country's 110 million people have been relatively unscathed, reporting just 52 cases so far, though some fear that the country's close ties to Beijing and commerce between the two nations means many more cases have gone unreported.

Iraq also extended the closure of its main border crossing with Iran as the 'official' death toll in that country passes 10k. Much to Trump's delight, the decision will put added economic pressure on Tehran, as it will disrupt trade between the two nations, something upon which Iran's sanctions-starved government greatly relies.

Certain progressive media outlets in the US will likely never forget that certain conservative pundits and even - to a much lesser degree - President Trump, Mitch McConnell and other Republican leaders played down the coronavirus as the first cases were confirmed in the US. While President Trump likes to brag about his decision to shut down travel from China, in reality, that was a half-measure (he should have shut down travel from Europe, as certain senior advisors reportedly urged). And while they're not wrong, they're only telling part of the story. A lot of people in positions of power - including, as the Intercept notes, NYC's Democratic mayor - either underestimated the outbreak, or have changed views on subjects like drugs, whether shutting down schools makes sense, whether a partial shutdown that preserves more of the economy might be a more appropriate response - the list goes on and on.

Going through this list, it appears to us that nobody is more guilty than the WHO, which is partly why President Trump is insisting that the US reexamine the WHO's funding, and has mocked the WHO for 'totally blowing it'.

Of course, anybody who has only just started paying attention in the past few weeks (ie most of America) probably doesn't remember the WHO dragging its feet on the global threat and pandemic designations (those were two separate declarations), while also insisting that travel restrictions and border closures weren't appropriate at a time when those decisions could have gone a long way toward suppressing the spread.

Because as the White House reportedly prepares a plan to get some healthy people back to work in the not too distant future, the WHO is now urging that countries considering a lifting of their lockdowns should probably reconsider (even as China prepares to send legions of infected Wuhan residents across its own country, and the world).

The WHO said Wednesday that "we have a long way to go” to defeat the pandemic, said Dr Hans Kluge, the WHO regional director for Europe, adding that now is “not the time to relax [lockdown] measures,” and all countries must “double and triple our collective efforts”. “We still have a long way to go,” he said. “The progress we have made so far in fighting the virus is extremely fragile.” Any relaxation of social distancing measures requires “very careful consideration,” he added. “We need to remain committed.”

His remarks were clearly directed at the West (after all, he was speaking in English), but would the WHO, which has come under fire for refusing to criticize Beijing, say the same about Wuhan?

If you, dear reader, happen to be a billionaire like Microsoft founder Bill Gates, or at least wealthy enough to perhaps be insulated from the vicissitudes of the combined economic and public health crises which have caused the economy to literally grind to a halt, then perhaps you don't understand how bad things really are out there (after all, the stock market has really bounced back over these last few days). For those who still believe most Americans could survive a ten week total economic shutdown, the OECD would just like you to know: Most of the world is already officially in a deep recession. A leading indicator published by the Paris-based NGO showed its biggest drop on record.

Just in case you weren't aware, the global economy is a giant dumpster fire right now. And while people with comfortable white collar jobs are shouting at everybody to "stay indoors!!!!", there are millions of people are this country who are still waking up every day trying to figure out how they're going to eat, or take care of other essential needs, in the middle of a lockdown.

Across the US, chatter on social media about the need to get at least some of the shut-down economy back online has intensified in recent days, as political commentary as inspired heated discussions as opponents accuse Republicans and many regular Americans of callously placing the economy and their own self-interest above protecting society's most vulnerable. Meanwhile, the global case total has surpassed 1.4 million, with 83k+ deaths.

But as JPM projected, and as was the case during SARS and other prior pandemics, even if the novel coronavirus does begin to recede heading into the summer, remember: this is only part one.

At this point, it's not like anybody is going to snap their fingers and suddenly turn the clock back to Dec. 31, 2019. Many Americans - especially those at high risk - will likely cut down on leisure air travel, as pundits are already talking about the death of the "one-flight meeting".

But as we begin to weigh the pros and cons, and the Trump Administration reportedly weighs a plan to reactivate parts of the economy and allowing some people to get back to work if they can demonstrate that they're healthy, the SCMP late last night highlighted some new scientific evidence that is extremely disturbing.

As we explained above, by lifting restrictions on Wuhan, China is potentially unleashing hundreds, maybe even thousands, of asymptomatic carriers on the rest of the country. But scientists believe the 'herd immunity' that has supposedly been built up during the first wave should blunt the impact of ensuing waves somewhat. Well, unfortunately, it looks like that thesis needs to be reexamined.

Since the early days of the outbreak, we've seen reports about people being reinfected with the virus (though in some cases there were doubts about whether the virus ever really left). Well, now, a team of researchers at Fudan University in Shanghai has discovered that an alarmingly high number of recovered patients whom they've tested show low, or no, levels of the virus antibodies in their blood. That means a sizable chunk of those who are infected will be vulnerable to reinfection.

In other words, if these findings are confirmed, the hoped-for "herd immunity" that is supposed to help us get things back to normal in the time between now and however long it takes researchers to mass produce a vaccine simply isn't going to materialize: Instead of diluting the density and acting as blockers for spread, many will be reinfected, and go on to spread the virus to others, all over again. It's just the latest reason to worry that the second wave of the virus could be larger than the first.

Some countries are already seeing the first stirrings of a second wave: On Wednesday, Tokyo reported a record 144 new cases on Wednesday as PM Shinzo Abe's lockdown (which is legally toothless but has inspired most businesses to close nonetheless) took effect.

As the virus continues its woefully underreported spread across Africa - or so public health experts fear - Ethiopia announced on Wednesday that it's joining a growing list of African nations - already including Botswana, Congo, Ivory Coast, Senegal, South Africa and others - by declaring a state of emergency over the virus. The country's 110 million people have been relatively unscathed, reporting just 52 cases so far, though some fear that the country's close ties to Beijing and commerce between the two nations means many more cases have gone unreported.

Iraq also extended the closure of its main border crossing with Iran as the 'official' death toll in that country passes 10k. Much to Trump's delight, the decision will put added economic pressure on Tehran, as it will disrupt trade between the two nations, something upon which Iran's sanctions-starved government greatly relies.

Certain progressive media outlets in the US will likely never forget that certain conservative pundits and even - to a much lesser degree - President Trump, Mitch McConnell and other Republican leaders played down the coronavirus as the first cases were confirmed in the US. While President Trump likes to brag about his decision to shut down travel from China, in reality, that was a half-measure (he should have shut down travel from Europe, as certain senior advisors reportedly urged). And while they're not wrong, they're only telling part of the story. A lot of people in positions of power - including, as the Intercept notes, NYC's Democratic mayor - either underestimated the outbreak, or have changed views on subjects like drugs, whether shutting down schools makes sense, whether a partial shutdown that preserves more of the economy might be a more appropriate response - the list goes on and on.

Going through this list, it appears to us that nobody is more guilty than the WHO, which is partly why President Trump is insisting that the US reexamine the WHO's funding, and has mocked the WHO for 'totally blowing it'.

Of course, anybody who has only just started paying attention in the past few weeks (ie most of America) probably doesn't remember the WHO dragging its feet on the global threat and pandemic designations (those were two separate declarations), while also insisting that travel restrictions and border closures weren't appropriate at a time when those decisions could have gone a long way toward suppressing the spread.

Because as the White House reportedly prepares a plan to get some healthy people back to work in the not too distant future, the WHO is now urging that countries considering a lifting of their lockdowns should probably reconsider (even as China prepares to send legions of infected Wuhan residents across its own country, and the world).

The WHO said Wednesday that "we have a long way to go” to defeat the pandemic, said Dr Hans Kluge, the WHO regional director for Europe, adding that now is “not the time to relax [lockdown] measures,” and all countries must “double and triple our collective efforts”. “We still have a long way to go,” he said. “The progress we have made so far in fighting the virus is extremely fragile.” Any relaxation of social distancing measures requires “very careful consideration,” he added. “We need to remain committed.”

His remarks were clearly directed at the West (after all, he was speaking in English), but would the WHO, which has come under fire for refusing to criticize Beijing, say the same about Wuhan?

If you, dear reader, happen to be a billionaire like Microsoft founder Bill Gates, or at least wealthy enough to perhaps be insulated from the vicissitudes of the combined economic and public health crises which have caused the economy to literally grind to a halt, then perhaps you don't understand how bad things really are out there (after all, the stock market has really bounced back over these last few days). For those who still believe most Americans could survive a ten week total economic shutdown, the OECD would just like you to know: Most of the world is already officially in a deep recession. A leading indicator published by the Paris-based NGO showed its biggest drop on record.

Just in case you weren't aware, the global economy is a giant dumpster fire right now. And while people with comfortable white collar jobs are shouting at everybody to "stay indoors!!!!", there are millions of people are this country who are still waking up every day trying to figure out how they're going to eat, or take care of other essential needs, in the middle of a lockdown.

That doesn't mean people should just flout the lockdown when they feel like it, it's just a reminder that everybody deserves the benefit of the doubt.

- Source, Zero Hedge

Monday, April 6, 2020

The Day of Reckoning For This Economic Crisis

Taxes refunded. Helicopter currency drops. Central banks trying to kick-start economies. It’s all here, in what he refers to as ‘The Day of Reckoning’.

- Source, Gold Silver

Saturday, April 4, 2020

Gold and Silver Supply, Jobless Claims Soar, Massive Stimulus

As jobless claims soar what are the real economic impacts for precious metals investors during this volatile period?

With more massive government stimulus on the way, we'll explore the real consequences of these injections and how the U.S. Dollar index will react.

We cover the prices of gold, silver, platinum, palladium, & the U.S. Dollar Index alongside metals miners.

- Source, Golden Rule Radio

Friday, April 3, 2020

Is the Physical Gold and Silver Supply Chain Empty?

Andy joins host Dunagun Kaiser to field some of the toughest questions faced by concerned people who’ve been calling in record numbers, troubled about protecting their savings, retirements, investments, IRAs, 401(k)s, pensions, and more.

Andy also shares his gripping personal experience of what happened to him when he attempted to personally carry a large amount of gold bullion coins through international airport customs.

Lessons learned for all of us who want to be aware and prepared for possible scenarios in the times ahead.

- Source, Reluctant Preppers

Leaks Everywhere: Federal Reserve Expands Balance Sheet at Fastest Rate Ever

The situation across the globe is deteriorating rapidly and I am not just talking about the continued spread of COVID-19, but the ramifications that come along with it, that will likely have just as dire consequences in the coming months, to years.

The most serious of these ramifications is the financial collapse that we now living through, which has resulted in a complete and utter gutting of many businesses, resulting in what will come to be in the following weeks, the highest unemployment that the Western world has ever seen.

This means that big government is being looked to more and more to help support and sustain the system in the short term, printing copious amounts of fiat money in the hope that they can plug as many holes as possible, while new leaks continue to spring up all around them.

I don't envy this position and unfortunately they are truly stuck between a rock and a hard place.

Save the economy and keep business open as usual, or shut down the whole globalized world and crash the markets, potentially destroying millions of jobs forever, while saving millions of lives in the short term. These are their choices at the moment.

Clearly, governments have chosen the latter and sprung into action, going into full blown bail-out mode.

This has resulted in a monstrous spike in government debt levels, as they continue to debase their currencies and print money out of thin air.

Dwarfing all others, as would be expected, is the Federal Reserve, who have expanded their balance sheet by ungodly levels in just three short weeks.

As can be seen from the chart above, the Federal Reserve has added a staggering $1.6 trillion to their balance sheet since March 13th, when the bailouts kicked into high gear.

This brings their current total levels to $5.81 trillion, which highlights just how rapidly the Federal Reserve is being forced to intervene in the markets.

Just to put this into perspective, as of the close of the trading session on Friday, April 3rd, in which the Fed's balance sheet is estimated to be approximately $6.0 trillion. The Federal Federal Reserve will of added more than the entirely of QE3, in just three weeks!

This truly is fiat money printing at a level we have never before seen.

Unfortunately, we haven't seen nothing yet, as this crisis is far from over and the Federal Reserve, along with countless other governments around the globe are going to be forced to intervene time and time again, unless they wish to not only being facing one of the greatest health crisis of our times, but also complete anarchy, if the financial system is allowed to fully implode within itself.

Still, I believe they are only slowing the inevitable, as many markets are also currently reflecting, such as the oil markets which have been completely devastated in the matter of just one month.

One example of this devastation was highlighted this week, as numerous media outlets began to point out the fact that you could buy a barrel of Canadian heavy oil, for less than one pint of beer at a pub.

Think about just how absurd that is for a moment. Then think about what it going to take to get the jobs that are centered around getting this oil out of the ground to return. This is a massive part of the Canadian economy.

Meanwhile, one commodity that has continued to hold strong, in the face of just about everything else collapsing, is gold bullion, which is currently trading at $1625.70 USD per oz, despite the historic amount of liquidation that is occurring within the system.

What is even more stunning, is that gold bullion is able to hold these strong levels, while the USD continues to strengthen.

Historically this is not the case, as a strong dollar, typically results in a weakening gold price.

If the USD ever begins to trend lower again, you can rest assured that gold bullion is going to blow off the charts, rocketing higher at an extreme velocity.

Even if this does not happen however and the USD continues to show strength, I still strongly believe that gold and silver bullion are going to trend higher, as more and more people continue to seek these commodities as safe haven assets, preparing for the eventual day when this historic amount of fiat money begins to flood back into the system.

Apparently many people agree with my assessment, as physical bullion remains incredibly hard to get your hands on, with many mines, mints and others in the industry being forced to close their doors due to COVID-19, just as the demand for physical metals hits new highs.

This is why you are seeing such a staggering difference in the price of physical precious metals and the price of paper metals, the two of which have begun to decouple from each other, with silver being the most noticeable of the two.

As previously stated, I don't envy our political leaders in these dire times, as I truly do believe that we have passed the Rubicon, a point I have highlighted many times before.

The debt levels are simply too high and never, ever, will this money be repaid in whole, meaning that the only way out of this is an eventually default.

Remember these words:

"What cannot be repaid, will not be repaid."

This however does not mean that you cannot protect yourself financially for that coming day. Now more than ever, I believe that people need to be moving their money into tangible, hard assets such as gold and silver bullion, as they are able to do so.

For over 10,000 years, precious metals have weathered each and every financial storm and without a doubt, they will weather this one as well, rewarding those who took action early, handsomely for doing so.

Stay safe and keep stacking.

- Source, Nathan McDonald via the Sprott Money Blog

The most serious of these ramifications is the financial collapse that we now living through, which has resulted in a complete and utter gutting of many businesses, resulting in what will come to be in the following weeks, the highest unemployment that the Western world has ever seen.

This means that big government is being looked to more and more to help support and sustain the system in the short term, printing copious amounts of fiat money in the hope that they can plug as many holes as possible, while new leaks continue to spring up all around them.

I don't envy this position and unfortunately they are truly stuck between a rock and a hard place.

Save the economy and keep business open as usual, or shut down the whole globalized world and crash the markets, potentially destroying millions of jobs forever, while saving millions of lives in the short term. These are their choices at the moment.

Clearly, governments have chosen the latter and sprung into action, going into full blown bail-out mode.

This has resulted in a monstrous spike in government debt levels, as they continue to debase their currencies and print money out of thin air.

Dwarfing all others, as would be expected, is the Federal Reserve, who have expanded their balance sheet by ungodly levels in just three short weeks.

As can be seen from the chart above, the Federal Reserve has added a staggering $1.6 trillion to their balance sheet since March 13th, when the bailouts kicked into high gear.

This brings their current total levels to $5.81 trillion, which highlights just how rapidly the Federal Reserve is being forced to intervene in the markets.

Just to put this into perspective, as of the close of the trading session on Friday, April 3rd, in which the Fed's balance sheet is estimated to be approximately $6.0 trillion. The Federal Federal Reserve will of added more than the entirely of QE3, in just three weeks!

This truly is fiat money printing at a level we have never before seen.

Unfortunately, we haven't seen nothing yet, as this crisis is far from over and the Federal Reserve, along with countless other governments around the globe are going to be forced to intervene time and time again, unless they wish to not only being facing one of the greatest health crisis of our times, but also complete anarchy, if the financial system is allowed to fully implode within itself.

Still, I believe they are only slowing the inevitable, as many markets are also currently reflecting, such as the oil markets which have been completely devastated in the matter of just one month.

One example of this devastation was highlighted this week, as numerous media outlets began to point out the fact that you could buy a barrel of Canadian heavy oil, for less than one pint of beer at a pub.

Think about just how absurd that is for a moment. Then think about what it going to take to get the jobs that are centered around getting this oil out of the ground to return. This is a massive part of the Canadian economy.

Meanwhile, one commodity that has continued to hold strong, in the face of just about everything else collapsing, is gold bullion, which is currently trading at $1625.70 USD per oz, despite the historic amount of liquidation that is occurring within the system.

What is even more stunning, is that gold bullion is able to hold these strong levels, while the USD continues to strengthen.

Historically this is not the case, as a strong dollar, typically results in a weakening gold price.

If the USD ever begins to trend lower again, you can rest assured that gold bullion is going to blow off the charts, rocketing higher at an extreme velocity.

Even if this does not happen however and the USD continues to show strength, I still strongly believe that gold and silver bullion are going to trend higher, as more and more people continue to seek these commodities as safe haven assets, preparing for the eventual day when this historic amount of fiat money begins to flood back into the system.

Apparently many people agree with my assessment, as physical bullion remains incredibly hard to get your hands on, with many mines, mints and others in the industry being forced to close their doors due to COVID-19, just as the demand for physical metals hits new highs.

This is why you are seeing such a staggering difference in the price of physical precious metals and the price of paper metals, the two of which have begun to decouple from each other, with silver being the most noticeable of the two.

As previously stated, I don't envy our political leaders in these dire times, as I truly do believe that we have passed the Rubicon, a point I have highlighted many times before.

The debt levels are simply too high and never, ever, will this money be repaid in whole, meaning that the only way out of this is an eventually default.

Remember these words:

"What cannot be repaid, will not be repaid."

This however does not mean that you cannot protect yourself financially for that coming day. Now more than ever, I believe that people need to be moving their money into tangible, hard assets such as gold and silver bullion, as they are able to do so.

For over 10,000 years, precious metals have weathered each and every financial storm and without a doubt, they will weather this one as well, rewarding those who took action early, handsomely for doing so.

Stay safe and keep stacking.

- Source, Nathan McDonald via the Sprott Money Blog

Thursday, April 2, 2020

How the Perfect Prepper Plans Can Still Go Wrong

Or, in the eloquent words of Mike Tyson, “Everyone’s got a plan ’til they get punched in the mouth.”

But, variables.

That’s just the thing. There is nearly always going to be a variable that doesn’t fall neatly into your imagined scenario. Your ability to roll with that is the truest test of your preps and indeed, your overall level of preparedness. It is more valid than any number of planned practice runs.

Don’t get me wrong. Planned practice runs are great and are a valuable technique to enhance your level of preparedness. But be honest – you nearly always do a little something extra to prepare for a practice run. Perhaps you make an extra trip to the store. Maybe you just got a brand new prep that you want to test out, inspiring the practice run that is a perfect scenario for the use of that prep.

But…disasters do not wait for the perfect time and circumstances. They don’t always indicate their arrival and allow enough time for a trip to the store. (At least not a trip to the store during which everyone else in your geographic vicinity is competing for the same supplies.)

Realizing this can take your preparedness to the next level.

Here’s an example that happened to us one weekend.

On Friday, I spent the afternoon canning. I did a huge batch of tomatoes, and anyone who has ever canned tomatoes can tell you exactly how messy that was. My poor white kitchen looked like a crime scene. I made dinner and stacked the pots, pans, and dishes in the sink. I had a huge mess in the kitchen. I had a load of dirty laundry humming along in the washing machine as I began to tackle the chaos.

Then, I turned on the faucet and nothing came out.

Not a drop.

My well pump had finally given up the ghost.

And my kitchen was a disaster area. And soapy, wet laundry sat in my washer.

On the first day of our family emergency, we went through nearly triple our allotted amount of water, just to get things to the condition in which we could abide by our plan. Fortunately, I had quite a bit of water stored, but it wasn’t going to last nearly as long as I had expected with the giant dent I put in the supply on Day 1.

I pulled out my notebook and began to jot down the things we learned with this unexpected drill and reported it to some prepper folks that I hang out with. One friend said that I normally wouldn’t start out with tomato guts all over the counters and a sink full of dirty dishes and a soapy load of clothes in the washing machine. Initially, I agreed, since this isn’t the usual state of my home.

But then, I thought about it.

There’s nearly always some weird variable.

A few years ago when the Derecho hit the Washington DC area, a local friend there told me it had been laundry day. She had put off doing laundry because the family had been busy, and they had piles and piles of dirty clothes.

The fact that they hardly anything clean left to wear had been the motivating factor in her sorting the large piles of laundry on the kitchen floor as she began to conquer the mountain.

And then the power went out. It went out for days. And there they were with all of that dirty laundry, a load in the washer, a load in the dryer, and hardly a thing to wear. They ended up hanging the stuff in the dryer, hand washing to complete the stuff in the washer, and wearing the same stuff for the next few days during a horrible heat wave with no power.

The lesson here?

When a disaster hits your house, you will probably have some variable too. Very few of us are in a constant state of readiness. Life just doesn’t work like that.

We have busy weeks during which we may skip laundry day. We have messy kitchens because we just did a huge project. We have times when our house is messy and disorganized, or when we are waiting for the next paycheck before hitting the grocery store for some staples that are running low. We use up all the BBQ’s propane during a weekend cookout. We discover the kids have been quietly snacking on some of the no-cook goodies we thought were secretly stashed away, but discover it only when we go to pull that food out to feed the family during a power outage.

When a disaster hits your house, you will probably have some variable too. Very few of us are in a constant state of readiness. Life just doesn’t work like that.

We have busy weeks during which we may skip laundry day. We have messy kitchens because we just did a huge project. We have times when our house is messy and disorganized, or when we are waiting for the next paycheck before hitting the grocery store for some staples that are running low. We use up all the BBQ’s propane during a weekend cookout. We discover the kids have been quietly snacking on some of the no-cook goodies we thought were secretly stashed away, but discover it only when we go to pull that food out to feed the family during a power outage.

There’s really never a perfect time.

There’s rarely a warning that comes at a time when we have enough in our bank account to grab anything we’re running short of, and also aligns with our ability to get to the store before everyone else that wants to pick up those vital items.

So, you have to make the best of it. You have to be ready to accept the fact that you’ll find that somewhere in your plans was a gap. You’ll learn that you had prepped for a neat, perfect scenario but that life handed you an asymmetrical mess with a pile of dirty laundry in the kitchen.

That’s when you’ll discover how prepared you really are. That is when you will truly be able to test your adaptability, which is the true key to surviving any crisis...

There’s rarely a warning that comes at a time when we have enough in our bank account to grab anything we’re running short of, and also aligns with our ability to get to the store before everyone else that wants to pick up those vital items.

So, you have to make the best of it. You have to be ready to accept the fact that you’ll find that somewhere in your plans was a gap. You’ll learn that you had prepped for a neat, perfect scenario but that life handed you an asymmetrical mess with a pile of dirty laundry in the kitchen.

That’s when you’ll discover how prepared you really are. That is when you will truly be able to test your adaptability, which is the true key to surviving any crisis...

- Source, Organic Prepper

Mike Maloney: Is This the End of the American Dream?

What can the average person do to prevent their wealth being erased?

These are the questions that Mike Maloney tackles in today’s update, you may be surprised by some of the data and evidence that he provides for his case.

- Source, Gold Silver

Wednesday, April 1, 2020

We Are Experiencing the End Game of the Great Debt Super Cycle

In the post-Keynesian era, the standard policy solution to a business cycle downturn has been for governments to temporarily offset any decline in demand with increased fiscal stimulus and easy money. This prescription has provided for smaller and less frequent slowdowns. The ultimate consequence is that businesses and households have been carrying larger debt loads and smaller cash reserves, confident that policymakers will restrain the severity of the consequences created by any shock to the economy.

This process of accumulating larger debt balances after each successive downturn is often referred to as the great debt super cycle. Over the past decades, the successful use of Keynesian stabilization policies has increasingly raised the confidence of investors and creditors alike that government can successfully truncate the downside of any recession.

The massive debt accumulation by U.S. households following accommodative monetary policy and easy credit led to the housing bubble. The collapse of this bubble destabilized the global financial system and could only be halted with unorthodox monetary policy and fiscal programs that led to partial or total nationalization of many financial institutions and manufacturers.

In the wake of that crisis governments themselves have become highly indebted, requiring virtually continuous support from central banks to acquire that debt to maintain low interest rates to support growth. The average ratio of government debt to GDP for G-7 economies reached 117 percent in 2019, up from 81 percent in 2007. Any attempt to taper or reverse the accumulation of government debt or other assets is quickly reversed as financial markets become unruly and economies slow.

Now faced with the exogenous shock of the COVID-19 pandemic, policymakers are returning to the same tools employed in the financial crisis a decade ago. They are desperately searching for programs that will fill the demand gap created by massive shutdowns and travel restrictions while simultaneously finding ways to prop up businesses that to a large degree are overly indebted as a result of artificially low interest rates from the past decade.

The ultimate policy goal is to stabilize the economy by salvaging industries that will need to provide employment when the pandemic ends. Given the high level of leverage in these companies, any gaps in cashflow will make it impossible for many companies to service their debt. The total debt of U.S. nonfinancial businesses has grown by about $6 trillion since 2007, while cash on hand has only grown by $1.7 trillion. A big driver of that debt growth has been buying back stock.

Lending these companies more money will only compound the long run problem resulting from over-leverage and make the companies even more vulnerable to failure in the long run.

We are experiencing the end game of the great debt super cycle. As the private sector has become increasingly over-levered, the baton is being passed to the public sector where resources are so strained that the printing press has become the last resort. At 4.6 percent of GDP, the U.S. federal budget deficit in FY 2019 was larger than anything we’ve seen outside of a recession or war.

The truth is that the only policy solution short of socialism is to accomplish a great transfer of wealth from investors to debtors. In the normal course, companies reorganize and creditors haircut debts on a case by case basis. This process, however, is time consuming and expensive. Given the systemic nature of the current crisis, the sheer volume of reorganizations would swamp the financial and legal systems and large defaults would be followed by asset liquidations that would depress the value of collateral backing other loans and likely set off a downward spiral.

Another answer is negative interest rates, where creditors accept a slow erosion of value. The hurdle to successfully implement this solution expeditiously seems completely unrealistic. To reach levels of negative interest rates that would effect a solution would require a rapid shift to a cashless global society and an overhaul of regulation around pension funds and the insurance industry, not to mention the logistical challenges of immediately implementing the systems throughout the financial industry.

Of course, there remains a tried and true method to achieve this policy: debasement. The process of inflating prices would result in shifting wealth from investors to creditors. Many believe inflation is dead and such a policy would not work. The question of how to succeed in raising the price level is more a degree of commitment than ability.

By quickly turning up the printing presses, global central banks would need to provide reserves at a faster rate than the collapse in the velocity of money. This is a delicate exercise and one that would be difficult to execute successfully.

The risks on both sides is not moving quickly enough and overdoing it. If there is too little money made available, the prices of assets used as collateral backing loans will spiral downward. If there is too much, inflation will spiral out of control.

Almost eight years ago I wrote of the Faustian bargain in which policy makers had engaged to solve the financial crisis. The awful consequence of these policies is that the bill may now be coming due.

- Source, Guggenheim Investments

Subscribe to:

Posts (Atom)