This new player was Serbia, who stated that they are hoping to increase their gold reserves in the face of mounting geopolitical uncertainty, uncertainty that seems to only be getting worse, not better with each passing day.

In just one month, Serbia increased their gold reserves by 1/3rd, by adding 9 tonnes of gold in that short window of time. This may not seem like a lot compared to some of the largest gold players, but to Serbia, it was a massive acquirement and is likely only just the beginning.

Not to be outdone, one of the rising stars in the precious metals space, Poland has announced another move that has surprised many in the bullion markets, while others simply nod their heads, acknowledging the trend that is now solidifying within the physical bullion markets.

The Central Bank’s governor, Adam Glapinski, announced on Monday that Poland had repatriated 100 tonnes of its gold from the Bank of England, while stating the following;

Also, Glapinski stated that Poland could sell these gold reserves for "billions" in profit, but had no intentions of doing so, as they are looking to increase their position in the yellow metal, not decrease.

The Central Bank of Poland has also stated that they will be repatriated more gold, of which roughly half is still held by the Central Bank of England, as they deem needed.

Taking to twitter, Poland showcased their recently returned wealth in a photo op;

100 ton zlota z rezerw @nbppl wrocilo do Polski pic.twitter.com/Guv03hZhCq— Pawel Czurylo (@czuryloPL) November 25, 2019

Prezes @nbppl Adam Glapiński i polskie złoto - 100 ton wrociło do Polski pic.twitter.com/5vTj5hLueY— Pawel Czurylo (@czuryloPL) November 25, 2019

The previous mentioned statement, indicating that the gold they repatriated from the UK symbolizes the strength of the country, is one that bears great mention, as it is a lesson that many in the financial industry have sadly forgotten, as gold has been a bulwark in times of great unrest and geopolitical uncertainty, times such as those that we now find ourselves living in.

Poland, along with Russia, China, Hungary, India, Serbia and many others are not ignorant of this fact and it is exactly why so many of these Central Banks are gobbling up every ounce of gold bullion that they can get their hands on, while tossing away as many fiat US dollars as they can.

They know that in the end, when the "you know what" hits the fan, that it is gold bullion that will offer protection, not fiat money, as it has been since golds inception into mankinds financial history, a history that spans over 10,000 years.

Unfortunately, these risks do indeed appear to be growing once again, as the situation with the China / US trade wars once again took a turn for the worse, after this week's event saw the United States sign the "Hong Kong Democracy Bill", a move that has "infuriated" Chinese officials and one that they vow will cause retaliation, although they have not stated what that retaliation will be as of yet.

Additional, with President Trump completely bogged down with the Impeachment circus show, talks with North Korea have all but evaporated, as the administration is too focused on dealing with the battering ram at their door, rather than what is outside of their immediate line of sight.

This has caused North Korea to once again lash out as they feel like they are being ignored, firing numerous test missiles over the last few days, once again raising tensions with neighboring countries and the world at large.

With all of the current nonsense unfolding around the world, more Central Banks around the world, especially those in the West should be following the example being set forth by net gold positive Central Banks, such as those in Russia, China, Poland and others.

Gold is needed now, gold will be needed in the future. It is the ultimate insurance policy and individuals who act before it is needed will be protected from the coming storm, those who don't, risk being washed away.

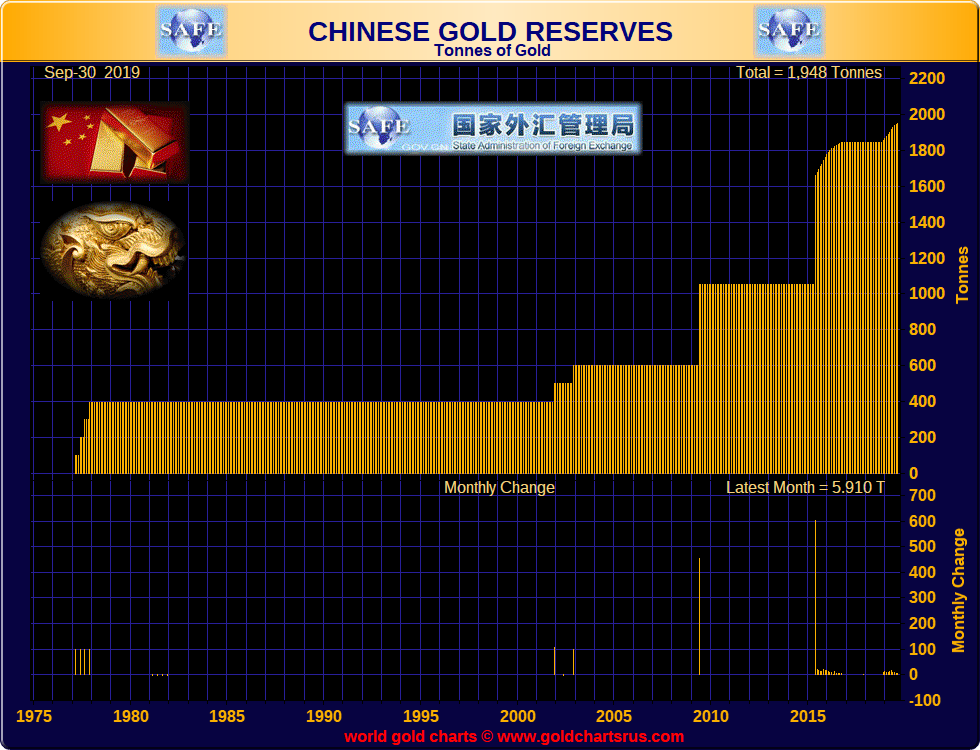

Chinese central bank gold reserves – No buying in October

Chinese central bank gold reserves – No buying in October

Distinctive slim gold bars from Vietnam’s Kim Thanh refinery, 1 tael

Distinctive slim gold bars from Vietnam’s Kim Thanh refinery, 1 tael From Vietnam to Hong Kong – Skyluck, the ship that smuggled 2,600 refugees. Source:

From Vietnam to Hong Kong – Skyluck, the ship that smuggled 2,600 refugees. Source:  Kim Daejung, then president elect, donated his gold in

Kim Daejung, then president elect, donated his gold in