Sunday, September 26, 2021

Silver price to hit ‘high ranges’ of triple digits; Not enough on planet to meet demands

Friday, September 24, 2021

A New Currency System is Emerging

Thursday, September 23, 2021

Gold & Silver's Next Major Push Explained

Tuesday, September 21, 2021

Friday, September 17, 2021

Silver Fortune: The Blueprint for a Silver Squeeze

Friday, September 10, 2021

Ron Paul: This is Not About Freedom or Personal Choice, It's All About TYRANNY

Monday, September 6, 2021

Tavi Costa: This is what held gold back and why it’s so ‘cheap’ now

Saturday, September 4, 2021

Friday, September 3, 2021

Martin Armstrong: Gold Gains As Confidence Collapses

Let me explain something. What I have pointed out about gold is that it DOES NOT rally merely because of inflation or the rise in debt.

It will rally when we are looking at the collapse in confidence. The central banks have no desire to raise for their own budget will blow apart. The Fed is restrained by the ECB and the rest of the central banks pleading with the Fed on their knees NOT to raise rates.

Do not get confused about comments from the central banks that they will not raise rates. CBs only can regulate the short-term. The long-term rates are set by the market. That is why they even do Quantitative Easing – they buy in the long-term debt trying to reduce those rates because they cannot control them.

Therefore, it really does not matter what they say. That is the Press spinning it because they have nothing else to say and they have always promoted propaganda with the markets relative to interest rates.

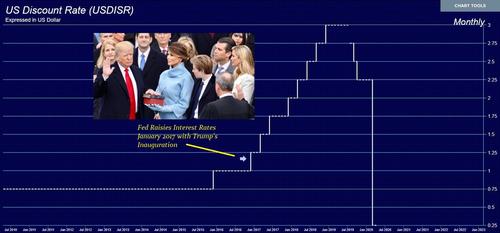

They kept preaching the market would decline because the Fed was raising rates.

Well, step back and close your ears to what the press says and the talking heads you hear on TV who do not know the first thing about markets. Interest rates ran up from 2016 throughout Trump’s 4 years.

They only dropped like a stone due to the COVID manipulation. The market rallied with higher rates – it crashed with lower rates – OMG!

Gold will NOT rally due to debt levels, QE, or any other BS scenario.

Gold rallies due to CONFIDENCE collapsing. This is what we are dealing with the failure of central banks and the collapse in Keynesian Economics.

This is why they are endorsing the Great Reset because CBs cannot raise interest rates and they have destroyed the bond market in Europe while wiping out their pension funds because they also decreed these funds MUST invest in government debt.

They have destroyed the economy and that is why they are using COVID as a military tactic.

Therefore, what I am saying about gold is that it rises when CONFIDENCE collapses, not the rise and fall of QE and interest rates in the normal course of business.

We must look to the general public. When they wake up and realize that there is no way this COVID nonsense will ever end because they are deliberately using it to seize the economy and transform it into this Great Reset where governments will no longer borrow money – just print.

They are intent to default on all public debt and replace even pensions with Guaranteed Basic Income. They are moving toward these end goals step by step so the people do not realize what is taking place.

For now, there is still the short-term risk that the dollar rises because Europe has utterly been destroyed and Schwab is in full control. Every strategic person in a key position is also on his board at the WEF.

- Source, Martin Armstrong