Monday, December 20, 2021

Silver will go 'crazy' in 2022, gold to break $2k again, speculation will end

Friday, December 17, 2021

Steven Van Metre: The Fed is Running out of Tools to Save the Market

Steven discusses his latest video on why Q.E. does not mean money creation. The Fed is just swapping assets and forcing money into the commercial banking system.

Tuesday, December 7, 2021

At Least 5 Major Governments Colluded To Manipulate Oil Prices Down A Lot Last 2 Weeks?

Sunday, December 5, 2021

Friday, December 3, 2021

Golden Rule Radio: If Volcker Was Measuring, Inflation Now At 13%

Tuesday, November 23, 2021

Don't invest in gold until you understand these fundamentals - Gary Wagner gives price targets

Sunday, November 21, 2021

Friday, November 19, 2021

Ron Paul: Is Inflation Biden's Fault? It's Certainly His Problem

Wednesday, November 10, 2021

Ron Paul: Shipping Crisis, Staffing Crisis, Empty Shelves!

Monday, November 8, 2021

Friday, November 5, 2021

John Rubino on Strikes and Wage Inflation

Tuesday, November 2, 2021

Hacking Your Mind: Are You A Victim Of Cognitive Warfare?

Sunday, October 31, 2021

Gold, Silver, & Platinum Market Update

Friday, October 29, 2021

Inflation Will Continue to Rise and Persist Amidst a Flattening Yield Curve

Sunday, October 17, 2021

Michael Pento: Runaway Inflation & Bail-Ins Lay Just Ahead

Friday, October 15, 2021

David Morgan: It's Happening: Shift From Stocks To Metals

Sunday, October 10, 2021

Ron Paul: Even a $1 Trillion Platinum Coin Will Not Pay To "Build Back Better"

Friday, October 8, 2021

Head of Research Alasdair Macleod Discusses Sound Money and Gold's History

Sunday, October 3, 2021

Friday, October 1, 2021

John Rubino The Money Tree, Open Borders & Other AOC Fantasies

Sunday, September 26, 2021

Silver price to hit ‘high ranges’ of triple digits; Not enough on planet to meet demands

Friday, September 24, 2021

A New Currency System is Emerging

Thursday, September 23, 2021

Gold & Silver's Next Major Push Explained

Tuesday, September 21, 2021

Friday, September 17, 2021

Silver Fortune: The Blueprint for a Silver Squeeze

Friday, September 10, 2021

Ron Paul: This is Not About Freedom or Personal Choice, It's All About TYRANNY

Monday, September 6, 2021

Tavi Costa: This is what held gold back and why it’s so ‘cheap’ now

Saturday, September 4, 2021

Friday, September 3, 2021

Martin Armstrong: Gold Gains As Confidence Collapses

Let me explain something. What I have pointed out about gold is that it DOES NOT rally merely because of inflation or the rise in debt.

It will rally when we are looking at the collapse in confidence. The central banks have no desire to raise for their own budget will blow apart. The Fed is restrained by the ECB and the rest of the central banks pleading with the Fed on their knees NOT to raise rates.

Do not get confused about comments from the central banks that they will not raise rates. CBs only can regulate the short-term. The long-term rates are set by the market. That is why they even do Quantitative Easing – they buy in the long-term debt trying to reduce those rates because they cannot control them.

Therefore, it really does not matter what they say. That is the Press spinning it because they have nothing else to say and they have always promoted propaganda with the markets relative to interest rates.

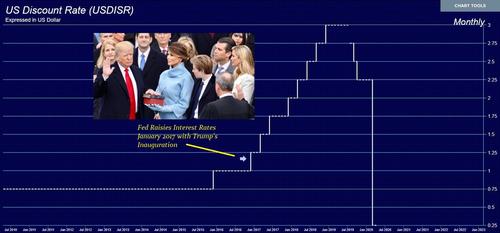

They kept preaching the market would decline because the Fed was raising rates.

Well, step back and close your ears to what the press says and the talking heads you hear on TV who do not know the first thing about markets. Interest rates ran up from 2016 throughout Trump’s 4 years.

They only dropped like a stone due to the COVID manipulation. The market rallied with higher rates – it crashed with lower rates – OMG!

Gold will NOT rally due to debt levels, QE, or any other BS scenario.

Gold rallies due to CONFIDENCE collapsing. This is what we are dealing with the failure of central banks and the collapse in Keynesian Economics.

This is why they are endorsing the Great Reset because CBs cannot raise interest rates and they have destroyed the bond market in Europe while wiping out their pension funds because they also decreed these funds MUST invest in government debt.

They have destroyed the economy and that is why they are using COVID as a military tactic.

Therefore, what I am saying about gold is that it rises when CONFIDENCE collapses, not the rise and fall of QE and interest rates in the normal course of business.

We must look to the general public. When they wake up and realize that there is no way this COVID nonsense will ever end because they are deliberately using it to seize the economy and transform it into this Great Reset where governments will no longer borrow money – just print.

They are intent to default on all public debt and replace even pensions with Guaranteed Basic Income. They are moving toward these end goals step by step so the people do not realize what is taking place.

For now, there is still the short-term risk that the dollar rises because Europe has utterly been destroyed and Schwab is in full control. Every strategic person in a key position is also on his board at the WEF.

- Source, Martin Armstrong

James Anderson: How Deep Pockets Will Fuel the Coming Bull Market in Silver

Thursday, September 2, 2021

Thoughts on Making Sense of the Silver Market in 2021, Four Ideas

Lobo Tiggre: Silver unlikely to track gold again, may "never go back as money", here's why

Wednesday, September 1, 2021

Chris Vermeulen: Stock Market Blow Off Top Coming

Tuesday, August 31, 2021

Newsmax's Steve Cortes Blasts The Fed For Crushing The Middle Class & Protecting Biden

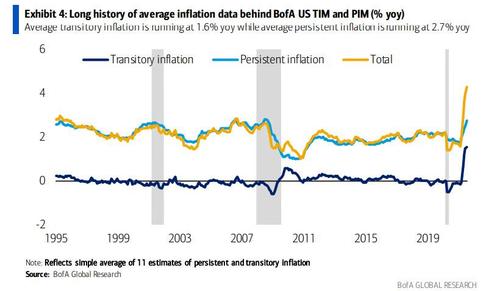

Before Regan spoke with Cortes, she provided readers with a backdrop of the word "transitory" and how The Fed ignores soaring prices of goods and services. Heck, it's a brilliant strategy by the Fed because if six months from now prices are still increasing, Chair Jerome Powell will merely say inflation remains transitory. Still, in reality, it's not and becoming more persistent...

Regan asked a very important question during in the intro of the podcast: How long can the middle class handle surging stagflation: soaring gasoline and supermarket prices and barely any real wage growth (on top of new virus restrictions).

She said the 11-14% food price increases at the supermarket are beginning to dent consumer sentiment, adding that middle-class wages adjusted for inflation aren't going as far as they used to. Many folks are living a different life than they were in pre-COVID times, and they're becoming furious that the American dream is collapsing in front of their eyes.

Regan adds a confluence of bad events, such as inflation, souring consumer sentiment, and the Afghanistan withdrawal debacle is damaging people's perception of the Biden administration.

And to circle back to the Fed, she said unless Powell and his gang of monetary wonks begin to taper or at least raise rates in the near-term, the inflationary impact will continue to crush middle America. She added that if inflation is not tamed and the Fed had to resort to former Fed chair Paul Volcker's move for drastic rate hikes to curb inflation, it would severely impact asset prices, such as stocks, bonds, and real estate.

Sunday, August 29, 2021

David Smith: Bitcoin Won't Stop! $150 Silver and $9000 Gold Coming Also

Friday, August 27, 2021

Wolf Street Report: The Most Monstrously Overstimulated Economy & Markets Ever

Thursday, August 19, 2021

All About Silver With David Morgan

Tuesday, August 17, 2021

Friday, August 13, 2021

Golden Rule Radio: Gold's Weekend Drop Explained

Friday, July 30, 2021

Why Silver is The Major Investment Of The Future

Thursday, July 29, 2021

No Economic Recovery: We're In Big Trouble Without Stimulus

Wednesday, July 28, 2021

John Rubino: New Honest Monetary Deposits Are Yours Now

Monday, July 26, 2021

The Coming Stampede Into Gold and Silver

Friday, July 23, 2021

John Williams: Hyperinflation Threat is Real, U.S. Could Become Weimar Republic

Saturday, July 17, 2021

Alasdair MacLeod: Next Steps in USD Collapse

Friday, July 16, 2021

Fed’s Powell says he hears inflation worries 'loud and clear,' but remains dovish

Monday, July 12, 2021

Tuesday, July 6, 2021

Saturday, July 3, 2021

Ron Paul: Forcing Americans Not to Work, Paying Them Not To Work

Wednesday, June 30, 2021

Trader Who Plead Guilty To Gold & Silver Manipulation Only Got Light Sentence From Court

Sunday, June 13, 2021

Liberty & Finance: When We'll See New Highs In Silver

Friday, June 11, 2021

Silver Market: The Tightest It's Been in Modern Times

Saturday, May 29, 2021

Friday, May 28, 2021

Alasdair MacLeod: Gold Manipulation Ending with Basel III

Sunday, May 23, 2021

Craig Hemke: How We Get To $2300 GOLD This Year

Saturday, May 22, 2021

Where Do We Go From Here? Silver Headed Back To $50

If you look at energy, if you are an oil executive you are not really sitting around thinking, how are we going to ramp up investment on these long-term projects when every single day you are hearing about some environmentalist that wants to put you out of business?

Inflation Will Last Well Into Next Year

But generally speaking the inflation story is a lot more than commodities and the transportation side. But the transportation side I don’t think is so transitory either. You’ve had a 10 year bear market in dry bulk shipping.

Things Are In Motion

Things are in motion here, but again it’s just the level of interest rates that’s just…that’s why it was so nonsensical for central banks to create the largest financial bubble in the history of markets in bonds, particularly in Europe with what the ECB did, at the same time rooting for inflation.

Silver Headed Back To $50 All-Time High

“You’ve been bullish on gold and silver, but I want to talk about specifically. The copper story is out there in terms of electric vehicles, but there is going to be a whole bunch of silver demand in the global push toward electric vehicles and I don’t think the ramp in silver production will be there. It feels like the price of silver wants to pulse through $30 and go right to $50, the old all-time high. Your thoughts on silver.”

Friday, May 14, 2021

Debt Bubble: How Long Will It Last?

Friday, May 7, 2021

Wednesday, April 28, 2021

Golden Rule Radio: From Helicopter Money To Fire Hose Favoritism

Wednesday, April 21, 2021

Is a Stock Market Correction Overdue? Inflation Above 2% is Here to Stay

Monday, April 19, 2021

For Those Of You Watching Prices Of Gold, US Dollar, Bitcoin And Lumber…

Gold’s History Makes It Solid

As a bull on gold I’ve been asked how I have any idea where that can go too but at least with gold I have thousands of years of history to analyze along with tens of thousands of tons owned by central banks as reserves…

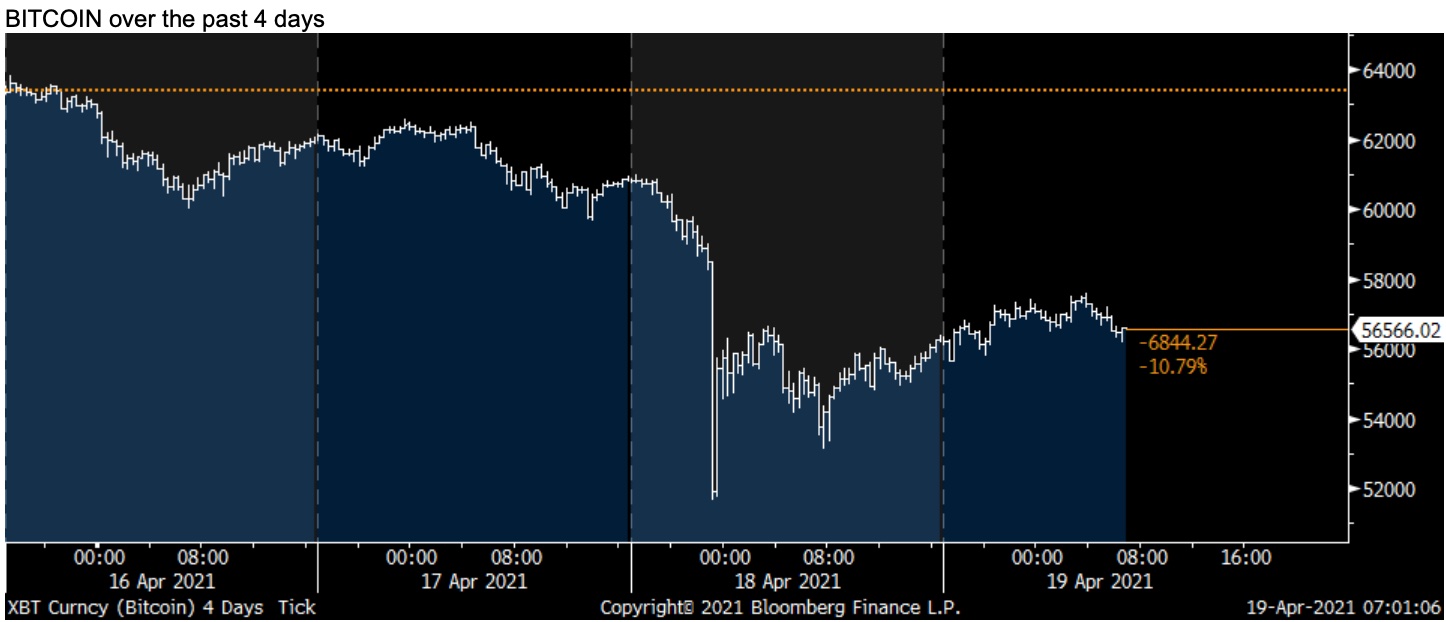

Either way, I think the direction of Bitcoin is a good bellwether on the risk appetite of the broader markets and view it from that lens more than anything else. With the selloff in Bitcoin over the weekend, that lens, and whether valid, will be put to a test.

US Dollar Struggling, Gold Surging

Keep an eye on the US dollar as it continues to rollover and now sits right on its 100 day moving average after breaking below its 50 and 200.

INFLATION: Lumber Prices Continue To Rise

Ahead of the mortgage apps data on Wednesday, existing home sales on Thursday and new home sales on Friday, the rise in lumber just keeps going vertical.

Friday, April 16, 2021

Big Problems At The Perth Mint While Gold Coin Sales Soar There?

Wednesday, April 14, 2021

Market Manias Galore, But Long-Term Interest Rates Smell a Rat

Saturday, April 3, 2021

Gold Rises as Financial Faith Weakens

That is, there are many who see a deflationary rather inflationary setting ahead.

The key arguments made by deflationary thinkers are not to be mocked or disregarded.

Their primary argument in favor of deflation boils down to one simple idea, namely: When economies and markets stall (or even collapse), this leads to dramatic slow-downs in consumer demand, and hence dramatic falls in consumer pricing—ie. deflation.

Needless to say, current economic conditions are anything but robust, which favors a deflationary premise.

By the turn of 2020’s in general, and during the global pandemic in particular, the world witnessed extreme levels of excess capacity (i.e. surplus rather than demand) in labor, manufacturing, retail and commercial real estate.

Banks this year, for example, are already telegraphing that in a post-COVID world, they will require 40% less office space as more and more systems have since been put in place to manage operations outside of traditional office settings.

All of these factors of excess capacity, from retail to commercial office space, one could sanely argue, point toward continued deflationary rather than inflationary forces going forward…

As to the staggering growth of the money supply unleashed by global central banks printing trillions of fiat currencies at record levels since 2008 in general, and the 2020 COVID period in particular, the deflation camp can further (and sanely) argue that such extreme money creation has not led to rising inflation, including hyper-inflation.

This, they legitimately argue, is for the simple reason that all those printed fiat currencies never enter the real economy, but remain contained within a closed-circuit loop of Treasury departments, central banks and Wall Street—not the real (i.e. Main Street) economy where money velocity truly can do its inflationary damage.

In short, so long as central banks act as insider-lenders of last resort to government treasury departments and overpaid CEOs, all that printed money is safely contained behind a Hoover-like dam of commercial and central bank balance sheets, not the real economy where such levels of money growth would and can do their inflationary damage.

Fair enough. Good points.

In fact, these deflationary views, make logical sense, and it would be arrogant to simply discount them.

That said, there are some key mistakes, I contend, in the premises behind such logic.

In short, let me now switch hats from a deflationary defense to a deflationary prosecutor…

Thursday, April 1, 2021

Ron Paul: Gold and Bitcoin Are at Risk of a Government Crackdown

Monday, March 29, 2021

The Great Mega Debt Bubble Reset: Coming to a Town Near Year

Friday, March 26, 2021

Golden Rule Radio: Why Buy Gold In 2021? Why Not?

Tuesday, March 23, 2021

Currency Wars? Massive Currency Devaluations Against US Dollar Since January 2020

Tuesday, March 16, 2021

Tuesday, March 9, 2021

The Fiat Endgame, $6,000 Gold and $180 Silver

Friday, February 26, 2021

Danielle DiMartino Booth: Will yield surge get out of control? This is the Fed's next move

Saturday, February 20, 2021

Friday, February 19, 2021

Ron Paul: The Social Cultural Authoritarian Bubble Will Pop

Sunday, February 14, 2021

Jerry Robinson - We Have to Protect Ourselves and Families From the Coming Collapse

Friday, February 12, 2021

The Debt Bomb is Set to Explode, Inflation to Spike in 2021

Sunday, February 7, 2021

GameStop Was A Warning: Elites Are Weaponizing Censorship To Keep Outsiders Out

GameStop stock, which closed at $17.69 a share on Jan. 8, shot up to $347.51 by the close last Wednesday. With combined losses of almost $20 billion, hedge funds were on the ropes and close to bleeding out, selling their longs in an increasingly futile effort to cover their shorts.

First, the digital distribution platform Discord banned the WallStreetBets account after the close Wednesday for “hate speech, glorifying violence, and spreading misinformation.” (For a moment, it looked like Reddit had also banned the group, but they resisted pressure to do so.) If the quoted justification sounds familiar, it’s nearly identical to the one given by Google, Apple, and Amazon for deplatforming Parler just three weeks earlier. Echoing Amazon, Discord said it had sent the group repeated warnings about objectionable content before deciding, on that day of all days, to shut them down.

Meanwhile, WallStreetBets investors were locked out of their trading accounts by online brokers such as Robinhood on Thursday morning. Based on new collateral requirements that it says were imposed by an industry consortium, Robinhood forbade its users from buying GameStop and other stocks that WallStreetBets had identified as short squeeze opportunities. Users were allowed only to “close their positions”—in other words, to sell to the shorts desperate to buy. When angry users registered their disapproval by leaving over 100,000 one-star reviews of the Robinhood app in the Google Play Store, Google deleted them.

Normal trading was allowed to resume Friday, but the hedge funds used their 24-hour sole ownership of the battlefield to fortify their positions, covering the most vulnerable shorts. Wall Street then sent in reinforcements, as new short positions were taken at these high price levels, virtually guaranteed to pay out when, inevitably, the air leaks out of the balloon.

Down the Slippery Slope

Some of us warned of a slippery slope when Parler was taken down and a sitting president was systematically ghosted from every online speech platform. But we could not have foreseen how slippery the slope would be, or how fast we would slide down it. We were told that the curbs on speech of President Trump and his supporters were necessary to prevent further “insurrection” and protect the peaceful transition of power.

How do we suppose Discord chose that moment to enforce its “Community Guidelines” against WallStreetBets? Almost certainly, one of the hedge funds whose ox was being gored combed through their message boards looking for anything that might violate the terms of service.

Did Discord warn WallStreetBets of content violations before last Wednesday? I’m sure they did. Amazon sent such a warning letter to Parler as well. Frankly, such a letter could be, and likely is, sent to every large message board on the web. The founder of a user-generated content site described it to me as “the One Percent Problem.”

Critics of social networks insist that these sites simply need to double down on censorship in order to finally rid us of problematic speech. But that ignores how social media moderation actually works. Algorithms set to recognize keywords capture only a small fraction of problematic posts, leaving millions of posts for humans to review.

Thursday, February 4, 2021

Surviving a Crash: Break From the Herd With David Smith

Friday, January 29, 2021

Portnoy Calls for People to be Jailed Over Hedge Fund Scandal in Scathing Interview

Wednesday, January 27, 2021

Strategic View: Gold Could see $25,000 in 10 years

Please note a significant pullback from $200 to $100 per ounce during this time, a 50% drawdown. Even in a bull market, prices often have to correct before finding new footing.

Great Reset

One might say that there was a “great reset” of the financial system in 1971, which moved the world past the Bretton Woods agreement.

Tech Bubble Bursting

In 2001, following the bursting of the tech bubble, the gold price again rallied over 10-years. This instance resulted in a maximum gain of seven to eight times the rally’s beginning point ($250). The tech bubble, followed by the housing bubble of 2007-2008, provided policy support for gold inflation through quantitative easing and other measures.

In 2021, amid a worldwide pandemic and political and societal upheaval, the World Economic Forum and other prominent world organizations call for and/or promote a “Great Reset.” Whether this Great Reset results in a new worldwide monetary paradigm is unclear. However, with government world debt increasing, concurrent with declining economic growth, the timing appears to be good for world leaders to have those discussions.

Regardless of whether we are on the cusp of a new monetary paradigm, the case for increased allocations to gold is compelling. As governments continue to add to their deficit spending, the expectations for inflation are rising. Gold tends to perform well in these inflationary environments.

It is our view that the next big bull market in gold is just getting started. In 2020, gold broke to new highs before recently pulling back to the $1,800 per ounce level. If we look back at the last two big runs higher in gold, it is reasonable to expect that gold could achieve ten-fold or twenty-fold increases over the next 10-years. Such is especially true if the world financial system experiences a “great reset.”

Technical and Tactical View

At the beginning of a bull market, one option for investors would be to increase gold allocations and hang on for the next decade or so. Such investors should prepare to endure meaningful drawdowns along the way.

We are long-only in our gold and precious metals holdings. Since gold follows seasonal and other patterns, we look for areas to accumulate more and take profits. We believe that we are near a decent point to accumulate more gold, miners, and other precious metals.

The $1,800 per ounce area was a significant resistance level in 2012 and 2013, and the breaching of this level in 2020 was a significant event. This resistance level has become a support level, and the $1,800 level was already successfully back-tested in November 2020. Another pull-back to the $1,800 per ounce level could be a good point for accumulation.

Zooming in to a weekly view, we see gold is trading near the 50-week moving average in a triangle formation and/or bull flag above $1,800. Such is undoubtedly a critical technical level, and we could see volatility, both up and/or down, over the next few weeks as gold seeks to find direction for its next move. If it falls below the 50-week moving average, then the next accumulation zone might be along the lower trend support line near $1,650.

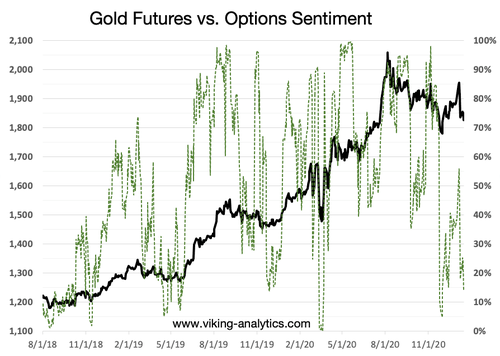

Gold Options Sentiment

Each day, we publish signals related to more than twenty different options markets. Our proprietary Options Sentiment index for gold is suggesting that this could be a good accumulation zone. Recently, when Options Sentiment was less than 20% (such as now), it has been an excellent time to accumulate.

Investors will recall the events of March 2020, which saw meaningful draw-downs in stocks, gold, and many other asset classes. If there is another flight to liquidity soon, we could see significant drawdowns in the gold price, as investors seek safe-haven cash to avoid all kinds of volatility.

Final Thoughts

We are very bullish for gold over the next ten years, and we will be looking for good entry points for gold, silver, and gold miners here in 2021. We will not be surprised to see $25,000 per ounce of gold by the year 2030. It will likely be a volatile ride higher, with large drawdowns along the way.

Technical analysis suggests that the $1,800/oz and $1,650/oz levels are good entry points for gold at this time. Options Sentiment also indicates that now is a decent time to accumulate more gold and/or precious metal mining stocks.