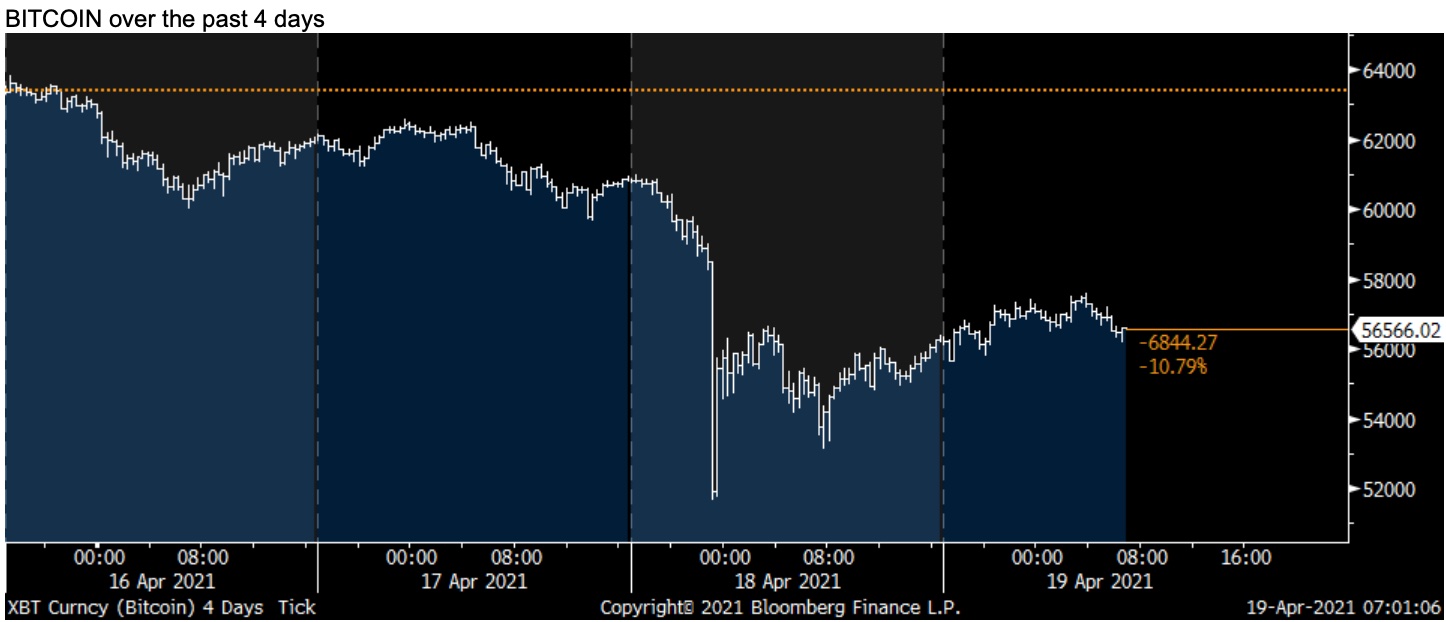

While I believe in the macro factors that was the genesis of Bitcoin and continue to drive it, I have no opinion on whether Bitcoin is worth $56,000, $64,000, $560,000 or $560.

Gold’s History Makes It Solid

As a bull on gold I’ve been asked how I have any idea where that can go too but at least with gold I have thousands of years of history to analyze along with tens of thousands of tons owned by central banks as reserves…

Either way, I think the direction of Bitcoin is a good bellwether on the risk appetite of the broader markets and view it from that lens more than anything else. With the selloff in Bitcoin over the weekend, that lens, and whether valid, will be put to a test.

US Dollar Struggling, Gold Surging

Keep an eye on the US dollar as it continues to rollover and now sits right on its 100 day moving average after breaking below its 50 and 200.

Ahead of the mortgage apps data on Wednesday, existing home sales on Thursday and new home sales on Friday, the rise in lumber just keeps going vertical.

Gold’s History Makes It Solid

As a bull on gold I’ve been asked how I have any idea where that can go too but at least with gold I have thousands of years of history to analyze along with tens of thousands of tons owned by central banks as reserves…

Either way, I think the direction of Bitcoin is a good bellwether on the risk appetite of the broader markets and view it from that lens more than anything else. With the selloff in Bitcoin over the weekend, that lens, and whether valid, will be put to a test.

US Dollar Struggling, Gold Surging

Keep an eye on the US dollar as it continues to rollover and now sits right on its 100 day moving average after breaking below its 50 and 200.

The index is at the lowest level since early March with the euro back above $1.20. I think the euro in particular is benefiting from a rebound in the pace of the vaccine rollout.

I remain a secular bear on the dollar as long as the trade and budget deficits remain on their current paths and the Federal Reserve continues with its 3rd world country monetary policy manipulation. Coincident with the dollar move and the fall in real rates, gold is rising to the highest since late February.

INFLATION: Lumber Prices Continue To Rise

INFLATION: Lumber Prices Continue To Rise

Ahead of the mortgage apps data on Wednesday, existing home sales on Thursday and new home sales on Friday, the rise in lumber just keeps going vertical.

It hasn’t had a red day since March 26th. Last week alone it was up 15% and by 36% since that day in March. Here is a chart since the mid 2000’s bubble in housing as of Friday’s close.

How companies, for those exposed, are maneuvering thru the broad based cost pressures will be key component of this earnings season.

- Source, King World News, read more here