Please note a significant pullback from $200 to $100 per ounce during this time, a 50% drawdown. Even in a bull market, prices often have to correct before finding new footing.

Great Reset

One might say that there was a “great reset” of the financial system in 1971, which moved the world past the Bretton Woods agreement.

Tech Bubble Bursting

In 2001, following the bursting of the tech bubble, the gold price again rallied over 10-years. This instance resulted in a maximum gain of seven to eight times the rally’s beginning point ($250). The tech bubble, followed by the housing bubble of 2007-2008, provided policy support for gold inflation through quantitative easing and other measures.

In 2021, amid a worldwide pandemic and political and societal upheaval, the World Economic Forum and other prominent world organizations call for and/or promote a “Great Reset.” Whether this Great Reset results in a new worldwide monetary paradigm is unclear. However, with government world debt increasing, concurrent with declining economic growth, the timing appears to be good for world leaders to have those discussions.

Regardless of whether we are on the cusp of a new monetary paradigm, the case for increased allocations to gold is compelling. As governments continue to add to their deficit spending, the expectations for inflation are rising. Gold tends to perform well in these inflationary environments.

It is our view that the next big bull market in gold is just getting started. In 2020, gold broke to new highs before recently pulling back to the $1,800 per ounce level. If we look back at the last two big runs higher in gold, it is reasonable to expect that gold could achieve ten-fold or twenty-fold increases over the next 10-years. Such is especially true if the world financial system experiences a “great reset.”

Technical and Tactical View

At the beginning of a bull market, one option for investors would be to increase gold allocations and hang on for the next decade or so. Such investors should prepare to endure meaningful drawdowns along the way.

We are long-only in our gold and precious metals holdings. Since gold follows seasonal and other patterns, we look for areas to accumulate more and take profits. We believe that we are near a decent point to accumulate more gold, miners, and other precious metals.

The $1,800 per ounce area was a significant resistance level in 2012 and 2013, and the breaching of this level in 2020 was a significant event. This resistance level has become a support level, and the $1,800 level was already successfully back-tested in November 2020. Another pull-back to the $1,800 per ounce level could be a good point for accumulation.

Zooming in to a weekly view, we see gold is trading near the 50-week moving average in a triangle formation and/or bull flag above $1,800. Such is undoubtedly a critical technical level, and we could see volatility, both up and/or down, over the next few weeks as gold seeks to find direction for its next move. If it falls below the 50-week moving average, then the next accumulation zone might be along the lower trend support line near $1,650.

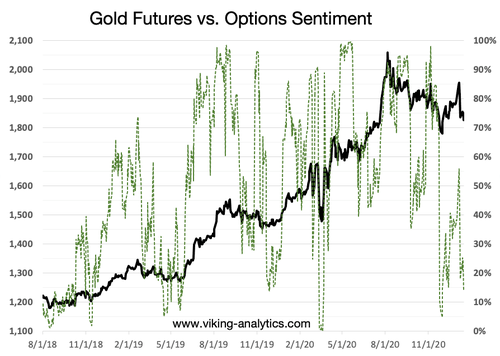

Gold Options Sentiment

Each day, we publish signals related to more than twenty different options markets. Our proprietary Options Sentiment index for gold is suggesting that this could be a good accumulation zone. Recently, when Options Sentiment was less than 20% (such as now), it has been an excellent time to accumulate.

Investors will recall the events of March 2020, which saw meaningful draw-downs in stocks, gold, and many other asset classes. If there is another flight to liquidity soon, we could see significant drawdowns in the gold price, as investors seek safe-haven cash to avoid all kinds of volatility.

Final Thoughts

We are very bullish for gold over the next ten years, and we will be looking for good entry points for gold, silver, and gold miners here in 2021. We will not be surprised to see $25,000 per ounce of gold by the year 2030. It will likely be a volatile ride higher, with large drawdowns along the way.

Technical analysis suggests that the $1,800/oz and $1,650/oz levels are good entry points for gold at this time. Options Sentiment also indicates that now is a decent time to accumulate more gold and/or precious metal mining stocks.

- Source, Silver Bear Cafe