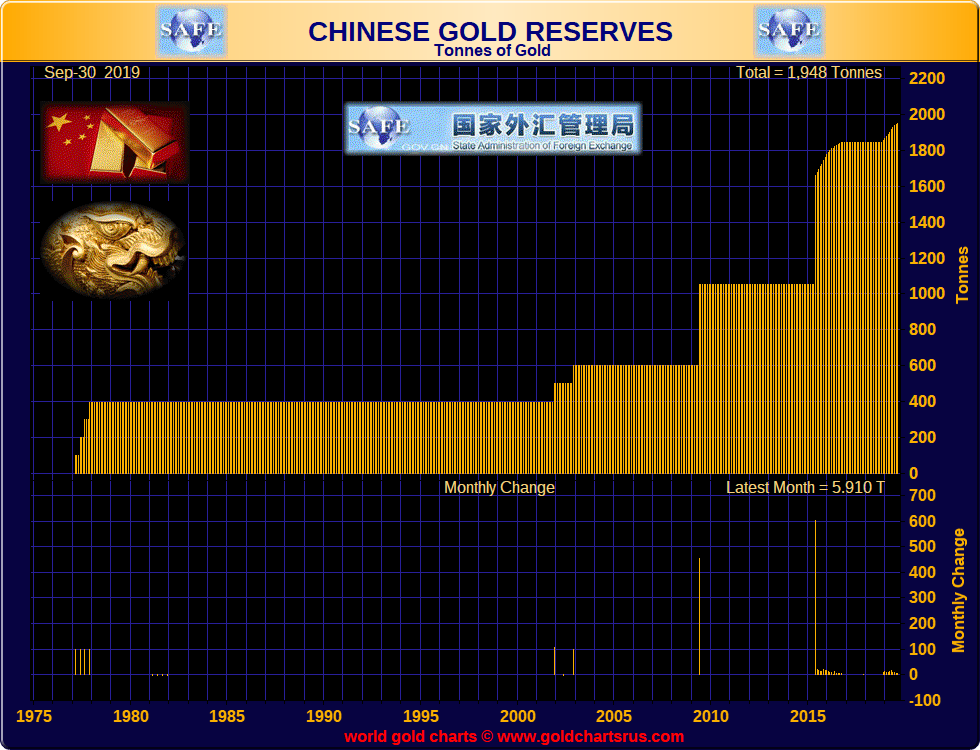

At least that’s according to October figures from the State Administration of Foreign Exchange (SAFE), China’s currency management agent, which each month announces the value of China’s foreign exchange and gold holdings for the previous month-end.

Given the pause or halt last month in China’s gold accumulation, the strategic gold reserves of the People’s Republic of China (PRC) now remain unchanged at 1948 tonnes

Chinese central bank gold reserves – No buying in October

Chinese central bank gold reserves – No buying in OctoberHowever, as with a lot of official Chinese figures, there is widespread skepticism about China’s official gold holding figures, as well as a widely held belief that the Chinese state holds far more gold than it claims to hold. This view subscribes to the opinion that China prefers to keep a large part of its gold reserves unreported as it continues to accumulate monetary gold towards or above the holdings of other economic blocs such as the Euro area or US.

A Trail of Crumbs

That’s not to say that criticism leveled against China in not being forthcoming about its national gold reserves could not be leveled against practically all the world’s central banks and monetary authorities. It could. I do not even know of even one central bank that is fully transparent about its gold holdings. Yet in a world of central bank gold holdings opacity, these official gold figures and their trajectories are arguably better than no figures at all. Crumbs to follow a trail. But better than no crumbs to follow.

Putting

To see China’s stop-start gold accumulation and how it announces additions to its gold reserves when it feels like it or when politically expedient to do so, it’s instructive to look back

In early January 2002, the Chinese central bank revealed that its gold reserves stood at 500 tonnes. Previously, in late 2001, the PBoC had been reporting gold holdings of 394 tonnes, a figure which had not changed since 1980. So where did this 106 tonnes of gold come from and when was it bought?

On the Q.T.

Then towards the end of 2002, the PBoC updated its gold holdings to 600 tonnes, implying that it had purchased another 100 tonnes in less than a year. When were these purchases made? Following this for more than six years, Chinese central bank gold reserves remained completely static. In

As Reuters noted at the time on Friday 24th April 2009:

“China disclosed on Friday that it had secretly raised its gold reserves by three-quarters since 2003, increasing its holdings to 1,054 tonnes and confirming years of speculation it had been buying.“

So China was buying secretly, on the q.t. Fast forward to July 2015, and the Chinese central bank did it again, announcing that it now held 1658 tonnes of gold. Another six years of static gold reserves from April 2009, and then suddenly a 604 tonne addition. When

As the Financial Times noted in its July 2015 article “China breaks 6-year silence on gold reserves“:

“China ended years of speculation about its official gold holdings by revealing an almost 60 per cent jump in its reserves since 2009.”

Then why did China stop announcing gold purchases in October 2016 all the way through to December 2018? If you asked the PBoC, it would answer ‘because we didn’t buy any gold during that time’.

On paper, there is no consistency in the communication of China’s gold buying if looked at in isolation. The communication is even less credible given that

- Source, Bullionstar, read more here