Friday, May 31, 2019

Golden Rule Radio: This is How To Avoid A Hyperinflation

Wednesday, May 29, 2019

Congressman wants to ban Bitcoin because it threatens the Federal Reserve

Apparently it’s a crime to sit down in public

A dangerous criminal in the United Kingdom has been sentenced to 20 weeks in prison after an egregious crime spree.

This psychopath admitted to the heinous crime of SITTING in public THREE TIMES, without a valid excuse.

The homeless man had already been given a “criminal behavior order” which banned him from sitting on the ground. But this social deviant just went ahead and did it anyway.

The Ministry of Justice says the average price of incarceration in Great Britain is around £32,500 per year.

So now instead of sitting on the ground in public, taxpayers will spend about £12,500 over 20 weeks for him to sit in a jail cell.

A US Congressman wants to ban Bitcoin for threatening the Federal Reserve

A US Congressman, Brad Sherman, is worried that Bitcoin and other cryptocurrencies will threaten US foreign policy, tax collection, and traditional law enforcement.

So his solution is to ban it.

Last week he urged his colleagues to make it illegal to mine, sell, or use Bitcoin and other cryptocurrencies in the United States.

The problem, he says, is that the US currently gains much of its power from the fact that most international money moves in US dollars, through the Federal Reserve.

“It is the announced purpose of the supporters of cryptocurrency to take that power away from us… the advantage of crypto over sovereign currency is solely to aid in the disempowerment of the United States and the rule of law.”

His version of “rule of law” includes things like civil asset forfeiture, just straight up stealing cash from people without even charging them with a crime.

So yes, if that is the type of “traditional law enforcement” Congressman Sherman fears will be undermined, he is correct.

And since US foreign policy involves funding endless wars with an inflationary fiat currency… well, he’s right again.

The aim of cryptocurrency is to hand the power of the purse back to the people.

Which is why it is comical that he thinks the cryptocurrency movement even could be nipped in the bud if they tried.

Maine wants to void its citizens’ Presidential votes

If a bill passed by the Maine Senate becomes law, the state will join 15 other states which have nullified their citizens’ choice for President.

These states have pledged to ignore their own voters, and just hand the state’s Electoral College votes to whichever candidate can scoop up the majority of the national ballots.

So if this passes, votes in Maine will no longer count– the state’s delegates will just automatically be cast for whoever people in the other 49 states choose.

For a country that prides itself on representative democracy, this is a truly bizarre trend.

Eminent domain takes now, pays later

The Supreme Court long ago decided in Kelo v. New London that the government can use eminent domain to steal your property.

Of course they still have to give you “just compensation.” But now they can take your land, and delay payment for several years. Here’s how it works:

When a company (often a company that builds oil pipelines) wants your land, they’ll petition the government to seize it under eminent domain authority.

The pipeline company then makes a ridiculous, lowball offer to compensate you for your land. But before you even accept, the government has already awarded them your property.

So you either have to accept their pitiful offer, or battle them in court for years to seek more appropriate compensation (let alone the fact that your land was seized without your consent).

This system is obviously an enormous disadvantage to people who are having their property seized, and the Institute for Justice is now helping affected landowners take this to the Supreme Court.

We’re following this one very closely to see how the Court votes.

Taxpayers pay for defense contractor’s 9400% profit margin

A $4,300 half-inch steel pin worth about $46 is just one of the products TransDigm supplies to the Pentagon.

This isn’t unusual for them– nearly all of the company’s products earn them between 95% to 9400% profits.

Now they are being brought in front of Congress to answer for these prices. But it takes two to tango.

Undoubtedly this company is taking advantage of government incompetence and bureaucracy, and they’re making a fortune. But the government is just as much to blame for being incompetent and bureaucratic in the first place.

Now Congress wants to show that they’re ‘doing something’ by chewing out these contractors in public. But it’s not like the system will really change. And the taxpayers will keep paying for it.

- Source, Sovereign Man

Monday, May 27, 2019

Populists Shatter EU Status Quo With Strong Showing In Parliamentary Vote

The preliminary results from the European Parliamentary elections are in. And just like the polls anticipated, the pro-European status quo has suffered a serious blow.

Winning over 30% of seats, Eurosceptic parties and anti-establishment groups now control their largest bloc of votes since the first EU Parliamentary election in 1979.

Meanwhile, the long-ruling "grand coalition" of center-right and center-left parties (the EPP, a collection of center right parties, and S&D, a collection of center-left parties) lost its combined majority, though both coalition groups retained a plurality of seats (180, or 24%, for EPP, and 146, or 19.4%, for S&D).

Though pro-European groups together maintain a clear majority, this broad grouping has become increasingly fragmented, which could complicate policy making, while a strong showing from eurosceptics will mount a serious challenge to the status quo, according to a group of analysts from Deutsche Bank.

This shows us two things: first, the pro-European camp has definitely become more fragmented and could not prevent losing some seats to the Eurosceptics who dream if not (anymore) of the end of the EU at least of a substantially different one. Second, pro-Europeans group together will still hold a clear majority of two-thirds of the seats in the next EP. This means: policymaking for them will become more complex and require broader cross-party agreements and discipline. But Eurosceptics will not be able block decisions unless centrist pro-European parties fail to cooperate.

Typically, turnout in the EU Parliamentary race is lackluster, similar to that of a (typical) American midterm election. But this year, turnout surged to its highest level in decades: With a provisional turnout of 51%, the strongest in 25 years, electoral turnout broke the downward trend of the past decade (that's compared with 43% in 2014). However, differences in turnout were substantial across EU members, with the UK and Eastern European states recording the lowest turnount.

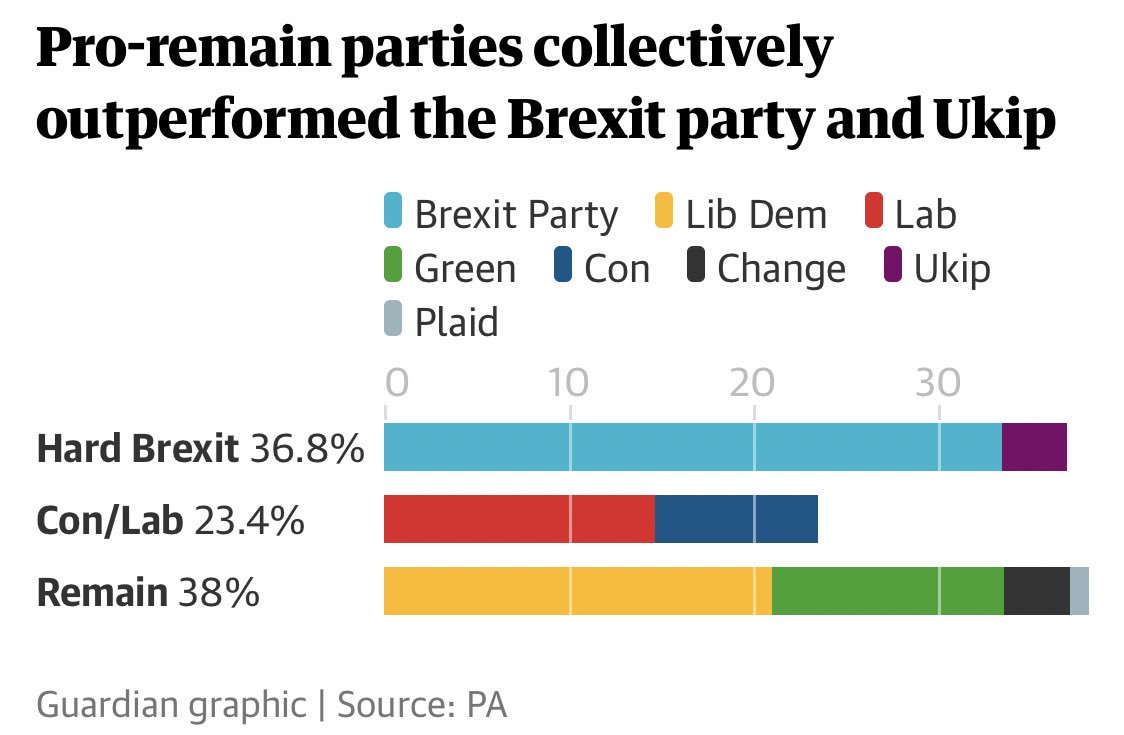

In the UK, which only opted to participate in the vote at the last minute as part of a can-kicking agreement with Brussels to extend the deadline for the UK's departure from the EU, Nigel Farage's Brexit Party won a plurality of votes (31.7%) - though liberal-leaning media outlets in the UK opted to spin the result as a victory for the "remain" camp, as the LibDems, Greens, SNP, Change UK and miscellaneous other parties won a combined 38%.

Despite being only four months old, Farage's Brexit Party emerged as one of the largest parties in the European Parliament (it's tied for first with Angela Merkel's center-right CDU/CSU, both with 29 seats). Merkel's CDU/CSU and SPU saw their support plunge below 29% and 16% respectively in their worst result in a national election.

Matteo Salvini's League Party came in second with 28 seats. Poland's Nationalist Law and Justice Party came in third with 23, while Marine Le Pen's National Rally Party won 22 seats, ahead of the 21 seats won by French President Emmanuel Macron's La Republique En Marche. Viktor Orban's Fidesz won 52% of the vote in Hungary, taking 13 of Hungary's 21 seats.

Though Sweden's Social Democrats remained the largest party in Europe, Sweden's anti-immigration Sweden Democrats won 15.4% of the vote, up from roughly 4% in the 2014 EU Parliamentary vote, growing their share of seats from two to three.

In Greece, Alexis Tsipras's Syriza was defeated by the center-right New Democracy Party, prompting Tsipras to call an early general election where New Democracy are expected to triumph. If that happens, it would end Syriza's four-year stint ruling Greece.

However, analysts are skeptical that the eurosceptic groups will be able to overcome partisan squabbling and work together to form a pan-European coalition - which is the only way to exercise real influence within the European Parliament. They will also lose some of their support when the UK finally leaves the bloc (if that ever happens), and the UK's 73 parliamentary seats are redistributed...

Winning over 30% of seats, Eurosceptic parties and anti-establishment groups now control their largest bloc of votes since the first EU Parliamentary election in 1979.

Meanwhile, the long-ruling "grand coalition" of center-right and center-left parties (the EPP, a collection of center right parties, and S&D, a collection of center-left parties) lost its combined majority, though both coalition groups retained a plurality of seats (180, or 24%, for EPP, and 146, or 19.4%, for S&D).

Though pro-European groups together maintain a clear majority, this broad grouping has become increasingly fragmented, which could complicate policy making, while a strong showing from eurosceptics will mount a serious challenge to the status quo, according to a group of analysts from Deutsche Bank.

This shows us two things: first, the pro-European camp has definitely become more fragmented and could not prevent losing some seats to the Eurosceptics who dream if not (anymore) of the end of the EU at least of a substantially different one. Second, pro-Europeans group together will still hold a clear majority of two-thirds of the seats in the next EP. This means: policymaking for them will become more complex and require broader cross-party agreements and discipline. But Eurosceptics will not be able block decisions unless centrist pro-European parties fail to cooperate.

Typically, turnout in the EU Parliamentary race is lackluster, similar to that of a (typical) American midterm election. But this year, turnout surged to its highest level in decades: With a provisional turnout of 51%, the strongest in 25 years, electoral turnout broke the downward trend of the past decade (that's compared with 43% in 2014). However, differences in turnout were substantial across EU members, with the UK and Eastern European states recording the lowest turnount.

You will find more infographics at Statista

In the UK, which only opted to participate in the vote at the last minute as part of a can-kicking agreement with Brussels to extend the deadline for the UK's departure from the EU, Nigel Farage's Brexit Party won a plurality of votes (31.7%) - though liberal-leaning media outlets in the UK opted to spin the result as a victory for the "remain" camp, as the LibDems, Greens, SNP, Change UK and miscellaneous other parties won a combined 38%.

Despite being only four months old, Farage's Brexit Party emerged as one of the largest parties in the European Parliament (it's tied for first with Angela Merkel's center-right CDU/CSU, both with 29 seats). Merkel's CDU/CSU and SPU saw their support plunge below 29% and 16% respectively in their worst result in a national election.

Matteo Salvini's League Party came in second with 28 seats. Poland's Nationalist Law and Justice Party came in third with 23, while Marine Le Pen's National Rally Party won 22 seats, ahead of the 21 seats won by French President Emmanuel Macron's La Republique En Marche. Viktor Orban's Fidesz won 52% of the vote in Hungary, taking 13 of Hungary's 21 seats.

Though Sweden's Social Democrats remained the largest party in Europe, Sweden's anti-immigration Sweden Democrats won 15.4% of the vote, up from roughly 4% in the 2014 EU Parliamentary vote, growing their share of seats from two to three.

In Greece, Alexis Tsipras's Syriza was defeated by the center-right New Democracy Party, prompting Tsipras to call an early general election where New Democracy are expected to triumph. If that happens, it would end Syriza's four-year stint ruling Greece.

However, analysts are skeptical that the eurosceptic groups will be able to overcome partisan squabbling and work together to form a pan-European coalition - which is the only way to exercise real influence within the European Parliament. They will also lose some of their support when the UK finally leaves the bloc (if that ever happens), and the UK's 73 parliamentary seats are redistributed...

- Source, Zero Hedge, Read More Here

Saturday, May 25, 2019

Russia Accelerates its De-Dollarization Process, Adds Gold Bullion

Poland, Hungary, China, India, Turkey, Russia and many others have been active buyers in the physical gold market over the last year and it appears that at least one, Russia, has no plans of slowing down.

Russia has been very open about the fact that they wish to continue on with what they are calling their "de-dollarization" process, shedding their US dollar reserves and moving it into other assets, with the most notable being gold bullion.

This is a trend that has been accelerating for years, with it truly kicking off in earnest after sanctions began to rain down heavily upon Russia after the annexation of Crimea from Ukraine in 2014.

The United States in particular has had a heavy hand in its dealings with Russia, as they believed this move to be in direct conflict with Western interest.

Since 2014, financial warfare has been raging both behind the scenes and out in the open.

A quick look through a timeline compiled by Radio Free Europe highlights just how many actions have been taken over the last five years and shows just how serious the West is in its goal of punishing the Russian Economy.

The effects have been severe, doing damage to the Russian economy, however, as they have so many times throughout history, the Russian people have pushed on, adapted and are surviving in their new geopolitical world.

The actions taken by the West and the constant beating of the war drum has not come without consequences however, as Russia has been forced to find alternative trade partners for their plentiful natural resources.

China, another country that is currently the target of scorn from the US administration has been forced closer and closer with Russia, finding an ally in both of their times of need.

It comes therefore as no surprise that they too are happily buying any and all natural resources they can get their hands on, stockpiling and preparing for not so sunny days.

This includes opening and buying mines around the world, anywhere and everywhere that they can.

Facing increased pressure and uncertainty is all the more reason for these two countries to continue in their accumulation of precious metals.

Russia is currently buying all domestically mined gold production, thus taking a huge amount of physical gold off of the market and making them the fifth largest holder of gold bullion reserves in the world.

This is a placing that I and many others believe will soon be a thing of the past, especially if they continue shedding US Dollars at the rate they are and moving these funds into gold bullion, which as they have stated, they intend to do.

Already Russia has quadrupled its bullion reserves over the past decade, adding a staggering 1 million ounces in February of this year alone!

“This is why we significantly lowered the share of the dollar.”

Clearly Russia feels politically, economically and physically threatened and are trying to mitigate their risks and retaliate in anyway possible.

Unfortunately for the West, the true ramification of this entire process is the fact that physical gold bullion is draining out of the open market at a rapid rate and they are creating a new golden powerhouse within the world.

But why are both Russia, China and so many other countries fleeing the US dollar and moving to a safe haven asset such as gold bullion?

I believe it is because they can see the long term writing on the wall, they can see that change is coming, they are making their plans for the future and setting themselves up for what they believe to be success.

Ultimately, I believe they hope to dethrone the US dollar as the reserve currency of the world and replace it with one of their own, with gold bullion playing a major role in that process.

Remember always the golden rule, "He who has the gold makes the rules".

- Source, Sprott Money Blog

Friday, May 24, 2019

Beware! Stagflation Rears Its Ugly Head & It's The Fed's Fault

Rising prices coupled with a recession is the worst of both worlds for the powers-that-shouldn't-be at The Fed.

Central planning is always doomed to failure. Economic reality always strikes with a vengeance.

- Source, Ron Paul

Wednesday, May 22, 2019

The Fed of St Louis Opposes The Gold Standard… For Environmental Reasons?

In a recent blog by the St. Louis Fed entitled “Here’s Why the US No Longer Follows A Gold Standard”, the author lays out 3 reasons with gold.

There are significant problems with tying currency to the gold supply:

It doesn’t guarantee financial or economic stability.

It’s costly and environmentally damaging to mine.

The supply of gold is not fixed.

“The U.S. mines a lot of gold, but we’re not the biggest producer,” Wheelock said. “The bigger suppliers of gold would have more control over our monetary policy, and there’s no reason to have it because we can get the advantages of the gold standard and avoid the disadvantages without being on a gold standard.”

Yes, but FIAT currency like the US dollar allows uncontrolled spending by the Federal government and endless devaluation of US consumer purchasing power. Why is that NOT a problem?

Since the creation of The Federal Reserve System in 1913, the purchasing power of the US dollar for consumers has been demolished while gold is increasing as consumer purchasing protection (on average).

The supply of gold is not fixed? No kidding. As of 2017, China, Australia and Russia produced more gold than the US.

Environmental concerns? Yes, but will China, Australia and Russia stop production of gold for environmental reasons? I think not.

True, gold prices can be quite volatile. But on the other hand, government spending cannot be contained. Hence the belief in MMT (modern monetary theory). Where government spending, debt and deficits don’t matter. Until they do!

I would like the ability to exchange a $10 bill for $10 of gold, even with volatility. And gold volatility is at its lowest level since 2006.

Fiat currency? That’s the way The Fed and Congress like it!

The 1928 $10 bill was replaced with .. no gold!

There are significant problems with tying currency to the gold supply:

It doesn’t guarantee financial or economic stability.

It’s costly and environmentally damaging to mine.

The supply of gold is not fixed.

“The U.S. mines a lot of gold, but we’re not the biggest producer,” Wheelock said. “The bigger suppliers of gold would have more control over our monetary policy, and there’s no reason to have it because we can get the advantages of the gold standard and avoid the disadvantages without being on a gold standard.”

Yes, but FIAT currency like the US dollar allows uncontrolled spending by the Federal government and endless devaluation of US consumer purchasing power. Why is that NOT a problem?

Since the creation of The Federal Reserve System in 1913, the purchasing power of the US dollar for consumers has been demolished while gold is increasing as consumer purchasing protection (on average).

The supply of gold is not fixed? No kidding. As of 2017, China, Australia and Russia produced more gold than the US.

Environmental concerns? Yes, but will China, Australia and Russia stop production of gold for environmental reasons? I think not.

True, gold prices can be quite volatile. But on the other hand, government spending cannot be contained. Hence the belief in MMT (modern monetary theory). Where government spending, debt and deficits don’t matter. Until they do!

I would like the ability to exchange a $10 bill for $10 of gold, even with volatility. And gold volatility is at its lowest level since 2006.

Fiat currency? That’s the way The Fed and Congress like it!

The 1928 $10 bill was replaced with .. no gold!

- Source, Confounded Interest

Monday, May 20, 2019

Trade Wars: The Truth About Tariffs

Join Mike Maloney as he examines the latest moves in the US/China trade war, and visits some compelling arguments from the Foundation for Economic Education.

To quote their article by Mark J Perry: "It’s a scientifically and mathematically provable fact that all tariffs, at any time and in any country, will harm economic growth, eliminate net jobs, destroy prosperity, and lower the standard of living of the protectionist country because tariffs are guaranteed by the ironclad laws of economics to generate costs to consumers that outweigh the benefits to producers, i.e. tariffs will always impose deadweight losses on the protectionist country (see diagram below, and “An economic analysis of protectionism clearly shows that Trump’s tariffs would make us poorer, not greater“).

That is, the reality that tariffs always inflict great economic damage and leave society worse off is not a debatable outcome, rather it’s a provable fact, like the law of gravity."

- Source, Gold Silver

Saturday, May 18, 2019

Will the Next FED Board Member be a Gold Bug? Could Balance Finally be Restored?

This was a secretive meeting in which no one at the time knew much about, nor knew what was discussed.

The secret would take three years to manifest itself, after which the Federal Reserve Act was passed in 1913, then three more years for the secret to become public, when journalist Bertie Charles Forbes in 1916 wrote an article about the "hunting trip".

From the year the Federal Reserve Act was passed, until this modern day, the United States has been run by a largely unaccountable body of banking elite executives, wielding ungodly powers that have shaped our economic history.

From that day onward, the United States and the West as a whole have systematically devolved further and further into a fiat based system, that cares little about accountability, or financial responsibility, preferring to simply print more and more fiat dollars to help keep this corrupt system afloat.

This financial moral bankruptcy really began to accelerate in 1933 on June 5th when President Roosevelt signed HJR 192 into law, demanding that all US citizens turn in their gold and gold certificates, disabling the citizens ability to redeem dollars for gold.

As the years went by, the Federal Reserve continued to pressure the US government from behind the scenes, moving the country further and further away from the founding fathers gold standard vision.

In 1971, it was officially time to severe all sense of sanity and all ties with the gold standard.

Fast forward to today, and you will see a purely fiat based dollar system, in which digital dollars are created in untold numbers, injected into the system at a rate that would even have the founders of the Federal Reserve shaking their heads.

Now we hear statements such as "barbarous relic" from modern Federal Reserve board members when referring to honest money such as gold and silver bullion. Ridicule and disrespect for the noble metal is not only common, but expected from any "sane" economist.

Fortunately, this may be about to change.

It is being speculated that at least one of the two empty Federal Reserve Board member seats might be filled by an open gold bug.

Judy Shelton is a friend of the precious metals community, as she is an advocate for the return of the gold standard and honest money policies.

Bloomberg reports;

Shelton has been contacted by the White House regarding the position, according to two people familiar with the matter who described the outreach on condition of anonymity."

Judy Shelton is currently considered a close economic adviser to President Trump and has penned articles such as those seen in the Wall St Journal, titled "The Case for Monetary Regime Change", in which she tries to address the issues in our horribly flawed fiat based system;

Sadly, even if nominated and appointed to the position, it is very unlikely that she alone will be able to make the radical changes that are needed to restore financial sanity and balance.

However, it undoubtedly would be a step in the right direction and for now, that's the best we can ask for.

- Source, as first seen on the Sprott Money Blog

Friday, May 17, 2019

Rob Kirby: Bitcoin is the New Gold? Or is it?

Why? Rob Kirby, proprietary analyst and founder of Kirby Analytics, returns to Reluctant Preppers to give us an earful of his sage perspective on the global elite's power plays, and what most likely comes next!

- Source, Reluctant Preppers

Wednesday, May 15, 2019

Mark Taylor: Justice is Pouring Down on Earth

Taylor says, “I don’t know the timing of this, but I sense we are on the cusp of a lot of big stuff happening because of the FISA report coming out. Justice is pouring down on the earth. This is why I am warning about the false flag stuff, these guys are panicking, they are going to do anything and everything they can to change the narrative and keep the focus off of them.”

Taylor also asks the question, “Are there indictments for the media? I think absolutely yes, and it’s part of the tearing down process. I think you are going to see some of these people go to prison for what they have done.”

- Source, USA Watchdog

Tuesday, May 14, 2019

Monday, May 13, 2019

A Market in Denial of Reality...

- Source, Silver Fortune

Saturday, May 11, 2019

Tariffs Scare Equities, Gold & Silver VS US Dollar

Tariffs scare the equities markets as the Trade War talks begin to escalate again. We look at the the Federal Reserve's announcement to leave rates once again unchanged.

The Trump administration continues to pressure Powell for a rate cut, as Federal Reserve governors struggle to identify a pathway forward.

We look at the purchasing power of gold & silver and how that purchasing power is preserved over time as the US Dollar continues to devalue.

- Source, Golden Rule Radio

Thursday, May 9, 2019

Investors Flee as the Latest Volley in the US, China Trade Wars Lands Home

Up, down, up down.

The markets have been trading wildly over the last few days, as panic is setting in across both the United States and Chinese stock markets.

The trade wars that truly never ended, but only temporary receded, are not only back on, but accelerating once again.

The United States government has stated that the Chinese government has not held true on their last round of negotiations and have failed to keep their promises.

This prompted the United States Secretary of the Treasury, Steven Mnuchin to lash out and state that further tariffs would be placed on Chinese goods entering into the United States, beginning Friday.

Robert Lighthizer, the current United States Trade Representative had the following to say;

“We felt we were on track to get somewhere. Over the course of last week we have seen an erosion of commitments by China,” Lighthizer said, adding that significant issues remain unresolved, including whether tariffs will remain in place.

Markets, which briefly recovered, crashed hard on this news, with the Dow dropping 450 points and falling below its 50 day moving average, while the VIX has spiked back above 20, indicating that investors are nervous.

However, it was not just the US markets that suffered under this recent news, not at all.

Chinese equities and the yuan also tumbled lower on this latest round of trade wars, causing their markets to suffer its largest one day drop in three years, followed by another vicious move lower the next day.

This has prompted Chinese officials to reach out in a conciliatory tone, hoping to calm down the markets and those within the US administration who are less than pleased that they have not held up "their end of the bargain".

People's Daily China released the following statement;

"Mutual respect, equality, and mutual benefit are the premise and basis for reaching an agreement, China's Foreign Ministry said on Tuesday at a regular press conference, adding that tariffs will not solve any problem."

Unfortunately for the Chinese economy, this news couldn't of come at a worse time as the European Central Bank just lowered its growth forecast for the European Union, citing continued uncertainty surrounding BREXIT as the cause.

This places Chinese officials between a rock and a hard place, as the Chinese economy is much more dependent on the success of the Euro zone and US economies, than the latter are on theirs.

This isn't your typical jawboning of the past, as the current US administration has shown more than once that they are willing to throw caution to the wind and negotiate hard, even if it risks damaging their own economy.

This has caused investors to flee to the safety of Treasuries once again, while foolishly ignoring the safety that only precious metals can offer in a time such as this.

Whether or not the rhetoric will continue to accelerate from this point on is anyone's guess, but with the VIX exploding higher, it appears that the markets don't believe that this round of pain is going to be settled anytime soon.

Expect increased volatility and hostilities at least in the short term, as the trade wars continue to escalate and heat up. Buckle up, this ride is going to get a whole lot bumpier, before it settles down again.

- Source, Sprott Money Blog

This places Chinese officials between a rock and a hard place, as the Chinese economy is much more dependent on the success of the Euro zone and US economies, than the latter are on theirs.

This isn't your typical jawboning of the past, as the current US administration has shown more than once that they are willing to throw caution to the wind and negotiate hard, even if it risks damaging their own economy.

This has caused investors to flee to the safety of Treasuries once again, while foolishly ignoring the safety that only precious metals can offer in a time such as this.

Whether or not the rhetoric will continue to accelerate from this point on is anyone's guess, but with the VIX exploding higher, it appears that the markets don't believe that this round of pain is going to be settled anytime soon.

Expect increased volatility and hostilities at least in the short term, as the trade wars continue to escalate and heat up. Buckle up, this ride is going to get a whole lot bumpier, before it settles down again.

- Source, Sprott Money Blog

Wednesday, May 8, 2019

Ron Paul: A Nuclear War Over Venezuela?

Ron Paul discusses the latest escalations over Venezuela and just how dangerous they are now becoming.

Could there possibly be a nuclear war? Has the world gone mad?

- Video Source, Ron Paul

Tuesday, May 7, 2019

The World is Changing Before Our Eyes

- Source, Gold Silver

Sunday, May 5, 2019

Dangerous Derivatives And Why Our Banks Are Hiding Them

- Source, Walk the World

Saturday, May 4, 2019

A Bloated Auto Sector Begins to Collapse Under its Own Weight

Often used as a strong indicator of a healthy consumer economy, declining auto sales are an early warning sign for economist and businesses hoping to forecast our unpredictable economic future.

This is the biggest drop since May 2011 and the lowest amount of sales throughout a month in over five years.

This is not only true within the United States, but is in fact a similar story that is unfolding all across the globe. Pointing to a much wider problem within the industry.

However, I believe that there is more to this story than first meets the eye.

Although declining auto sales are indeed a bad sign for the economy in general, what is being missed by many is the fact that these declining auto sales directly align with rapidly rising average car prices.

The average car price in the United States is expected to hit $33,319 by the end of the first quarter, a $1000 increase over the same time last year.

This comes on the back of years of rapidly rising car prices, while the average income of consumers has been relatively stagnant.

So how are manufacturers doing this? How are they demanding higher and higher prices and why in the world would anyone pay these outrageous prices for a new vehicle?

The reason for this is similar to the 2008 crisis, as lenders are already forgetting the follies of their recent past.

People are leveraging higher and higher as lenders extend the average length of their loans, while at the same time reducing their standards.

In the not too distant past, car loans were a maximum of five years. Now, that number has increased from six years, to a stunning seven years!

Depending on where you live this means that your car could be a hunk of junk by the end of your term, while you are still paying the large monthly payments that you began your loan cycle with.

This stretching out of the length of the loan does not result in lower monthly payments for you the consumer, no, not at all.

All this allows is for dealerships to charge the same monthly payment that you were accustomed to during the five year term, but for seven years instead.

This is akin to a slow boil inflation, such as keeping a bag of chips the same dimensions, while at the same time reducing its contents and it is now beginning to backfire on those who orchestrated it, as people are taking notice and voting with their feet.

Still, even though people are waking up to the shyst that was pulled on them, this does not mean that serious ramifications may not result because of this.

If we do enter into a serious recession, something that I do see coming over the next few years, then we may witness massive defaults on loans that people are simply unwilling to pay and would rather walk away from.

Car loans are not as sacred as home loans. People are much more willing to simply throw their hands up in the air in disgust and let the Repo man take their car, especially if it means they get to protect their home and other assets.

This could cause a rapidly spreading contagion among the auto lenders who have over-leveraged themselves with these horrible loans, threatening to bring the entire banking sector to its knees just as we witnessed throughout the 2008 crisis, once again increasing the need for a precious metals "insurance policy".

Regardless of the outcome, I highly suspect that we are going to see a swing back towards correction as auto manufacturers are forced to lower their prices, which is going to be a tough pill to swallow for them indeed.

- Source, Sprott Money Blog

Friday, May 3, 2019

Gregory Mannarino: Gold and Silver Are the Greatest Trades on Earth

We need to be on the right side of the trade. Bet against the debt, and become your own central bank.

This is what people need to do: buy hard assets, like gold and like silver. A house is a hard asset, but it is massively overvalued. The real estate market is in a bubble worse than 2008.

That’s going to correct too. Interest rate suppression has forced cash into assets it shouldn’t have gone into.

I think we started this entire conversation off with the distortions that exist today have eclipsed every single distortion that has ever existed in financial markets in history. This is very unique.

Physical gold, and more specifically physical silver, are the greatest trades on earth. They are the most undervalued and suppressed assets on earth. They are real wealth, and they have represented real wealth for thousands of years.

No politician and no Federal Reserve Chairperson is going to tell me different.

No amount of rigging will be able to stop the explosive move that gold and silver will make at some point.”

- Source, USA Watchdog

Thursday, May 2, 2019

Off The Cuff: Living With Integrity

Last week's 'Off The Cuff' podcast received so many of these requests that we are releasing it to all here.

In last week's Off The Cuff podcast, Chris delivered a very personal message about how we each decide to live our lives. A growing number of people are watching the "prosperity" around them -- record high asset prices, record-low unemployment, new technologies, etc and yet feeling that we're making the wrong trade-offs as a society.

All that wealth is flowing into fewer and fewer pockets, ecosystems are faltering and an alarming number of species are dying off, depression rates (especially among the youth) are skyrocketing. In short: there's more money flowing around than ever, and yet we and the planet are becoming sicker and unhappier.

Why? From Chris' point of view, it comes down integrity. The modern human way of life lacks integrity as a guiding principle. For those of us who desire a better future, brining our actions into better alignment with our integrity is the path to true prosperity.

- Source, Peak Prosperity

Wednesday, May 1, 2019

GDP Numbers Show Gold Is Learning To Live Without the US Dollar

Gold has been trending with the dollar in recent trading sessions, signaling a decoupling of the yellow metal’s traditional negative correlation on the U.S. dollar, said George Gero, managing director of RBC Wealth Management.

Gero said that this trend reversal may be caused by strong demand for gold outside the U.S., especially in countries that needed gold the most, like Venezuela, but could not afford it in U.S. dollar terms.

“It’s interesting that gold, in the just last few sessions, is learning to live with a strong dollar, and the reason for the strong dollar hasn’t really been the possibility that the Fed is going to hike rates again,” Gero told Kitco News.

“Actually, traders are all keen on the next May 1st Fed meeting which could be very, very interesting for traders, to see if the fact that these strong GDP numbers today will bring back some talks about maybe, after all, there could be a rate hike.”

Gero added that a rate hike may not be likely, owing to the fact that most central banks around the world still have loose monetary policies, since a lot of these countries are not “booming” like the U.S.

- Source, Kitco News

Subscribe to:

Comments (Atom)