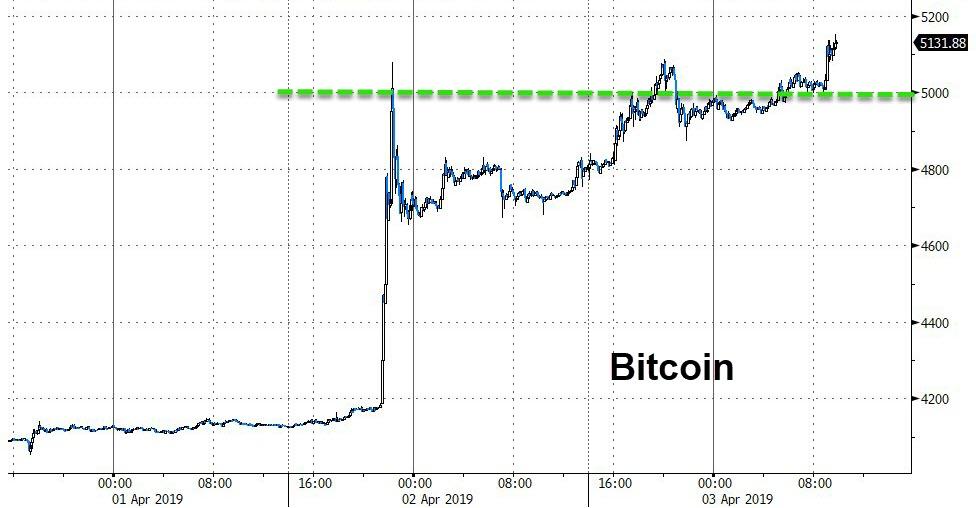

Bitcoin has broken back above $5000 and pushed to new cycle highs...

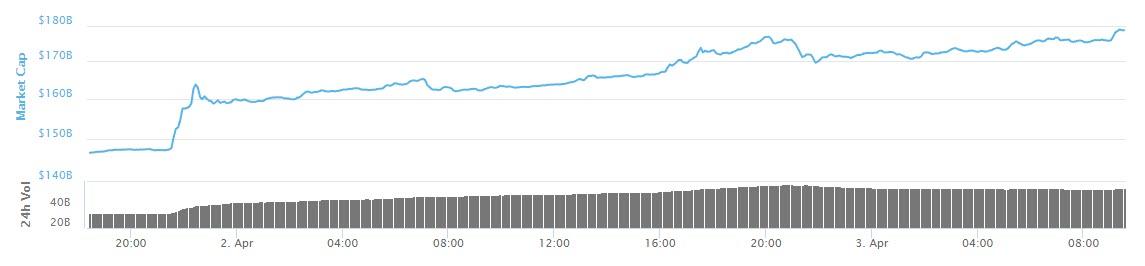

The broad Cyrpto market capitalization has risen around $40 billion in the last 24 hours...

As for other altcoins, CoinTelegraph notes that all major currencies except Maker (MKR) and Tezos (XTZ) are in the green and seeing moderate to visible gains in the last 24 hours. Bitcoin Cash (BCH) has jumped to over $280, showing gains of around 50 percent. Another major winner is Litecoin (LTC), gaining over 20 percent within a day and trading at $84.

Dogecoin (DOGE), recently promoted by Tesla’s Elon Musk as his favorite coin, has seen over a 30 percent rise in price following the entrepreneur’s tweet.

The major market recovery, which started late April 1, has been widely discussed both in the crypto community and financial world. Most of the crypto insiders state that there is no particular reason behind the leap, and that all of the explanations are currently speculatory.

For instance, Binance’s CEO Changpeng Zhao, most known as CZ, admits that he’s “clueless” about the real causes of what is happening, while Bloomberg author Eric Lam also believes that there is no definite answer.

Ikigai founder and a former Point72 Asset Management executive, Travis Kling, called the recent Bitcoin price surge “nail in the coffin.” King made his remarks during an interview with Yahoo Finance on April 2. He said:

“The likelihood that we’re going to retest the lows of mid-December has materially diminished over the last seven weeks. And then, with the price action last night, I think it’s pretty safe to say that there’s about as close to a nail in the coffin as you can have in terms of feeling good about the bottom being in for this crypto market. Never say never, but it would take a massive shift in the appetite for risk assets globally for us to go retest the lows or make new lows for the crypto market now.”