- Source, Golden Rule Radio

Wednesday, April 28, 2021

Golden Rule Radio: From Helicopter Money To Fire Hose Favoritism

Wednesday, April 21, 2021

Is a Stock Market Correction Overdue? Inflation Above 2% is Here to Stay

“[The Fed] won’t let it get away from [3%], they’ll raise rates ahead to pre-empt it. Certainly, I don’t think we’re going to see a sub-2% [inflationary] environment like we’ve enjoyed for the last 20 years,” he said.

- Source, Kitco News

Monday, April 19, 2021

For Those Of You Watching Prices Of Gold, US Dollar, Bitcoin And Lumber…

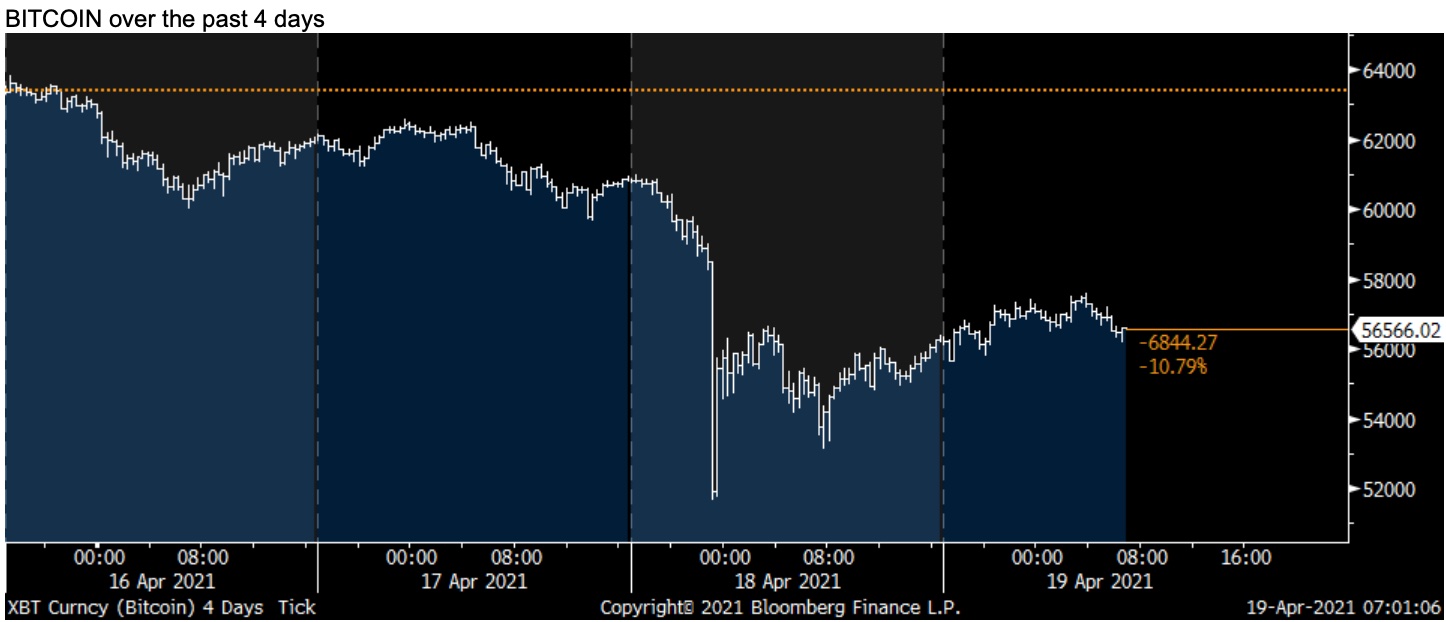

While I almost never talk about the price of Bitcoin, I do follow closely the infrastructure of crypto and how it is unfolding and am a believer (some of the lingo and terminology however is Greek to me but I’m trying to learn), though not an owner of any coins.

While I believe in the macro factors that was the genesis of Bitcoin and continue to drive it, I have no opinion on whether Bitcoin is worth $56,000, $64,000, $560,000 or $560.

Gold’s History Makes It Solid

As a bull on gold I’ve been asked how I have any idea where that can go too but at least with gold I have thousands of years of history to analyze along with tens of thousands of tons owned by central banks as reserves…

Either way, I think the direction of Bitcoin is a good bellwether on the risk appetite of the broader markets and view it from that lens more than anything else. With the selloff in Bitcoin over the weekend, that lens, and whether valid, will be put to a test.

US Dollar Struggling, Gold Surging

Keep an eye on the US dollar as it continues to rollover and now sits right on its 100 day moving average after breaking below its 50 and 200.

Ahead of the mortgage apps data on Wednesday, existing home sales on Thursday and new home sales on Friday, the rise in lumber just keeps going vertical.

Gold’s History Makes It Solid

As a bull on gold I’ve been asked how I have any idea where that can go too but at least with gold I have thousands of years of history to analyze along with tens of thousands of tons owned by central banks as reserves…

Either way, I think the direction of Bitcoin is a good bellwether on the risk appetite of the broader markets and view it from that lens more than anything else. With the selloff in Bitcoin over the weekend, that lens, and whether valid, will be put to a test.

US Dollar Struggling, Gold Surging

Keep an eye on the US dollar as it continues to rollover and now sits right on its 100 day moving average after breaking below its 50 and 200.

The index is at the lowest level since early March with the euro back above $1.20. I think the euro in particular is benefiting from a rebound in the pace of the vaccine rollout.

I remain a secular bear on the dollar as long as the trade and budget deficits remain on their current paths and the Federal Reserve continues with its 3rd world country monetary policy manipulation. Coincident with the dollar move and the fall in real rates, gold is rising to the highest since late February.

INFLATION: Lumber Prices Continue To Rise

INFLATION: Lumber Prices Continue To Rise

Ahead of the mortgage apps data on Wednesday, existing home sales on Thursday and new home sales on Friday, the rise in lumber just keeps going vertical.

It hasn’t had a red day since March 26th. Last week alone it was up 15% and by 36% since that day in March. Here is a chart since the mid 2000’s bubble in housing as of Friday’s close.

How companies, for those exposed, are maneuvering thru the broad based cost pressures will be key component of this earnings season.

- Source, King World News, read more here

Friday, April 16, 2021

Big Problems At The Perth Mint While Gold Coin Sales Soar There?

Wednesday, April 14, 2021

Market Manias Galore, But Long-Term Interest Rates Smell a Rat

- Source, Wolf Street Report

Saturday, April 3, 2021

Gold Rises as Financial Faith Weakens

Despite all the reasons discussed in preceding reports (i.e., money supply, commodity super cycles, deficit spending, and governmental credit guarantees to commercial banks) as to what we see as the current as well as future inevitability of rising inflation, there are many credible individuals, including those who strongly favor gold, who see a very different horizon.

That is, there are many who see a deflationary rather inflationary setting ahead.

The key arguments made by deflationary thinkers are not to be mocked or disregarded.

Their primary argument in favor of deflation boils down to one simple idea, namely: When economies and markets stall (or even collapse), this leads to dramatic slow-downs in consumer demand, and hence dramatic falls in consumer pricing—ie. deflation.

Needless to say, current economic conditions are anything but robust, which favors a deflationary premise.

By the turn of 2020’s in general, and during the global pandemic in particular, the world witnessed extreme levels of excess capacity (i.e. surplus rather than demand) in labor, manufacturing, retail and commercial real estate.

Banks this year, for example, are already telegraphing that in a post-COVID world, they will require 40% less office space as more and more systems have since been put in place to manage operations outside of traditional office settings.

All of these factors of excess capacity, from retail to commercial office space, one could sanely argue, point toward continued deflationary rather than inflationary forces going forward…

As to the staggering growth of the money supply unleashed by global central banks printing trillions of fiat currencies at record levels since 2008 in general, and the 2020 COVID period in particular, the deflation camp can further (and sanely) argue that such extreme money creation has not led to rising inflation, including hyper-inflation.

This, they legitimately argue, is for the simple reason that all those printed fiat currencies never enter the real economy, but remain contained within a closed-circuit loop of Treasury departments, central banks and Wall Street—not the real (i.e. Main Street) economy where money velocity truly can do its inflationary damage.

In short, so long as central banks act as insider-lenders of last resort to government treasury departments and overpaid CEOs, all that printed money is safely contained behind a Hoover-like dam of commercial and central bank balance sheets, not the real economy where such levels of money growth would and can do their inflationary damage.

Fair enough. Good points.

In fact, these deflationary views, make logical sense, and it would be arrogant to simply discount them.

That said, there are some key mistakes, I contend, in the premises behind such logic.

In short, let me now switch hats from a deflationary defense to a deflationary prosecutor…

That is, there are many who see a deflationary rather inflationary setting ahead.

The key arguments made by deflationary thinkers are not to be mocked or disregarded.

Their primary argument in favor of deflation boils down to one simple idea, namely: When economies and markets stall (or even collapse), this leads to dramatic slow-downs in consumer demand, and hence dramatic falls in consumer pricing—ie. deflation.

Needless to say, current economic conditions are anything but robust, which favors a deflationary premise.

By the turn of 2020’s in general, and during the global pandemic in particular, the world witnessed extreme levels of excess capacity (i.e. surplus rather than demand) in labor, manufacturing, retail and commercial real estate.

Banks this year, for example, are already telegraphing that in a post-COVID world, they will require 40% less office space as more and more systems have since been put in place to manage operations outside of traditional office settings.

All of these factors of excess capacity, from retail to commercial office space, one could sanely argue, point toward continued deflationary rather than inflationary forces going forward…

As to the staggering growth of the money supply unleashed by global central banks printing trillions of fiat currencies at record levels since 2008 in general, and the 2020 COVID period in particular, the deflation camp can further (and sanely) argue that such extreme money creation has not led to rising inflation, including hyper-inflation.

This, they legitimately argue, is for the simple reason that all those printed fiat currencies never enter the real economy, but remain contained within a closed-circuit loop of Treasury departments, central banks and Wall Street—not the real (i.e. Main Street) economy where money velocity truly can do its inflationary damage.

In short, so long as central banks act as insider-lenders of last resort to government treasury departments and overpaid CEOs, all that printed money is safely contained behind a Hoover-like dam of commercial and central bank balance sheets, not the real economy where such levels of money growth would and can do their inflationary damage.

Fair enough. Good points.

In fact, these deflationary views, make logical sense, and it would be arrogant to simply discount them.

That said, there are some key mistakes, I contend, in the premises behind such logic.

In short, let me now switch hats from a deflationary defense to a deflationary prosecutor…

- Source, KWN, read the full article here

Thursday, April 1, 2021

Ron Paul: Gold and Bitcoin Are at Risk of a Government Crackdown

“The government is a threat,” Paul said. “They will crackdown because they have the ability to do it. We had a taste of [a free society]. If you don’t know where to start, just start with the Constitution, that might give you an idea of what a free society is all about.”

Paul noted that this “crackdown” could take the form of taxes.

- Source, Kitco News

Subscribe to:

Comments (Atom)