Roubini told "Bloomberg Surveillance" the global economy is slowing, and another downturn could be ahead if a vaccine is not found in short order.

Bloomberg TV

Bloomberg TV He said the shape of the recovery is transforming from a "V" and is "becoming a U and the U could become a W if we don't find a vaccine and don't have enough stimulus."

Roubini, the chief executive of Roubini Macro Associates Inc., said the recovery on Wall Street doesn't reflect the real economy:

"Main Street is struggling," he said.

Roubini said Europe's policies to protect workers are much more robust than the U.S., where tens of millions of folks are jobless, hungry, and face eviction.

"The European system of greater social cohesion gives you better economic outcomes than the one of the United States that is just Wild West capitalism," he said."That's why the unemployment rate barely went up in Germany or even in Italy, while in the U.S. we've had double-digit unemployment rate and actually even worse, considering underemployment and so on."

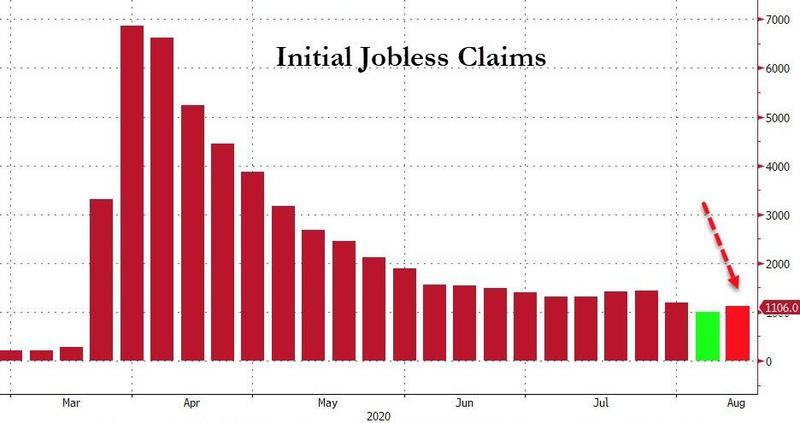

Jobs data this week showed the U.S. labor market recovery continues to reverse. Another million Americans filed for jobless benefits last week, back above one million and up notably from the 971k (revised higher) last week, and notably worse than the 920k expected...

The Federal Reserve's minutes on Wednesday from its July meeting highlighted doubts about the "V-shaped" recovery, showing that the swift labor market rebound seen in May and June had likely slowed. Quoting Rabobank's global strategist Michael Every, he told clients: "Of course, the Fed agreed that the virus is weighing heavily on the economy: is that some kind of surprise? Apparently, it was."

While it was a surprise to many on Wall Street who have turned a blind eye to the utter destruction of the labor market and small businesses, the Fed's monetary cannon has injected trillions of dollars into the economy markets to reinflate asset prices and distract everyone from the worst economic crash since the Great Depression in the 1930s.

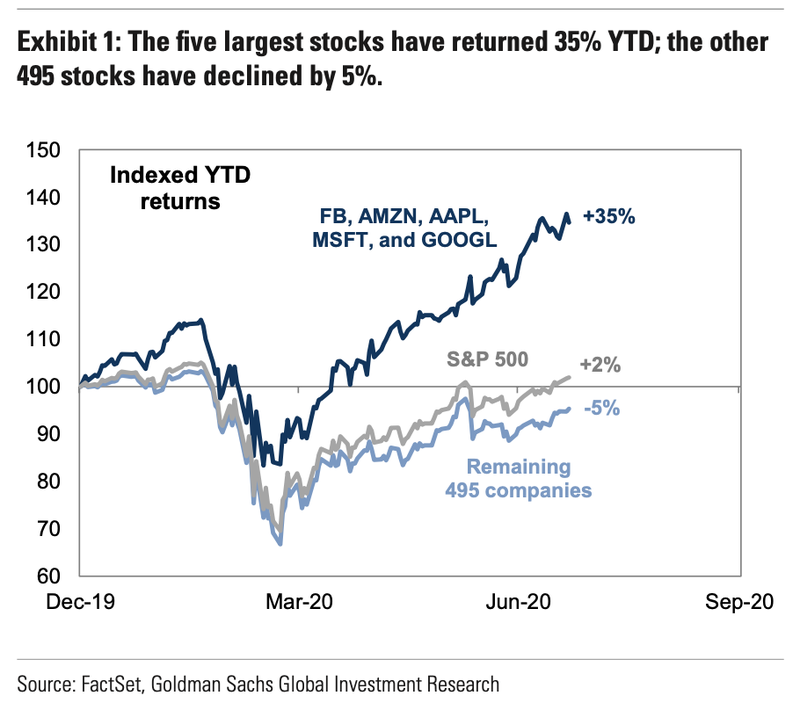

The party on Wall Street, driven by liquidity via central banks has reinflated financial assets to nosebleed valuations as the labor market implodes.

The party on Wall Street is also concentrated in a handful of technology stocks, about five to be exact. If Facebook, Amazon, Apple, Microsoft, and Google were removed from the S&P500 index, the overall main equity index would be flat on the year, as opposed to +35%.

As for the rest of the world, a resurgence of coronavirus across the Asia Pacific, Europe, and the U.S. have stalled the global recovery. The risk now is the world economy slumps in the back half of the year.

The consequence of central banks saving Wall Street at the expense of main street will result in widening wealth inequality to unimaginable levels that will continue to lead to a socio-economic implosion of the middle class.

- Source, Zero Hedge