Monday, August 31, 2020

Wolf Street Report: Second Wave of Layoffs is Here, Now Hitting Well Paying Jobs

Saturday, August 29, 2020

The Coming Chaos and the Eruption of Extreme Volatility

At the time of writing, both gold and silver bullion are trading higher, moving up by a significant 1.44% for the former and even better 1.74% for the latter.

Zero Hedge wrote an article covering last nights "protests" following the RNC convention at the White House, in which congress members and their families were harassed and attacked by a violent mob following the closure of the event and as they attempted to head back to their hotels.

(Chart source, goldprice.org)

This of course is down from the highs seen earlier this month, which broke previous records for the price of gold bullion and saw silver nearing the $30 per oz mark, however, I believe that this setback is going to be short lived indeed.

The need for personal and financial protection is coming in the near term future, more now than ever due to an ever unceasing number of threats to the system and unfortunately, the vast majority of the population (as typically happens in a time of great crisis), are going to be completely caught off guard.

The Increased Anxiety Rooted in COVID-19

One of these ongoing threats and of which can be argued as the root of many of the other problems that are going to ensue in the coming months, is the continued ongoing COVID-19 pandemic threat.

Depending on the part of the world you live in, this is either greatly diminished, or continuing to escalate.

However, in totality, cases across the globe continue to rise, as do the total number of deaths related to the coronavirus.

Although COVID-19 is not nearly as deadly as what was first predicted, it is largely still unknown, with the "science" seemingly changing with each passing day, leading to people quoting outdated information to each other and other conflicting "facts", that no longer agrees with the new daily developments.

In addition to this, most people of the world have found their lives radically changed, whether it be through business closures, prior forms of leisure lost, or mandatory mask wearing, just to name a few.

This leads to a drastic increase in a number of things, but most notably, heightened levels of anxiety.

This anxiety, due to such a radically changed way of living our lives has manifested itself in a number of ways, whether it be through substance abuse, depression, or violence in a small, but growing number of people.

As we are now seeing, across just about any major city within the United States, senseless violence is becoming an almost daily part of some peoples lives as this anxiety begins to manifest itself.

The protests, which were largely peaceful in the beginning and in response to a heinous act of neglect by law enforcement, have now turned deadly for some and incredibly destructive for many others.

This has led to unfathomable destruction to peoples lives, both physically, mentally and financially, of which some may never recover from.

The Mainstream Media Are Once Again Complicit

Local news and the alternative media have largely done a decent job of covering the riots, destruction and protest, calling a spade a spade and an ace and ace, however, as we have seen so many times in the past, the large Mainstream Media outlets are singing a different tune.

For some reason (of which many of you can speculate on), the MSM have once again gone into pure propaganda mode, seeking to shirk off just about all acts of violence as one offs and call these now nearly nightly events, "mostly peaceful protests".

And although there are many peaceful elements, of which their cause is just and true, there are without a doubt a large, significant portion of those who are taking advantage of the chaos, sowing seeds of destruction and violence wherever and whenever they can.

These acts are not minor nor one offs, they are on such a large scale that the police cannot even control them, only further emboldening these people.

This has led to an ever increasing amount of violence, threat, destruction and anarchy.

Many people feel justified in their actions, as they believe they are fighting an "unjust" system and are hell bent on seeing it fall, one brick at a time.

This is not going to happen unfortunately for them, and fortunately for the vast majority of people who call the West home, as I believe we are hitting a tipping put, a point in which the public is going to say "enough is enough".

The fact of the matter is that there is undoubtedly room for change within the West, but as someone who has traveled the world and seen many other countries first hand, the West has done a lot right and made much progress.

To simply cast this progress aside as meaningless, dismantling it in its entirety would be beyond reckless.

Violence in the Streets Will Not Help Win the Election

Zero Hedge wrote an article covering last nights "protests" following the RNC convention at the White House, in which congress members and their families were harassed and attacked by a violent mob following the closure of the event and as they attempted to head back to their hotels.

It is well worth the read, as you will see some historic on the ground footage, that the MSM would never be willing to show, demonstrating just how lawless things have truly become.

I personally am far from a fan of everything that the RNC represents, but as someone who considers themselves staunchly in the center, I cannot endorse this approach and I know that I am not alone.

Additionally, I believe that more and more footage showing the political left engaging in such a way is going to have the opposite effect of what they are hoping for, pushing more and more people into the hands of supporting President Trump, possibly even securing his re-election come November.

At the moment, the only ones openly condemning the violent protesters are those on the political right, however, I hear more and more concern privately among those have always considered themselves on the left.

Lawlessness breeds fear and the vast majority of people always vote to protect themselves and their families. Which is why I believe the MSM are attempting to downplay the violence in such a meaningful way.

The November to End all Novembers

The Presidental Election between Joe Biden and Donald Trump officially takes place on November 3rd, however, it is largely being speculated by many that the results will not be known that day.

This is due to a large percentage of population taking place in "mail-in voting", much more than any other time in prior history.

Many believe that this is going to lead to ungodly amounts of "funny business" and conspiracy theories are raging on both the left and the right, with both sides already stating that the other is "rigging" the election.

This in addition to the political divide, of which has never been so great since the Civil War, is going to lead (in my opinion) to nether party accepting the results immediately.

This will lead to countless recounts and possibly even a "hung" election if one side does win overwhelmingly.

If this occurs, hold onto your seats, as an extreme amount of chaos and volatility will be unleashed across the United States, that will have a rippling effect across the rest of the world.

Even if this does not occur, I believe that violence and anarchy are only going to increase, until the point in which one side is forced to put a "hard boot" on the other, which is a scenario that throughout history has never ended well.

In Conclusion

The fact of the matter is that we have brush fires all across the world, some of which are threatening to become blazing infernos at any moment.

In the meantime, we have a global pandemic, unfathomable fiat money creation and unaccountable debt creation, all of which would be bad enough in isolation, let alone occurring all at once.

It is only a matter of time before the back of the system as we know it cracks under all of this pressure, causing great financial chaos and destruction.

Precious metals in this scenario will rise higher and higher, as people seek the safety that only they can offer in times of extreme volatility.

I believe these reasons are exactly why Central Bankers and now the "smart money" are beginning to move into the metals in a meaningful way.

Sadly, as previously mentioned, much of the general public will be to late for the "party", missing these artificially depressed prices that cannot and will not last forever.

Prepare accordingly.

Wednesday, August 26, 2020

Main Street Is Struggling Severely: Nouriel Roubini Warns Wall Street Euphoria Ignores Main Street Crash

Speaking on Bloomberg Television Friday, Nouriel Roubini warned the stock market is completely disconnected from the dire economic outlook of a waning recovery amid continued depressionary pressures.

Roubini told "Bloomberg Surveillance" the global economy is slowing, and another downturn could be ahead if a vaccine is not found in short order.

Bloomberg TV

Bloomberg TV

He said the shape of the recovery is transforming from a "V" and is "becoming a U and the U could become a W if we don't find a vaccine and don't have enough stimulus."

Roubini, the chief executive of Roubini Macro Associates Inc., said the recovery on Wall Street doesn't reflect the real economy:

"Main Street is struggling," he said.

Roubini said Europe's policies to protect workers are much more robust than the U.S., where tens of millions of folks are jobless, hungry, and face eviction.

"The European system of greater social cohesion gives you better economic outcomes than the one of the United States that is just Wild West capitalism," he said."That's why the unemployment rate barely went up in Germany or even in Italy, while in the U.S. we've had double-digit unemployment rate and actually even worse, considering underemployment and so on."

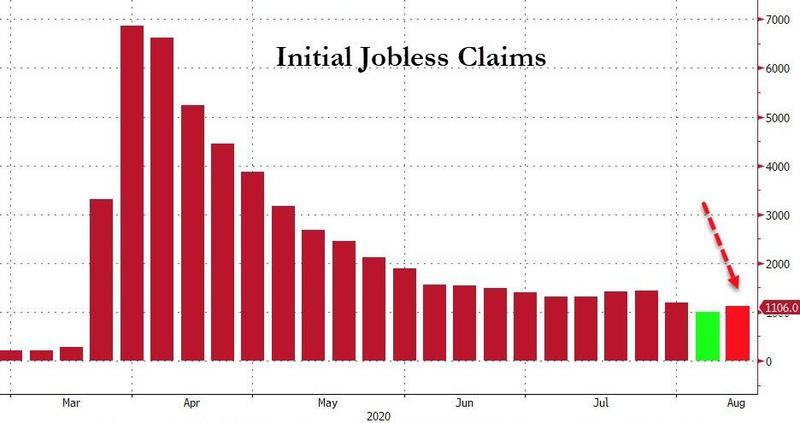

Jobs data this week showed the U.S. labor market recovery continues to reverse. Another million Americans filed for jobless benefits last week, back above one million and up notably from the 971k (revised higher) last week, and notably worse than the 920k expected...

The Federal Reserve's minutes on Wednesday from its July meeting highlighted doubts about the "V-shaped" recovery, showing that the swift labor market rebound seen in May and June had likely slowed. Quoting Rabobank's global strategist Michael Every, he told clients: "Of course, the Fed agreed that the virus is weighing heavily on the economy: is that some kind of surprise? Apparently, it was."

While it was a surprise to many on Wall Street who have turned a blind eye to the utter destruction of the labor market and small businesses, the Fed's monetary cannon has injected trillions of dollars into the economy markets to reinflate asset prices and distract everyone from the worst economic crash since the Great Depression in the 1930s.

The party on Wall Street, driven by liquidity via central banks has reinflated financial assets to nosebleed valuations as the labor market implodes.

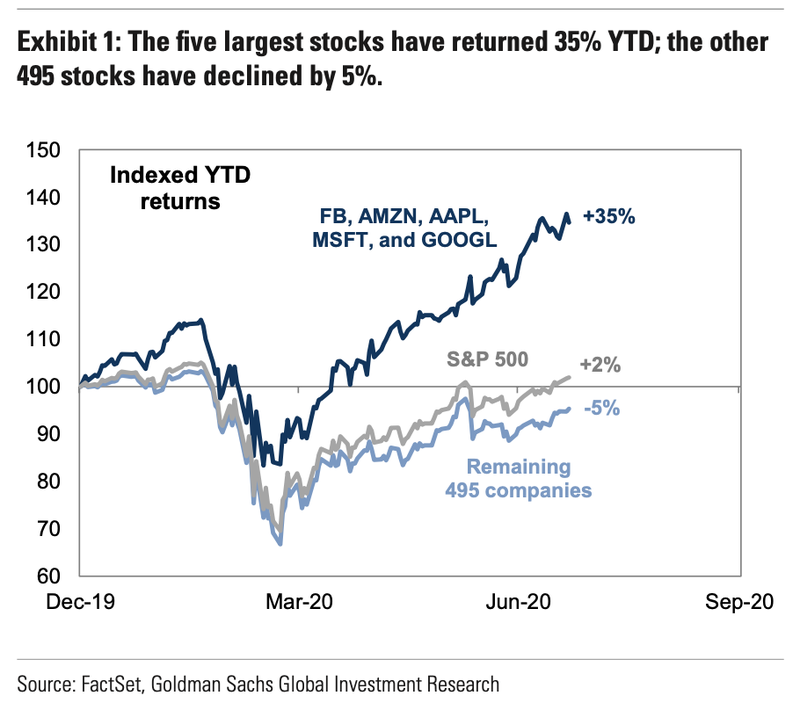

The party on Wall Street is also concentrated in a handful of technology stocks, about five to be exact. If Facebook, Amazon, Apple, Microsoft, and Google were removed from the S&P500 index, the overall main equity index would be flat on the year, as opposed to +35%.

As for the rest of the world, a resurgence of coronavirus across the Asia Pacific, Europe, and the U.S. have stalled the global recovery. The risk now is the world economy slumps in the back half of the year.

The consequence of central banks saving Wall Street at the expense of main street will result in widening wealth inequality to unimaginable levels that will continue to lead to a socio-economic implosion of the middle class.

Roubini told "Bloomberg Surveillance" the global economy is slowing, and another downturn could be ahead if a vaccine is not found in short order.

Bloomberg TV

Bloomberg TV He said the shape of the recovery is transforming from a "V" and is "becoming a U and the U could become a W if we don't find a vaccine and don't have enough stimulus."

Roubini, the chief executive of Roubini Macro Associates Inc., said the recovery on Wall Street doesn't reflect the real economy:

"Main Street is struggling," he said.

Roubini said Europe's policies to protect workers are much more robust than the U.S., where tens of millions of folks are jobless, hungry, and face eviction.

"The European system of greater social cohesion gives you better economic outcomes than the one of the United States that is just Wild West capitalism," he said."That's why the unemployment rate barely went up in Germany or even in Italy, while in the U.S. we've had double-digit unemployment rate and actually even worse, considering underemployment and so on."

Jobs data this week showed the U.S. labor market recovery continues to reverse. Another million Americans filed for jobless benefits last week, back above one million and up notably from the 971k (revised higher) last week, and notably worse than the 920k expected...

The Federal Reserve's minutes on Wednesday from its July meeting highlighted doubts about the "V-shaped" recovery, showing that the swift labor market rebound seen in May and June had likely slowed. Quoting Rabobank's global strategist Michael Every, he told clients: "Of course, the Fed agreed that the virus is weighing heavily on the economy: is that some kind of surprise? Apparently, it was."

While it was a surprise to many on Wall Street who have turned a blind eye to the utter destruction of the labor market and small businesses, the Fed's monetary cannon has injected trillions of dollars into the economy markets to reinflate asset prices and distract everyone from the worst economic crash since the Great Depression in the 1930s.

The party on Wall Street, driven by liquidity via central banks has reinflated financial assets to nosebleed valuations as the labor market implodes.

The party on Wall Street is also concentrated in a handful of technology stocks, about five to be exact. If Facebook, Amazon, Apple, Microsoft, and Google were removed from the S&P500 index, the overall main equity index would be flat on the year, as opposed to +35%.

As for the rest of the world, a resurgence of coronavirus across the Asia Pacific, Europe, and the U.S. have stalled the global recovery. The risk now is the world economy slumps in the back half of the year.

The consequence of central banks saving Wall Street at the expense of main street will result in widening wealth inequality to unimaginable levels that will continue to lead to a socio-economic implosion of the middle class.

- Source, Zero Hedge

Monday, August 24, 2020

Jackson Hole: Big Dollar Moves Expected, Sell Gold Now or Hold?

“When you’ve got all of the major central banks getting together, they recognize the need for a long-term plan rather than what's the economy going to look like next year, they're actually looking out at the next decade.

What that tells me is that they know that the crisis we're in is not going to be resolved overnight and so that's what's so critically important," Wagner told Kitco News.

“I believe that it could have a detrimental effect on the U.S. dollar. If it does, we will see gold take off and that will indicate the bottom of this recent gold price correction."

- Source, Kitco News

Saturday, August 22, 2020

Warren Buffet Turns Positive on Gold, Negative On Banks

The writing is on the wall and as I have written about numerous times, Central Banks are well aware of the necessity to move a significant portion of their reserves into gold bullion, which is exactly why they have been net positive buyers over the last couple of years.

Central Banks have steadily been increasing their holdings, while the rest of the masses foolishly ignored the safety of precious metals, even while the risks continued to mount all around them.

This of course does not include everyone, but in the grand scheme of the investment community, those who have been partaking in the steady accumulation of precious metals is a dedicated, but small percentage of the overall markets.

I believe that this is set to change and in a very, very significant way.

One of my predication's at the start of this year, was that 2020 was going to see the institutional investor change their opinion on investing in precious metals, leading to a boon for the metals as the "smart money" began to pile into both gold and silver bullion, resulting in a renewal of the bull market.

This is exactly what we are starting to see, as arguably the most renowned investor in the world, Warren Buffet has made a significant move into the precious metals marketplace.

Warren Buffet Moves on Gold

On August 14th, there was 13F filing update within the United States, which gives valuable insight into what the "smart money" is currently buying and putting their funds towards.

Many other market participants respect these investors and will often take their lead, investing their funds into what the "smart money" has already moved in on, often causing a self fulfilling trend to occur.

Warren Buffet is one of the most watched names within these filings, as he has been heralded by many as one of the greatest investors of all time.

Therefore it shocked and stunned many within the markets when it was revealed through these 13F filings, that Berkshire Hathaway’s activity showed a drastic change in course, with the fund making a major move on the Canadian mining company, Barrick Gold.

As indicated through the filings, Berkshire Hathaway purchased 21 million shares, which equates to nearly $564 million worth of Barrick Gold, making it one of the largest investments for Warren Buffet in 2020.

This comes as even more of a shock to many, given Warren Buffet's historic disdain for investing in precious metals.

To those who do not believe in the protection that precious metals can offer in a time of crisis, this severe change in course from one of the most seasoned investors should come as major warning as to just how dire things have become.

Buffet Turns Negative on the Broader Markets

The other cause for concern that should have many investors who are blindly buying into this artificially inflated stock market, is not only what Buffet bought, but also what he sold.

In what many consider to be a negative indicator for the U.S. economy moving forward, Warren Buffet dumped almost the entirety of his shares in Goldman Sachs, selling nearly 2 million shares of the stock.

And he didn't stop there.

In addition to shedding his position in Goldman Sachs, Buffet also sold out of 61% of his position in JPMorgan Chase and nearly a quarter of his position in Wells Fargo.

Finally, as indicated in the 13F filing for Berkshire Hathaway, they heavily sold out of their position in airline companies, further indicating that he likely sees a prolonged downturn for the U.S. and even global economy.

Famed precious metals and bitcoin bull, Max Keiser gave his opinion on what these moves by Buffet mean;

I couldn't agree more, as it is indeed a strong indication of just how unstable things have become and just how much risk is present in today's financial markets around the globe.

In Conclusion

Ill-regardless of Warren Buffet making a major move on the gold markets, while also shedding some of the largest banking names in the world, the fact of the matter remains that the fundamentals for precious metals remain rock solid.

These actions only further support the fundamentals and will help perpetuate the positive trend higher for both gold and silver bullion as we move forward.

Additional institutional investors are already taking notice of the moves Warren Buffet has made and as many of them have in the past, will follow in his wake in the coming days, months and years.

Prices will gyrate, volatility will be extreme.

However, a steady increase higher is all but assured at this point, as the metals account for the historic amount of fiat money that the world has created out of thin air and of which will never be taken back out of the system.

Remember, the trend is your friend until the end and the trend for precious metals is strong indeed.

Stay safe and keep stacking.

Central Banks have steadily been increasing their holdings, while the rest of the masses foolishly ignored the safety of precious metals, even while the risks continued to mount all around them.

This of course does not include everyone, but in the grand scheme of the investment community, those who have been partaking in the steady accumulation of precious metals is a dedicated, but small percentage of the overall markets.

I believe that this is set to change and in a very, very significant way.

One of my predication's at the start of this year, was that 2020 was going to see the institutional investor change their opinion on investing in precious metals, leading to a boon for the metals as the "smart money" began to pile into both gold and silver bullion, resulting in a renewal of the bull market.

This is exactly what we are starting to see, as arguably the most renowned investor in the world, Warren Buffet has made a significant move into the precious metals marketplace.

Warren Buffet Moves on Gold

On August 14th, there was 13F filing update within the United States, which gives valuable insight into what the "smart money" is currently buying and putting their funds towards.

Many other market participants respect these investors and will often take their lead, investing their funds into what the "smart money" has already moved in on, often causing a self fulfilling trend to occur.

Warren Buffet is one of the most watched names within these filings, as he has been heralded by many as one of the greatest investors of all time.

Therefore it shocked and stunned many within the markets when it was revealed through these 13F filings, that Berkshire Hathaway’s activity showed a drastic change in course, with the fund making a major move on the Canadian mining company, Barrick Gold.

As indicated through the filings, Berkshire Hathaway purchased 21 million shares, which equates to nearly $564 million worth of Barrick Gold, making it one of the largest investments for Warren Buffet in 2020.

This comes as even more of a shock to many, given Warren Buffet's historic disdain for investing in precious metals.

To those who do not believe in the protection that precious metals can offer in a time of crisis, this severe change in course from one of the most seasoned investors should come as major warning as to just how dire things have become.

Buffet Turns Negative on the Broader Markets

The other cause for concern that should have many investors who are blindly buying into this artificially inflated stock market, is not only what Buffet bought, but also what he sold.

In what many consider to be a negative indicator for the U.S. economy moving forward, Warren Buffet dumped almost the entirety of his shares in Goldman Sachs, selling nearly 2 million shares of the stock.

And he didn't stop there.

In addition to shedding his position in Goldman Sachs, Buffet also sold out of 61% of his position in JPMorgan Chase and nearly a quarter of his position in Wells Fargo.

Finally, as indicated in the 13F filing for Berkshire Hathaway, they heavily sold out of their position in airline companies, further indicating that he likely sees a prolonged downturn for the U.S. and even global economy.

Famed precious metals and bitcoin bull, Max Keiser gave his opinion on what these moves by Buffet mean;

In Conclusion

Ill-regardless of Warren Buffet making a major move on the gold markets, while also shedding some of the largest banking names in the world, the fact of the matter remains that the fundamentals for precious metals remain rock solid.

These actions only further support the fundamentals and will help perpetuate the positive trend higher for both gold and silver bullion as we move forward.

Additional institutional investors are already taking notice of the moves Warren Buffet has made and as many of them have in the past, will follow in his wake in the coming days, months and years.

Prices will gyrate, volatility will be extreme.

However, a steady increase higher is all but assured at this point, as the metals account for the historic amount of fiat money that the world has created out of thin air and of which will never be taken back out of the system.

Remember, the trend is your friend until the end and the trend for precious metals is strong indeed.

Stay safe and keep stacking.

- Source, Nathan McDonald via Sprott Money Blog

Friday, August 21, 2020

Robert Kiyosaki Says Don’t Make This Financial Mistake and Get Manipulated

Kiyosaki referred to these assets as “fake money” and detailed how investors can differentiate between “real” and “fake” assets in his book “FAKE: Fake Money, Fake Teachers, Fake Assets: How Lies Are Making the Poor and Middle Class.”

“The problem with my generation is that they think that what is safe is U.S. Treasuries,” Kiyosaki told Kitco News. “Treasuries are how the Fed and the Treasury manipulate the markets, and they’ve wiped out savers.”

- Source, Kitco News

Wednesday, August 19, 2020

Richard Duncan: It's Too Late To Turn Back Now... So Borrow More

The Dollar Crisis: Causes, Consequences, Cures (John Wiley & Sons, 2003, updated 2005), predicted the global economic disaster that began in 2008 with extraordinary accuracy. It was an international bestseller.

His second book was The Corruption of Capitalism: A strategy to rebalance the global economy and restore sustainable growth. It was published by CLSA Books in December 2009.

His latest book is The New Depression: The Breakdown Of The Paper Money Economy (John Wiley & Sons, 2012).

- Source, Golden Rule Radio

Monday, August 17, 2020

Saturday, August 15, 2020

Gold and Silver Suffer Temporary Setback, Fundamentals Remain Unchanged

Just as expected, gold and silver bullion have pulled back, suffering throughout the week as a renewed attack was presented against the metals, causing wild gyrations and shaking out those who just recently "joined the party" and are historically consider "weaker hands" than those who have been dollar cost averaging into the price of precious metals over a longer, more challenging period of time.

(Chart source, goldprice.org)

Prices took a beating at the opening of the week, with the most severe trading action taking place throughout Tuesday, which saw the price of gold bullion shed 4% of its price, a heavy, however very temporary loss to those who plan to hold for the longer term and who are not simply gambling on prices.

This move lower, which followed on the heels of Fridays strong jobs data report within the United States, was made worse predominately due to Treasury yields ticking higher in price, with the 10-year Treasury note yielding 0.658% on Wednesday, up from 0.562% at the end of last weeks trading session.

This caused a sell off in precious metals, due to a Treasuries being viewed as a "alternative" to gold and silver bullion, with some thinking it a wiser "safe-haven" asset than bullion.

This is a common trend, as precious metals typically move higher in price, the lower yields go.

(Chart source, silverprice.org)

As can be seen from the chart above and as previous noted, silver bullion experienced the same reaction as gold bullion, moving sharply lower off of the back of Treasury yields moving higher.

This in my personal opinion is akin to jumping "out of the frying pan and into the fire", as Treasury yields are just one more, illusionary, artificially maintained fiat paper asset, that is not tangible and can be taken away at a moments notice. Which is in stark contrast to physical precious metals that you have taken personal possession of.

Precious Metals Begin to Rebound

Even though the trading action throughout the week has been brutal, with precious metals owners getting put through their paces, this short term correction already appears to be reversing course throughout today's trading session, as seen from the charts above, with both gold and silver bullion moving off of their lows and regaining some of the losses experienced in the previous few days.

As I stated last week, this is not all bad and a correction should not only be expected, but welcomed, as we want a steady, accumulative move higher, rather than a parabolic one.

A bull market that experiences regular corrections lower is good, as it will lead to a much more durable price trajectory and not a "blow off" top, that eventually implodes in upon itself, such as what was seen throughout the bitcoin mania, that eventually suffered an outright collapse.

This will also encourage more and more strong hands to continue to surf the wave of higher prices, without the faith of those who cannot stomach extreme volatility being shaken off in the process of erratically moving prices.

This strength will ultimately lead to much higher highs, as many other precious metals experts are predicting, such as Peter Schiff and James Rickards, who made a stunning $15,000 per oz gold price prediction in a recent joint interview.

Additionally, wild estimates of $1,000 per oz silver prices are now being predicted, which may seem unrealistic based on today's prices, but is truly a possibility if the system continues down this unsustainable path that it now finds itself on, with ever increase fiat money printing and debt creation.

The reality of the situation is that the system can only take so much abuse.

Throughout history, debt to GDP ratios the likes of which we are now seeing in almost every Western Nation have resulted in complete and utter collapse, with systems eventually buckling under the incredible pressure that results from such high, unsustainable debt loads.

Add into the mix the ever growing geopolitical and social unrest that we are now experiencing the world over, with COVID-19 making matters even more untenable, then we have a true recipe for disaster brewing.

The winners in the end, as they always have been throughout mankind's financial history will be those who prepared accordingly, acquiring physical precious metals in advance and when they were able to at reasonable prices, mitigating the financial damages caused by the ensuing financial collapse.

The question is, are you prepared?

Keep Stacking.

- Source, Nathan McDonald via the Sprott Money Blog

Friday, August 14, 2020

Real Vision Finance: The 2020 Gold Rush, the Corona Correction

- Source, Real Vision Finance

Tuesday, August 11, 2020

Dan Oliver Explains How Market Inflation Truly Works and the Damage it Can Do Society

- Source, Jay Taylor Media

Monday, August 10, 2020

Bo Polny: Silver Will Turn into Rocket Fuel Come 2021

It’s going to be really fun to watch. Silver turns into rocket fuel in 2021 in the real bull market that we are waiting for. So, we ain’t seen nothing yet.”

Gold is also heading much higher, according to Polny’s cycles, and “$2,500 per ounce in September is very possible and could be much higher.” Bottom line, Polny says, “Gold and silver will continue to get more expensive, and prices will continue to explode higher.”

In the stock and bond market, Polny says, “We have not seen the real crash yet. What we saw in March was a prelude to the crash.” Polny says the two things you should do now is “keep praying and vote this November to make the second Trump cycle become a reality.”

- Source, USA Watchdog

Saturday, August 8, 2020

Gold and Silver Experience Stunning Gains, Just the Tip of the Iceberg

Gold and silver just experienced a stunning week, in which they surged higher, based purely on real, solid fundamentals and of which truly spectacular gains are yet to come.

This comes in stark contrast to the truly mind boggling actions seen over the last few years in the broader markets, whose gains were based largely on illusions, huge injections of fiat money, debt creation and all around tomfoolery.

It is going to take time for people to adjust to this reality, to understand that this rally in both gold and silver bullion are based on overwhelmingly strong fundamentals, as it has been so long since the financial world has operated in such a manner, however, once this change in mindset occurs, we are going to experience one of the greatest bull markets this world has ever seen, with precious metals taking off to what some would believe unobtainable levels based on today's pricing.

This comes in stark contrast to the truly mind boggling actions seen over the last few years in the broader markets, whose gains were based largely on illusions, huge injections of fiat money, debt creation and all around tomfoolery.

It is going to take time for people to adjust to this reality, to understand that this rally in both gold and silver bullion are based on overwhelmingly strong fundamentals, as it has been so long since the financial world has operated in such a manner, however, once this change in mindset occurs, we are going to experience one of the greatest bull markets this world has ever seen, with precious metals taking off to what some would believe unobtainable levels based on today's pricing.

(Chart Sources, goldprice.org)

This weeks trading action in the metals was a just a sample of what is to come, with both of the metals leaping to new levels, as I predicted they would after breaking through key resistance levels just a few short weeks ago, carried higher first by true fundamentals, then propelled even further by the Wall Street algorithms, with both feeding upon the other in a revolving cycle.

However, as stated last week and as we are seeing in today's trading action, pull backs are going to occur and this is a good thing. We do not want a runaway break out, a straight up parabolic rise such as that seen during the Bitcoin mania, as that leads to weak hands and an inevitable crash lower.

A steady, healthy increase higher, with new "floors" being set is what we want to see, as that will ultimately result in long term, more sustainable gains, with stronger hands staying with precious metals as they inevitably climb higher.

This pull back in precious metal prices comes on the heels of a strong payroll numbers report being released, as 1.76 million jobs were added, according to officially reported figures by the Bureau of Labor Statistics.

However, this data is lagging and may be short lived, as already more and more States are imposing renewed lockdown due to the resurgence of COVID-19 in many locations.

Even so, a return to a strong work force, which is coming, will not change the fundamentals for precious metals in a meaningful way in the long term, as the historic amount of debt creation and fiat money printing that we have experienced since the pandemic began is not simply going to erase itself.

(Chart Source, Federal Reserve)

This newly created "money" is out there and is not going way. Gold and silver bullion are accounting for this and they are ultimately going much higher as a result.

This is not going to change and is only going to accelerate as we move forward and as more and more institutional investors join the ranks of Central Banks, buying gold hand over fist moving forward, hopping aboard the train, hoping to ride the strong fundamentals of precious metals higher until a true blow off top occurs.

The Next Catalyst For Precious Metals Moving Higher

Another upcoming event that I keep pointing out and of which seemingly many are simply discounting is the extreme unrest within the United States that is coming in November of this year, following the results of the Presidential Elections.

The DNC seems hell bent on sending Joe Biden out to a massacre, which is baffling a large amount of people on the left, right and those staunchly in the center, the latter of which I consider myself a part of.

This is even more odd, given the fact that the Democratic party seems to be taking a full blown campaign strategy, based purely on "orange man bad", choosing to hide Biden from the public eye almost entirely, likely due to the fact that when allowed to speak, he appears disorientated and confused, showing as many have pointed out, clear signs of cognitive decline.

This is made even more concerning given the fact that Biden himself has stated that "he is being constantly tested", which is an odd thing to say, but yet, will not release the results of those tests, as previous Presidential candidates have done.

Even the mainstream media, who predominately hates Trump, has even started to take notice and point these issues out.

I personally don't agree with everything President Trump has done, or stated while in office, however, I cannot see how Joe Biden is expected to go toe to toe with President Trump on the debate stage, without it resulting in a complete disaster for the Democrats.

Perhaps this is why the DNC is attempting to get the number of Presidential debates reduced, while the RNC is looking to get more debates scheduled.

Even though the official polls have Biden leading slightly over Trump if the election were to take place today, as we saw in the 2016 elections, these polls are far from accurate and typically are largely skewed towards the candidate who is deemed "socially" acceptable in the mainstream narratives eyes. Given the fact that many believe they cannot openly voice their support for President Trump, or risk being ridiculed, persecuted or worse.

I believe that ultimately, unless the DNC changes course and chooses to throw Biden under the bus and nominate a different candidate of their choosing, forgoing the primary results (something they can actually do, although unlikely), then I believe it very likely that Donald Trump is going to win re-election by a slight margin, leading to one of the most contested elections ever given the current circumstances ongoing within the United States and given the fact that many States are choosing to go the mail-in ballot route.

This is going to lead to massive unrest and social upheaval, regardless of who is going to win, as I believe neither the far left, nor the far right are going to simply accept the results at face value.

Chaos will be the name of the game, with precious metals moving higher to adjust and account for this increased risk to the system, adding even further to an already rapidly accelerating bull market.

Don't believe me? Just wait and see. Time will reveal all.

Until then, stay safe and as always, keep stacking.

- Source, Nathan McDonald via the Sprott Money Blog

Friday, August 7, 2020

Volatile Selloffs Expected Before $10000 Gold and $300 Silver

David believes this cycle will end in a bust, something more significant than a deep recession but not a drawn-out depression. He anticipated a big run from the March lows and says we are poised for another big run soon into a top.

He cautions that historic debt & derivative exposure will magnify market moves in both directions. Momentum, further stimulus and a V-shaped second half recovery will combine to drive the market to its final top.

However, much damage has been done and money alone cannot sustain a recovery. David expects a second phase of the bust in 2021 including a global financial crisis and a huge involuntary debt liquidation cycle. He gives his expectations for oil, the U.S. dollar, gold, silver and the miners.

- Source, Palisade Radio

Wednesday, August 5, 2020

Liberty & Finance: The Elites Are Taking Physical Silver Delivery

Will this sea-change break the back of the concentrated short campaign that has been credited with holding silver prices at or near production costs for most of the past decade?

Andy Schectman, CEO of Miles Franklin Precious Metals Investments, returns to Liberty and Finance / Reluctant Preppers to answer viewers’ questions about the fractured gold & silver supply chain, and the volatile prices and premiums now and going forward.

- Source, Liberty & Finance

Tuesday, August 4, 2020

Silver is on the Move and is Going a Lot Higher, FED Attempting to Control the Economy

Lior says that gold and silver are not in a bubble and inflation is a future marker, watch the 2% marker that the Fed puts out.

We are now entering a transition stage, the world is watching.

- Source

Saturday, August 1, 2020

Gold Bullion Touches $2000, Sets New All Time High

As I pointed out in last week's article, the price of gold bullion was showing impressive strength, that was threatening to surpass its old all time high of $1,920.70 USD per oz, set previously nine years ago in 2011.

To say that gold bullion started the week off strong would be an understatement, as it opened with fantastic gains that continued to build momentum into the after hours trading session, with futures hitting a stunning $2000 USD per oz before correcting lower.

This significant surge higher was founded on all of the chaos that we have discussed over the past few months, including but not limited to the ongoing COVID-19 pandemic, the trade wars between the United States / China, the political chaos, and of course the ongoing beatings that our economies around the globe continue to take.

However, the spark that truly ignited this move higher was the fact that the United States Mint stated that they were being forced to reduce supply to authorized distributors, due the fact that they cannot meet demand under their new COVID-19 working conditions.

Bloomberg reports;

"The U.S. Mint has reduced the volume of gold and silver coins it’s distributing to authorized purchasers as the coronavirus pandemic slows production, a document seen by Bloomberg shows.

The Mint’s West Point complex in New York is taking measures to prevent the virus from spreading among its employees, and that will probably slow coin production there for the next 12 to 18 months, the document shows. The facility is no longer able to produce gold and silver coins at the same time, forcing it to choose one metal over the other, according to the document, which was presented to companies authorized to buy coins from the Mint last week."

Well, That Didn't Take Long

To say that gold bullion started the week off strong would be an understatement, as it opened with fantastic gains that continued to build momentum into the after hours trading session, with futures hitting a stunning $2000 USD per oz before correcting lower.

(Chart source, Zerohedge)

However, the spark that truly ignited this move higher was the fact that the United States Mint stated that they were being forced to reduce supply to authorized distributors, due the fact that they cannot meet demand under their new COVID-19 working conditions.

Bloomberg reports;

"The U.S. Mint has reduced the volume of gold and silver coins it’s distributing to authorized purchasers as the coronavirus pandemic slows production, a document seen by Bloomberg shows.

The Mint’s West Point complex in New York is taking measures to prevent the virus from spreading among its employees, and that will probably slow coin production there for the next 12 to 18 months, the document shows. The facility is no longer able to produce gold and silver coins at the same time, forcing it to choose one metal over the other, according to the document, which was presented to companies authorized to buy coins from the Mint last week."

This restriction of only being able to produce either gold or silver coins at one time, but not both together, means that a massive source of new supply entering into the precious metals market is going be greatly diminished, for the foreseeable future.

This comes at a period in time, in which precious metals are entering into a new upward phase of significant strength, as it looks more and more likely with each passing day that we are heading into a strong, new bull market for the metals.

(Chart source, goldprice.org)

Premiums for both gold and silver bullion were already high, with the demand for physical, real precious metals seeing a significant surge since the outbreak of the coronavirus crisis.

However, this large reduction in new supply hitting the precious metals market means that premiums for physical gold and silver bullion are only going to get higher in the coming months, as those seeking safe haven assets continue to chase the price of precious metals higher, hoping to protect themselves from the coming economic and political storms that lay just over the horizon.

At the onset of this year, I stated that both gold and silver bullion appeared to be setting up for a slam dunk of a year, with both likely to experienced sustained and long term demand as both Central Banks continue to buy the metals and as individual / institutional investments begin to join in on the fun, this was before we knew about the COVID-19 pandemic and the havoc that it would inflict upon the world.

(Chart source, goldprice.org)

This has resulted in both the kings metal and the peoples metal experiencing truly impressive gains throughout the year, as gold bullion is posting a 38.08% gain yoy, while silver bullion outdoes even gold, experiencing a 49.01% gain yoy.

To break this down even further, if you began to move into silver bullion a little over a month ago, you would already be up by 35.10%.

What makes these gains even more impressive is the fact that this isn't over. No far from it my friends.

Remember, strength begets strength in a crazy algorithm controlled market, at least in the short to medium term. This is even more true when that strength is founded on solid, undeniable fundamentals.

Gold and silver's fundamentals couldn't be any stronger in 2020 and thus, I believe that we have only just begun this new bull market cycle.

Large Investors Are Taking Notice and the Masses are Coming

This means that a wave of fresh money is going to be piling into precious metals in short order, forcing ever increasing new highs as Central Banks around the world continue to print fiat money at a historic rate.

I fully expect silver to go above its old all time highs and trade solidly into the $50 per oz level, meaning that stunning gains still lay in wait for this metal and those who take action sooner, rather than later.

Gold bullion will as always be the rock that weathers the storm and is much more suited for those who cannot stomach the extreme volatility that silver bullion is likely to experience, while also increasing solidly in price as well.

However, this does not mean that prices will go straight up forever, in fact, this is exactly what we do not want to see in the coming months, as a parabolic rise always ends badly.

We want to see steady, incremental gains, that will set new resistance levels and create a floor for those joining into the party later than those who smartly stacked early, preventing a wash out of "weak hands".

For those that have been steadily taking advantage of dollar cost averaging into both gold and silver bullion over the last few years, while the price of bullion has been artificially depressed, then your patience may soon be rewarded, handsomely.

As always, stay safe and keep stacking.

- Source, Nathan McDonald via the Sprott Money Blog

Subscribe to:

Comments (Atom)