Our current world leaders are going to be scrutinized, or praised, depending on how they handle this unfolding crisis. I truly don't envy them, for I believe we are truly living in a "damned if you do, damned if you don't" style scenario.

Unfortunately, it appears that what I have been writing about for the last few months, in regards to how the coronavirus crisis was going to unfold, appear to be coming true, but much worse than anyone could of anticipated.

(Chart source, Worldometers)

Being the honorable tin foil hat wearer that I am, I was well ahead of the curve in predicting what was going to come next, the carnage that it was going to inflict on our markets and the way that our governments around the world were going to react, as the crisis spread.

Sadly, it appears that my small group of tin foil hat wearers has ballooned to monstrous proportions, as conspiracy theories abound on social media and even in the Mainstream Media, as people attempt to make sense of what is unfolding, how it happened and what governments are going to do.

What they are going to do next, will determine our economic future for not only the next few years, but possibly even the next decade.

What governments are going to continue to do, because in their eyes they have no choice otherwise, is exactly what they have done over the past week, except more, much more.

Quantitative easing, the likes of which we have never before seen is going to be unleashed around the world. This has already begun, with countries such as Canada, the United Kingdom, the United States and countless many others unveiling massive stimulus programs to help keep their citizens afloat, while the economy grinds to a halt due to self isolation measures being put in place.

Canada has just unveiled an $82 billion stimulus program, that will go directly towards keeping businesses and individuals afloat while they are out of work, due to the coronavirus. This may not sound like much to Americans, but to an economy the size of Canada, this is monstrous.

The United States, in true Trump fashion, has decided to go big league, with the Senate putting forward a stimulus proposal that is expected to top $1 trillion.

Just like with Canada, the US stimulus program is intended to keep its citizens and businesses afloat, while the economic pain that the coronavirus is inflicting, continues to be felt.

Depending on peoples income, this means that US citizens could be directly receiving either a $1200, or $2400 cheque each.

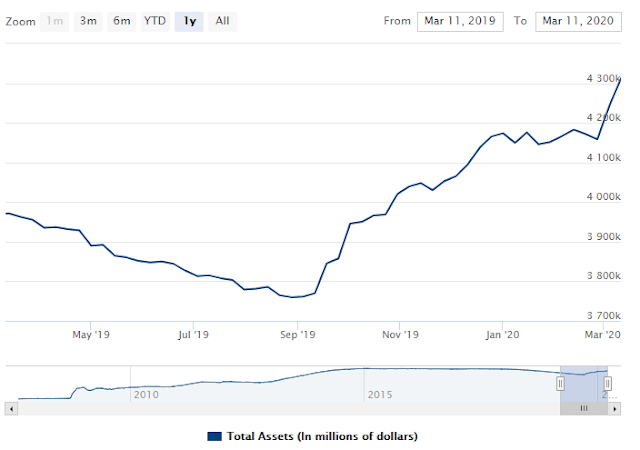

Meanwhile, the Federal Reserve has had to remain directly involved in the repo markets, injecting billions upon billions of dollars into the markets, as credit starts to freeze and as institutions stop lending to each other.

(Chart source, Federal Reserve)

These stimulus programs come on top of Central Banks slashing interest rates across the world, hoping that will help mitigate some of the economic fallout that is occurring.

Unfortunately, as seen when the Federal Reserve slashed interest rates to 0%, earlier this week, Wall St is still not satisfied and stocks, although recovering temporary, have continued their trend lower.

(Chart source, google.com)

Meanwhile, precious metals, after taking a beating earlier in the week due to people liquidating all paper positions, are beginning to recover as of today, posting significant gains at the time of writing.

(Chart source, goldprice.org)

However, even though bullion prices took a beating in previous days, what many people aren't aware of, was that these losses were largely only in paper positions, as bullion dealers around the world are experiencing massive backlogs and huge premiums, due to the monumental demand for PHYSICAL precious metals.

As I've stated many times before, if you don't hold it, you don't own it. Physical is king and eventually it will completely disconnect from the bogus paper prices, that are highly rehypothecated and thus easily manipulated lower.

Perhaps, what we have seen unfold throughout this week, as the physical metals have maintained a premium over the paper prices, is just the start of this decoupling process, perhaps this crisis is the straw that breaks the camels back and allows tangible metals to break free of their paper shackles?

Perhaps, however, I believe that even paper bullion prices are going to rally and rally hard once sanity begins to return and after all the weak hands have flushed out of their positions.

We are living through a period of time in which the printing presses are going to be running non stop, as bailout after bailout is announced, dwarfing the QE that we saw throughout the 2008 crisis, as now individuals, plus businesses are going to need help remaining afloat.

The question is, for how long? How long will this crisis drag out and how much of a strain can the system maintain? Hopefully a lot more.

Stay safe. Stay prepared. Batten down the hatches. This crisis is far from over.

- Source, Sprott Money Blog