- Source, Golden Rule Radio

Sunday, July 24, 2022

Golden Rule Radio: Peak To Peak To Peak Inflation, The New Transitory

Friday, July 22, 2022

Monday, July 4, 2022

Thursday, June 30, 2022

Ron Paul: Inflation Nightmare & The Fed's 2% CPI Pipe Dream

Further, it was only able to spend those trillions because the Fed counterfeited the money out-of-thin-air. Today's economic suffering could not be more predictable.

- Source, Ron Paul

Thursday, June 23, 2022

Global Market Collapse: Protect Your Portfolio With Silver

Tuesday, June 21, 2022

Market Horror: Three Witches and a slice of Fruitcake

Saturday, June 18, 2022

Real Vision Finance: When Will This Volatility End?

Darius, the founder and CEO of 42 Macro, joins Real Vision’s Maggie Lake to answer that question and to talk about today’s price action in the aftermath of the Federal Reserve’s biggest rate hike since 1994.

According to Darius, “This trending volatility won’t end until the liquidity cycle inflects and speeds up the growth cycle bottom.” Mortgage rates have already exploded past 6%, a sign tighter monetary policy is already impacting consumers.

How far will the Fed go to catch inflation? “Inflation KILLS societies,” says Darius. We also hear from Mark Ritchie II about how to manage risk in a volatile environment.

- Source, Real Vision Finance

Bob Moriarty: "It's Only Just Started" - End Of The Empire

The Federal Reserve "has painted itself into a corner." The only options going forward are hyperinflation or a market crash. Moriarty sees both may happen.

- Source

Thursday, June 9, 2022

Ron Paul: Woke Capitalism Is An Economic Disaster In The Making

The failure rate is 100%. "Woke" Capitalism, with "ESG scores" for corporations, and "social credit scores" for individuals, are merely the newest iteration.

They too are destined for disaster. The costliest lesson in all of economic and political history is that freedom always prevails.

- Source, Ron Paul

Wednesday, June 8, 2022

Inflation Now 4 Times Higher Than Expert's Estimates...

Sunday, June 5, 2022

David Brady: The Dollar is Scheduled for Demolition

David discusses the changes that have occurred in the markets since his last appearance on the show nearly two years ago.

He believes another massive rally is coming for gold and that the Fed will reverse course.

Countries never chose to default they always inflate their debts away.

Markets today are centrally managed. What we have is not free-market capitalism.

- Source, Palisade Radio

Friday, June 3, 2022

The Big Conversation: Is Inflation Spreading?

US inflation may have peaked in H1, but that doesn’t mean it will quickly drop back to ‘normal’ levels.

Furthermore, if it continues to spread from durable goods to essentials such as food and energy, then the Fed may have an even harder job on its hands.

- Source, Real Vision Finance

Sunday, May 29, 2022

Golden Rule Radio: Precious Metals Bounce Up While Equities Continue To Drop

The US Stock market has had a challenging year thus far in 2022 and it is just the start of what is to come as the Fed seems to no longer have the ability to bolster a meaningful comeback in the major indices.

With all eyes now on the US stock market and inflation reaching record levels, safe-haven assets that offer savers a hedge continue to shine.

- Source, Golden Rule Radio

Saturday, May 28, 2022

A food shortage is now a real risk, this is how everyone would be impacted

- Source, Kitco News

Sunday, May 22, 2022

The Economic Ninja: Another Large Real Estate Crash Is Coming Soon?

Long term Travis is very bullish on Bitcoin, precious metals and many key commodities.

He thinks that the food and energy crisis will get a lot worse.

Friday, May 20, 2022

Ron Paul: Liberty Challenged, More Government, More Debt, More War!

- Source, Ron Paul

Monday, May 16, 2022

Food Shortages: Biggest Shock Of Our Lifetime Coming, Inflation to Rage

The supply chain is in a state of collapse," says Mike Adams, the "Health Ranger," an outspoken consumer health advocate, award-winning investigative journalist, internet activist, and science lab director.

"Don't panic," he says, "get prepared.... This is going to be the biggest shock of our lifetimes."

- Source, Reluctant Preppers

Wednesday, May 4, 2022

Dollar Rises Rapidly, Inflation Grows, Gold & Silver's Next Move?

What are gold & silver's next move and where will they go during quarter 2?

We will cover the price movements of gold, silver, platinum, US dollar index, and more.

- Source, Golden Rule Radio

Sunday, May 1, 2022

Peter Schiff: The Fed’s Ego Is the Only Thing Bigger Than This Bubble

The Fed insists it can tighten monetary policy and tackle inflation without hurting the economy. Federal Reserve Chairman Jerome Powell and other central bankers claim the economy is strong enough to handle higher interest rates. Peter Schiff said this is just another in a long line of arrogant miscalculations by the Fed.

As the central bank begins to raise rates and gets set to shrink its balance sheet, some analysts worry that the Fed will make a mistake and tighten too much. But Peter said the Fed already made the mistake.

"It’s not about the Fed might make a mistake. They’ve already made nothing but mistakes. The Fed has never done anything right. And because they made so many mistakes in the past, they’ve already doomed us in the future. It’s not about the mistakes they may make. It’s about the mistakes they’ve already made.”

And Peter said given all of the mistakes the central bankers have made in the past, it seems certain there will be more mistakes moving forward.

"The mistake they’re going to make in the future is not tightening too much, but not tightening enough — bowing down to the political pressure once the economy really starts to tank and the markets are deep in bear-market territory. When the Fed takes its foot off the brake and slams it back on the gas, that’s when the economy is going over a cliff because inflation is going to run out of control.”

Peter pointed out the recent plunge in speculative stocks and said it was a function of the mistakes the Fed has already made.

"2021 was peak insanity caused by the most reckless of all monetary policies by the Fed, which created the mother of all inflation. And now the Fed wants to try to put the genie back in the bottle. It doesn’t want to accept any responsibility for having allowed the genie out of the bottle. It wants to blame it all on Putin. It wants to blame it all on COVID.

So, why should we believe them?

Peter said he thinks it’s “three strikes and you’re out.”

"Strike one – subprime contained. Strike two – inflation is transitory. Strike three – we can raise interest rates. The economy is strong enough to withstand it. I think all of the Fed’s credibility is going to be lost when that mistake is revealed.”

As the central bank begins to raise rates and gets set to shrink its balance sheet, some analysts worry that the Fed will make a mistake and tighten too much. But Peter said the Fed already made the mistake.

"It’s not about the Fed might make a mistake. They’ve already made nothing but mistakes. The Fed has never done anything right. And because they made so many mistakes in the past, they’ve already doomed us in the future. It’s not about the mistakes they may make. It’s about the mistakes they’ve already made.”

And Peter said given all of the mistakes the central bankers have made in the past, it seems certain there will be more mistakes moving forward.

"The mistake they’re going to make in the future is not tightening too much, but not tightening enough — bowing down to the political pressure once the economy really starts to tank and the markets are deep in bear-market territory. When the Fed takes its foot off the brake and slams it back on the gas, that’s when the economy is going over a cliff because inflation is going to run out of control.”

Peter pointed out the recent plunge in speculative stocks and said it was a function of the mistakes the Fed has already made.

"2021 was peak insanity caused by the most reckless of all monetary policies by the Fed, which created the mother of all inflation. And now the Fed wants to try to put the genie back in the bottle. It doesn’t want to accept any responsibility for having allowed the genie out of the bottle. It wants to blame it all on Putin. It wants to blame it all on COVID.

But it thinks it’s a simple task to undo the damage. All they’ve got to do is jack rates back up to 2.5, 3%, get there quickly, and because we have such a strong economy with a super-hot labor market, the Fed can do today what it never could do in the past because the economy now is so much stronger than it was in the past. Well, it’s not stronger. It’s just a bigger bubble.”

But the central bankers at the Fed don’t seem to understand that.

"In fact, probably the only thing that’s bigger than this bubble is the egos of the FOMC members and how clueless they are about economic reality.”

The Fed has a horrible track record. Fed Chairman Jerome Powell has been wrong, wrong, and more wrong. But it’s not just Powell. The Fed has a long history of missing the mark.

In 2006 and 2007, the Fed insisted there was no problem in the housing market. When it became clear there was a problem, the central bankers said, “No worries, it’s contained to subprime.” When the financial markets crashed in 2008 and the Fed started quantitative easing, Ben Bernanke said the central bank was not monetizing the debt and that it would sell all of the bonds it was buying after the emergency was over.

But the central bankers at the Fed don’t seem to understand that.

"In fact, probably the only thing that’s bigger than this bubble is the egos of the FOMC members and how clueless they are about economic reality.”

The Fed has a horrible track record. Fed Chairman Jerome Powell has been wrong, wrong, and more wrong. But it’s not just Powell. The Fed has a long history of missing the mark.

In 2006 and 2007, the Fed insisted there was no problem in the housing market. When it became clear there was a problem, the central bankers said, “No worries, it’s contained to subprime.” When the financial markets crashed in 2008 and the Fed started quantitative easing, Ben Bernanke said the central bank was not monetizing the debt and that it would sell all of the bonds it was buying after the emergency was over.

During the pandemic, they said printing trillions of dollars wouldn’t cause consumer prices to rise. When inflation reared its ugly head, they promised it was transitory. Now they’ve conceded it’s not transitory, but assure us they can fix it. They say they can raise rates without hurting the economy.

So, why should we believe them?

Peter said he thinks it’s “three strikes and you’re out.”

"Strike one – subprime contained. Strike two – inflation is transitory. Strike three – we can raise interest rates. The economy is strong enough to withstand it. I think all of the Fed’s credibility is going to be lost when that mistake is revealed.”

- Source, Schiff Gold

Global food supply is now in danger; These commodities most at risk from Ukraine war

- Source, Kitco News

Monday, April 25, 2022

A Currency Revolution Begins: James Turk, Alasdair Macleod

- Source, Gold Money

Friday, April 22, 2022

The Breakdown of a "Well Managed" World

- Source, Golden Rule Radio

Sunday, April 17, 2022

Friday, April 15, 2022

What Is Happening With Food Availability, Price, And Supply In The US?

What is going on with food prices, and, more importantly, where is this all headed?

- Source, Silver Doctors

Thursday, April 14, 2022

Ron Paul: Why Does It Seem Biden Is Prolonging The Ukraine War?

Sending weapons that have little chance of making a big difference in the outcome only keeps the fighting and killing going strong, and the Administration has shown no interest in pushing a quick diplomatic end to the war.

On the contrary, Biden openly calling for regime change and a war crimes trial makes diplomacy nearly impossible. Why prolong the fighting?

US National Security Advisor Jake Sullivan gave us a hint, when he told NBC News over the weekend that the US wants " a weakened and isolated Russia."

- Source, Ron Paul

Tuesday, April 12, 2022

Ron Paul: The Dollar's Reserve Status Is Ending. Will Bitcoin Save Us?

Government can't create gold out-of-thin-air (like it does with dollars) to fund its expansion into every aspect of our lives. But change is in the air.

- Source, Ron Paul

Sunday, April 10, 2022

Friday, April 8, 2022

Wolf Street Report: Bond Massacre, Inflation Prick Biggest Bond Bubble in History

- Source, The Wolf Street Report

Wednesday, March 30, 2022

David Morgan: The Run To Gold is On?

- Source, David Morgan

Monday, March 28, 2022

Oil Volatility The New Normal? Despite Much Higher Oil Prices OPEC Doesn't Meet Production Quota

The world could see a record breaking oil supply shock.

- Source, Wall St for Main St

Sunday, March 27, 2022

Michael Pento: Revenge of the Real Economy

Regardless of what the Fed does, the economy sinks.

"The economy is already rapidly deteriorating," says portfolio manager Michael Pento. "This is the revenge of the real economy," he says.

- Source, Liberty and Finance

Friday, March 25, 2022

Doug Casey: These crises will reshape the world; Gold will be reinstituted as money

- Source, Kitco News

Wednesday, March 9, 2022

Palisade Gold Radio: Gold to $4000 in 2024? Silver to $100?

Meanwhile, the Russian invasion into Ukraine is going to disrupt global energy and food markets, leading to persistent and likely higher inflation this year.

A historical parallel could be the 1973 to 1975 period which included a bear market and stagflationary recession. The Gold surged and peaked near the end of the bear market and recession while Silver and general commodity prices peaked well before Gold.

Gold is on the cusp of making one of its most significant breakouts. It has upside targets of $3,000 and $4,000 which could be hit in 2024. Silver will likely break $50 but it is less certain if it can hit $100 in this scenario.

- Source, Palisade Radio

Tuesday, March 8, 2022

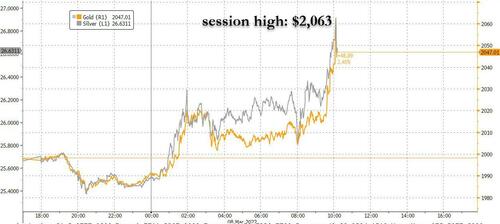

Gold Soars To $2063, Just One Cent Away From New All Time High

With digital gold acting more like digital lead in recent weeks, as bitcoin and the broader crypto sector trade as high-beta tech stocks perhaps helping tech funds satisfy margin calls, the real gold has no such qualms and after flatlining for much of the past 18 months, has broken out solidly to the upside, and just today spike more than 3%, rising to session high of $2,063.53

Why $2,063.53? Because $2,063.54 was the closing high on August 6, 2020 when gold hit an all time high in the aftermath of the Fed's money debasement frenzy when the Fed's balance sheet exploded by hundreds of billions weekly.

But while technical selling may have emerged at this key resistance level, we expect it to be taken out shortly, with even Goldman raising its gold forecast overnight, writing that in light of the Russia-Ukraine war, the bank is raising its gold price target over different time horizons. Targets raised for:

3-month horizon to USD2,300 vs. $1950 previous.

6-month horizon to USD2,500, from $2050 previous.

12-month horizon to USD2,500 vs. $2150 previous.”

Why? Because "An increase in demand from consumers, investors, central banks due to the rising geopolitical uncertainty."

Why $2,063.53? Because $2,063.54 was the closing high on August 6, 2020 when gold hit an all time high in the aftermath of the Fed's money debasement frenzy when the Fed's balance sheet exploded by hundreds of billions weekly.

But while technical selling may have emerged at this key resistance level, we expect it to be taken out shortly, with even Goldman raising its gold forecast overnight, writing that in light of the Russia-Ukraine war, the bank is raising its gold price target over different time horizons. Targets raised for:

3-month horizon to USD2,300 vs. $1950 previous.

6-month horizon to USD2,500, from $2050 previous.

12-month horizon to USD2,500 vs. $2150 previous.”

Why? Because "An increase in demand from consumers, investors, central banks due to the rising geopolitical uncertainty."

- Source, Zero Hedge

Monday, March 7, 2022

Ron Paul: Are Sanctions Acts of War?

They also place heavy economic costs on the civilians of nations imposing the sanctions.

To add insult to injury, the track record of sanctions forcing political change is disgracefully bad as well.

- Source, Ron Paul

Thursday, March 3, 2022

David Morgan: Stocks, Silver, and Bitcoin

Bitcoin price jumps above $42,320, altcoins rally along side. But, will crypto soon be banned? Silvers day is coming.

Obviously, no one has a crystal ball. And hence, no one really knows when.

Everybody involved in the silver market is asking: when? Patience is key.

- Source, David Morgan

Sunday, February 27, 2022

Gold On Breakout Pattern Amid Market Tensions

- Source, Golden Rule Radio

Friday, February 25, 2022

Ron Paul: The Economic Consequences of Senseless Wars

A fight on the other side of the world has generated war fever in the minds of America's political classes.

They're already telling American citizens that "sacrifices will have to be made." Is this what Americans need to hear after years of Covid tyranny?

- Source, Ron Paul

Wednesday, February 23, 2022

Crack-up boom: When money system breaks, civil unrest follows

- Source, Kitco News

Sunday, February 20, 2022

Liberty and Finance: China To Dethrone The Dollar

- Source, Liberty and Finance

Friday, February 18, 2022

2022 Silver Price Predictions - The World's Most UNDERVALUED ASSET

What methods can we use to predict what might happen?

Join Mike Maloney and Jeff Clark as they discuss Jeff's most recent article that answers all these questions... and much more.

- Source, Gold Silver

Monday, February 14, 2022

Gold & Silver Update: March Interest Rate Rise?

- Source, Golden Rule Radio

Friday, February 11, 2022

John Williams: Inflation is really 15%, highest since 1947, Why is government suppressing data?

Williams told David Lin, anchor for Kitco News, that the true headline CPI number is loser to 15%, not 7%, as reported by the Bureau of Labor Statistics.

Here's why the government has a political incentive to "suppress" the reported inflation number.

- Source, Kitco News

Gold, silver sales are still being taxed, is that about to change soon?

- Source, Kitco News

Sunday, January 16, 2022

Julius Krein: What Happened to the American Economy & How to Fix It

The episode is broken into two parts, the first hour of which focuses on issues of political-economy, policy, and market dynamics that have driven the American economy into a state of “proletarianization,” where its citizens are increasingly ruled by an oligarchy of global elites whose insatiable appetite for wealth and power is endangering the very systems of free-market capitalism and liberal democracy that this kakistocracy claims to uphold.

It’s an outcome that Julius Klein would refer to as “capitalism without competence and feudalism without nobility.”

The second hour of today’s conversation is, unsurprisingly, the most satisfying insofar as Demetri and Julius tackle the socio-political and cultural dimensions and manifestations of the problems created by the perversions of what was earlier described as the “proletarianization” or conversion of the American economy and political system into a more corrupt, upwardly sclerotic, and extractive system of governance than anything experienced in America since at least the Gilded Age.

- Source, Hidden Forces

Friday, January 14, 2022

Jim Grant on What Inflation Means for Asset Values, Crypto, and Meme Stocks

- Source

Subscribe to:

Comments (Atom)