Gold Bull Mobius Says Every Portfolio Needs at Least 10%

(Bloomberg) — Veteran investor Mark Mobius says that gold’s set to push higher, potentially topping $1,500 an ounce, as interest rates head lower, central banks extend purchases, and uncertainty surrounding geopolitics and cryptocurrencies fans demand.“I love gold,” Mobius, who set up Mobius Capital Partners LLP last year after three decades at Franklin Templeton Investments, said in an interview in Singapore, adding bullion should always form part of a portfolio, with a holding of at least 10%. “As these interest rates come down, where do you go?”

Gold has rallied in 2019, rising to the highest level in six years, as investors contemplate slowing economic growth, prospects for easier monetary policy in the U.S.

The upswing has been given added momentum as central banks, including

“What’s the sense of holding euro when you get a negative

Two points about Mobius’ suggestion that most portfolios should be 10% allocated to gold:

First, the idea of replacing dollar cash with a historically better-performing store of wealth seems like a no-brainer in a world of soaring fiat currency debt and plunging interest rates.

Second and vastly more interesting, the current allocation to gold in the financial world is about 1% of total

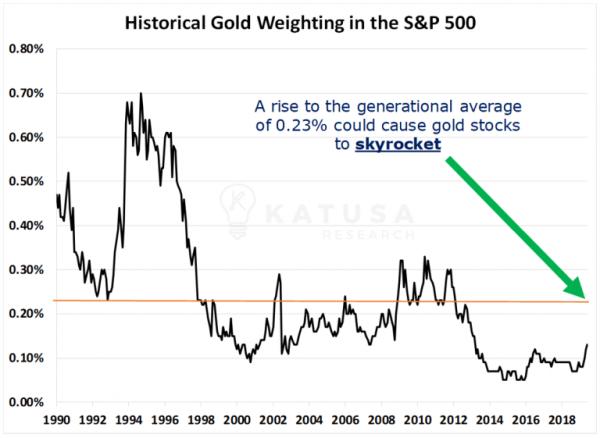

As for gold mining stocks, here’s a chart from Marin Katusa showing their weighting within the S&P 500. Note that it’s both minuscule and historically low. A reversion to just the average would send the miners up dramatically.

- Source, John Rubino